Donate Stock or Cash to Charity?

When giving a gift, how your investment has fared will make a big difference on your taxes.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Which is better -- donate stock to a charity or donate the proceeds from selling the stock?

It depends on whether you've gained or lost money on the investment.

If the stock has increased in value since you bought it, then you'll be better off donating it to charity instead of selling it. That way, you'll avoid the capital-gains taxes on the profit. Say you bought 100 shares of a stock at $10 and it's now worth $40 per share. If you give the stock to charity, you won't have to pay the capital-gains taxes on the $3,000 in profit. If you held the stock for more than a year and are in the 15% long-term capital gains tax bracket, that move will save you $450 in taxes, which you'd owe if you sold the stock first. And if you've owned the stock for more than a year, you'll still be able to deduct its current market value -- $4,000 -- as a charitable contribution on your taxes if you itemize, like you would whether you gave stock or cash. (If you held the stock for one year or less, then you'd only be able to deduct the original $1,000 purchase price.)

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

If the stock has decreased in value, though, it's better to cash it in first so you can deduct the loss. If that 100 shares of stock you bought at $10 is now worth $4, for example, you'll be able to write off the $600 loss if you sell the stock before giving the money away. If you held the stock for more than a year and are in the 15% long-term capital-gains bracket, for example, that move can save you $90. And you'll still be able to deduct the value of the gift as a charitable contribution -- $400 in this case.

Before you give away stock, first make sure the charity is set up to deal with the gift. Some small charities don't have brokerage accounts and may have a tough time selling the stock or mutual funds.

Another option: Set up a donor-advised fund. You can then give the stock to the donor-advised fund, which sells the investment and gives the cash to the charity. You'll get a tax deduction for the charitable gift when you transfer the stock to the donor-advised fund, but will have unlimited time to decide which charity to support -- making it a good move if you'd like to make a donation before year-end for tax purposes but would like some extra time to select the charity. For more information about donor-advised funds, see Philanthropy Made Easy.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

As the "Ask Kim" columnist for Kiplinger's Personal Finance, Lankford receives hundreds of personal finance questions from readers every month. She is the author of Rescue Your Financial Life (McGraw-Hill, 2003), The Insurance Maze: How You Can Save Money on Insurance -- and Still Get the Coverage You Need (Kaplan, 2006), Kiplinger's Ask Kim for Money Smart Solutions (Kaplan, 2007) and The Kiplinger/BBB Personal Finance Guide for Military Families. She is frequently featured as a financial expert on television and radio, including NBC's Today Show, CNN, CNBC and National Public Radio.

-

Timeless Trips for Solo Travelers

Timeless Trips for Solo TravelersHow to find a getaway that suits your style.

-

A Top Vanguard ETF Pick Outperforms on International Strength

A Top Vanguard ETF Pick Outperforms on International StrengthA weakening dollar and lower interest rates lifted international stocks, which was good news for one of our favorite exchange-traded funds.

-

Is There Such a Thing As a Safe Stock? 17 Safe-Enough Ideas

Is There Such a Thing As a Safe Stock? 17 Safe-Enough IdeasNo stock is completely safe, but we can make educated guesses about which ones are likely to provide smooth sailing.

-

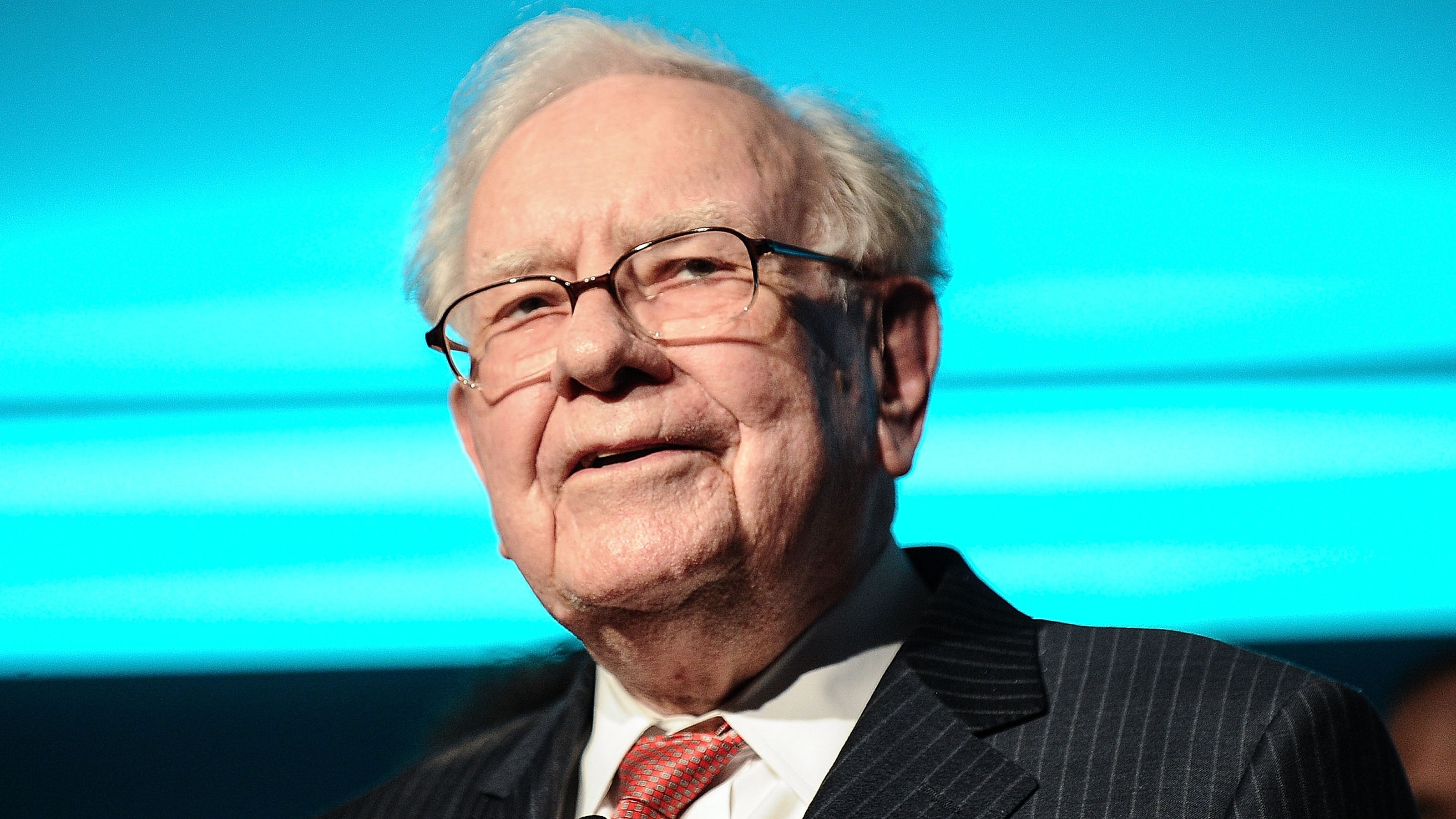

I'm an Investing Expert: This Is How You Can Invest Like Warren Buffett

I'm an Investing Expert: This Is How You Can Invest Like Warren BuffettBuffett just invested $15 billion in oil and gas, and you can leverage the same strategy in your IRA to potentially generate 8% to 12% quarterly cash flow while taking advantage of tax benefits that are unavailable in any other investment class.

-

Give Cash Now, Cut Your Estate Tax Later

Give Cash Now, Cut Your Estate Tax Latertaxes During this season of giving, take advantage of the annual gift tax exclusion before the year ends.

-

It’s Not Too Late to Boost Retirement Savings for 2018

It’s Not Too Late to Boost Retirement Savings for 2018retirement Some retirement accounts will accept contributions for 2018 up until the April tax deadline.

-

How to Correct a Mistake on Your RMDs from IRAs

How to Correct a Mistake on Your RMDs from IRAsretirement If you didn't take out the correct required minimum distribution because your brokerage firm made a mistake, the IRS may show some leniency.

-

Ways to Spend Your Flexible Spending Account Money by March 15 Deadline

Ways to Spend Your Flexible Spending Account Money by March 15 Deadlinespending Many workers will be hitting the drugstore in the next few days to use up leftover flexible spending account money from 2018 so they don’t lose it.

-

Making the Most of a Health Savings Account Once You Turn Age 65

Making the Most of a Health Savings Account Once You Turn Age 65Making Your Money Last You’ll face a stiff penalty and taxes if you tap your health savings account for non-medical expenses before the age of 65. After that, the rules change.

-

Reporting Charitable IRA Distributions on Tax Returns Can Be Confusing

Reporting Charitable IRA Distributions on Tax Returns Can Be ConfusingIRAs Taxpayers need to be careful when reporting charitable gifts from their IRA on their tax returns, or they may end up overpaying Uncle Sam.

-

When You Can Expect to Receive Your Tax Refund

When You Can Expect to Receive Your Tax Refundtaxes The quickest way to receive your tax refund is to file electronically and have the money directly deposited into your bank account.