Taxpayers Weigh In on the New Tax Law

A Kiplinger-Barclays poll shows that most Americans aren't feeling a financial boost from the tax overhaul.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

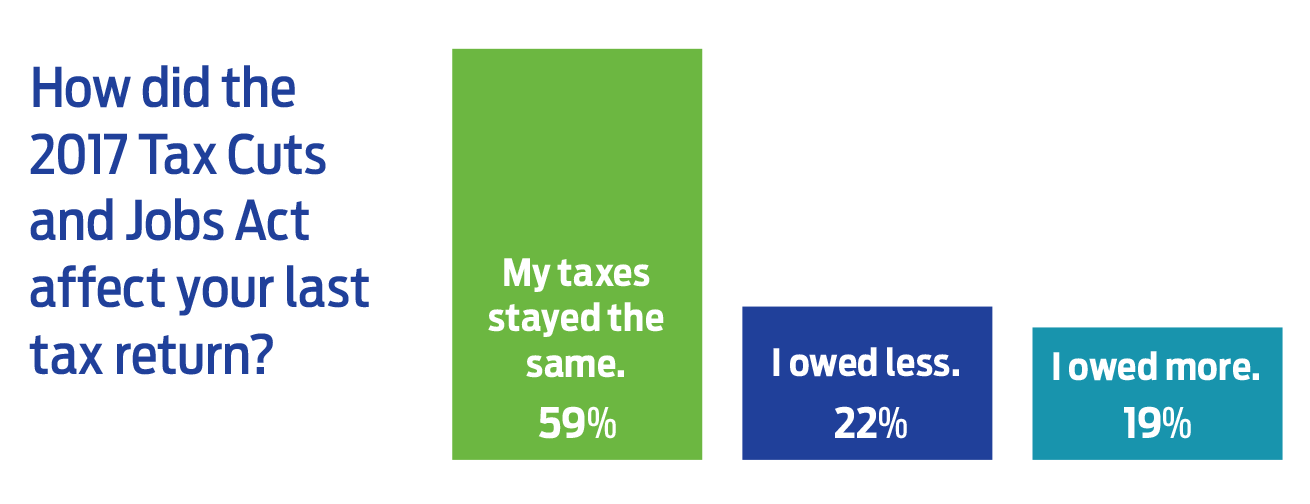

A majority of Americans surveyed in a new poll conducted by Kiplinger in partnership with Barclays Bank say their taxes stayed about the same after the 2017 Tax Cuts and Jobs Act, with remaining respondents almost equally split between higher and lower taxes.

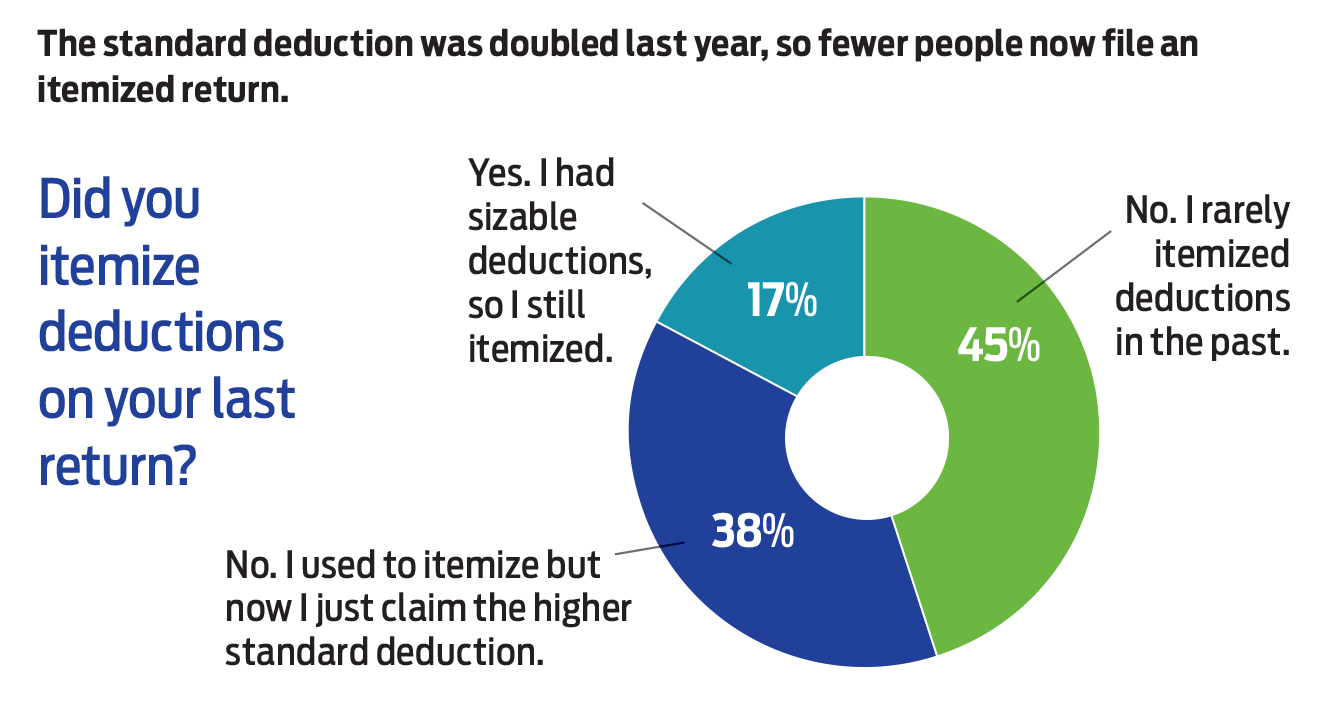

The tax overhaul lowered tax rates and expanded income thresholds, but employers also reduced withholding for many wage earners. That may have reduced refunds or inflated balances due with the returns of many taxpayers—and given the impression that savings under the new law were less generous. In addition, the law scaled back itemized deductions. Some 15% of respondents report being affected by the new $10,000 cap on deducting state and local taxes. Some 20% said they felt the impact of no longer being able to claim miscellaneous itemized deductions to write off items such as tax preparation and investment fees and unreimbursed business expenses.

Other highlights: Nearly 40% of respondents say they switched from itemizing deductions to taking the standard deduction, which increased to $12,000 for individuals and $24,000 for married couples filing jointly for the 2018 tax year (higher for taxpayers age 65 or older). Nonitemizers can’t deduct charitable contributions, and roughly 20% of respondents report reducing donations. But about two-thirds of those surveyed say they give to charity regardless of any tax break.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

About three-fourths of respondents got a refund on their last return. Nearly two-thirds say they’d rather get a refund than a bigger paycheck throughout the year.

The poll surveyed a national sampling of 852 taxpayers between December 3 and 13, 2019. The median age was 49 years old, and the median household net worth was $203,850 (excluding a primary residence). This survey was conducted by Brown Oak Audience Insights between December 3 and 13, 2019 and has a 3% margin of error.

We’ve included highlights here (figures are medians unless otherwise indicated).

Which of these tax changes affected you?

I can no longer take miscellaneous itemized deductions: 20%

I can’t deduct state and local taxes that exceed $10,000: 15%

I can only deduct interest on a mortgage of up to $750,000 (down from $1 million): 8%

Now I can only deduct casualty losses if they occurred in a federally declared disaster area: 7%

I can no longer deduct moving expenses when relocating for a job: 4%

I can no longer deduct alimony payments: 1%

None of these 58%

Has your charitable giving changed?

No, I give regardless of any tax break: 66%

Yes, I have decreased the amount I donate to charity: 20%

Yes, I combined two or more years of charitable giving into a single year to qualify for the tax deduction: 8%

I’m over 70 and now give to charity directly from my IRA: 3%

Yes, I opened a donor-advised fund: 1%

I can no longer deduct alimony payments: 3%

Do you usually hire someone to prepare your tax return?

No: 52%

Yes: 48%

If you prepare your own return, do you use tax software?

Yes: 72%

No: 28%

Which tax software do you use?

TurboTax: 75%

H&R Block: 17%

Tax Act: 13%

Other: 4%

Did you receive a refund after filing your last tax return?

Yes: 74%

No: 28%

Would your rather get a tax refund or have less tax withheld throughout the year and receive bigger paychecks?

Refund: 63%

Bigger paycheck: 37%

The median tax refund for 2018 was $2,154. What did you do with your refund?

Saved it: 38%

Spent a portion; saved the rest: 23%

Created an emergency fund: 6%

Invested it: 10%

Paid credit card bills: 25%

Paid student loans: 3%

Bought gifts for friends or family: 3%

Bought myself a gift: 6%

Splurged on a vacation: 7%

Spent it on everyday items: 7%

After filing your last tax return, did you make changes to your W-4 to adjust your withholding?

No, I’m fine with the way it is: 88%

Yes, I had more taxes taken out of my paycheck: 8%

Yes, I had fewer taxes withheld: 4%

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

Standard Deduction 2026 Amounts Are Here

Standard Deduction 2026 Amounts Are HereTax Breaks What is the standard deduction for your filing status in 2026?

-

Three Popular Tax Breaks Are Gone for Good in 2026

Three Popular Tax Breaks Are Gone for Good in 2026Tax Breaks Here's a list of federal tax deductions and credits that you can't claim in the 2026 tax year. High-income earners could also get hit by a "surprise" tax bill.

-

Five Ways Trump’s 2025 Tax Bill Could Boost Your Tax Refund (or Shrink It)

Five Ways Trump’s 2025 Tax Bill Could Boost Your Tax Refund (or Shrink It)Tax Refunds The tax code is changing again, and if you’re filing for 2025, Trump’s ‘big beautiful’ bill could mean a bigger refund, a smaller one or something in between next year. Here are five ways the new law could impact your bottom line.

-

New SALT Deduction Could Put Thousands Back in California Homeowners’ Pockets

New SALT Deduction Could Put Thousands Back in California Homeowners’ PocketsTax Breaks The federal state and local sales tax (SALT) deduction cap is higher this year, and could translate into bigger savings for Golden State homeowners.

-

Key 2025 Tax Changes for Parents in Trump's Megabill

Key 2025 Tax Changes for Parents in Trump's MegabillTax Changes Are you a parent? The so-called ‘One Big Beautiful Bill’ (OBBB) impacts several key tax incentives that can affect your family this year and beyond.

-

Elon Musk and Most Taxpayers Don't Like What's in Trump's 'Big Beautiful Bill'

Elon Musk and Most Taxpayers Don't Like What's in Trump's 'Big Beautiful Bill'Tax Policy President Trump is betting big on his newest tax cuts, signed into law on July 4. But not everyone is on board.

-

'Unprecedented' Private School Voucher Tax Credit in Trump's Megabill

'Unprecedented' Private School Voucher Tax Credit in Trump's MegabillTax Credits The so-called ‘One Big Beautiful Bill’ is now law, and one provision calls for a major tax break for private school donors.

-

2025 SALT Cap Could Hurt Top 'Hidden Home Cost'

2025 SALT Cap Could Hurt Top 'Hidden Home Cost'Tax Deductions The GOP tax bill could make hidden homeowner costs worse for you. Here’s how.