7 Tips for Talking to Millennials About Money

Discussing financial matters with your kids can be difficult. Try to remember that they are adults.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

You have probably watched your Millennial struggle financially, from credit cards to career decisions. If it's any consolation, money troubles are not unique to your kids: A recent study by PricewaterhouseCoopers found that a staggering 42% of surveyed Millennials rely on payday loans and tax refund advances. Nearly 30% of Millennials are routinely overdrawing on their checking accounts, and almost half of those surveyed could not come up with $2,000 if an unexpected need arose.

This is a troubling state of affairs, and you might wonder how we got here. The short answer is a combination of the difficult job market, easy access to credit-card debt and high student loans. Compounded by inadequate financial knowledge, you have the makings of a personal financial disaster.

Working in the wealth advice industry and observing the lives of my friends, I have seen parents respond to this struggle with one of two extremes. They either always come to the rescue or relentlessly require 100% no-excuses-allowed financial independence. A balanced position is hard to come by, and for good reason. As a society, we are not well-trained to talk about money. So, from a Millennial who actually manages money for a living, here are seven tips for having money conversations with your adult kids.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

#1: Model constructive money conversations.

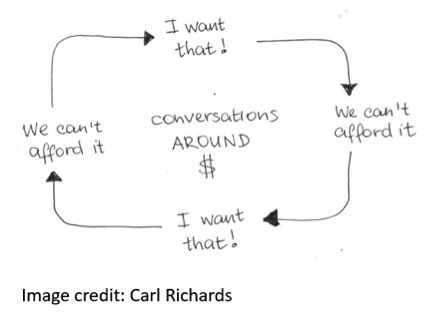

Talking about money is uncomfortable. Here is a visual illustration of how the conversation usually goes from Carl Richards, a New York Times columnist and the author of The Behavior Gap.

Why do we talk around money instead of addressing it head-on? In my experience, it's because money is a stand-in for deeper issues. Safety, belonging and self-esteem can get tangled together in messy ways. The best way to unravel the knot is to model direct and honest conversations about money in your family. If you discover that there are ways you could have done better, share that. Your willingness to be vulnerable will go a long way towards making an impact.

#2: Choose the conversation setting wisely.

Most Millennials have negative associations with sitting across the table from their parents, teachers and other authority figures. The typical connotation of that setting is "you are in trouble," which can trigger a defensive mindset before you say a single word.

Instead, consider having the conversation in a setting that feels safe and open. A chat during a ballgame, over cups of frozen yogurt or even just walking in nature can encourage willingness to consider a different perspective.

#3: Recognize that some formulas and guidelines no longer work.

As a parent, you have considerably more personal experience with money than your child. However, openness to different ideas is a critical ingredient of difficult conversations.

The rule of spending no more than 25% of your paycheck on housing is virtually impossible to follow in most major cities. A traditional 9-5 job in the office is no longer the only way of making a living. Technology and globalization have changed the path to financial independence. Your kids may not have it all figured out, but you should recognize that some of the advice that may have worked for you can no longer work for them.

#4: Talk about concepts and big picture.

From buying a Subzero fridge to missing a student loan payment, opportunities to make snarky comments about your kid's money decisions are endless. Resist that urge. Your Millennial will likely bristle and get defensive—hardly a recipe for a heart-to-heart conversation.

Try to talk about money in the context of values instead. Millennials are naturally tuned in to honoring their values, and helping your kids get clarity on what's most important can create a considerable impact. Encourage them to think out loud about strategy, and tactics will take care of themselves.

#5: Share lessons learned without judging their choices.

It is easy to label a lease of a luxury car irresponsible and self-indulgent, especially with student-loan payments coming due next week. Clever commentary along the lines of "aren't we living large?" might make you feel good in the moment, but in the long run it does more damage than good.

Instead, let go of right and wrong in favor or more constructive feedback. Is the choice functional? If something works and you still don't like it, it's a matter of personal preference. If a choice does not work, talking about it from a factual perspective will get you further than judgment.

#6: Allow them to own their choices.

When talking to your Millennial about money, keep in mind that you are talking to an adult. Whether you agree with his or her choices, your child is entitled to choose and own the consequences. There are a few situations that may require intervention: signs of a disorder-level pathology, addiction or concerns about safety may warrant a direct conversation. Otherwise, set clear expectations and let your child work through his or her puzzle.

#7: Offer an introduction to a financial planner or an attorney.

Sometimes, they simply need to hear it from someone else. If you feel that you have exhausted your options, consider introducing your child to a professional. It may be especially beneficial for him or her to work with a specialist who is similar in age or life stage. A message may carry more weight coming from someone in the same shoes.

Above all, remember that your kids need to know that you trust them and believe in them. It is perfectly valid to set clear expectations and hold the boundary. However, in everything you say and do, remember that your relationship with your son or daughter is all you have. Put that first, enter the conversation in the spirit of openness, and you will create a better outcome and a stronger bond with your Millennial.

William Rassman, CFP® is the Director of Advisory Services at Centric Capital Advisors. He began his career in 2008, working for several large firms before joining Centric.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

William Rassman is a Certified Financial Planner™ and Vice President – Wealth Adviser for the independent investment and insurance firm Centric Capital Advisors. He began his career in NYC at Smith Barney in 2008.

-

Over 65? Here's What the New $6K 'Senior Deduction' Means for Medicare IRMAA Costs

Over 65? Here's What the New $6K 'Senior Deduction' Means for Medicare IRMAA CostsTax Breaks A new deduction for people over age 65 has some thinking about Medicare premiums and MAGI strategy.

-

U.S. Congress to End Emergency Tax Bill Over $6,000 Senior Deduction and Tip, Overtime Tax Breaks in D.C.

U.S. Congress to End Emergency Tax Bill Over $6,000 Senior Deduction and Tip, Overtime Tax Breaks in D.C.Tax Law Here's how taxpayers can amend their already-filed income tax returns amid a potentially looming legal battle on Capitol Hill.

-

5 Investing Rules You Can Steal From Millennials

5 Investing Rules You Can Steal From MillennialsMillennials are reshaping the investing landscape. See how the tech-savvy generation is approaching capital markets – and the strategies you can take from them.

-

I'm a Financial Planner: These Small Money Habits Stick (and Now Is the Perfect Time to Adopt Them)

I'm a Financial Planner: These Small Money Habits Stick (and Now Is the Perfect Time to Adopt Them)February gets a bad rap for being the month when resolutions fade — in fact, it's the perfect time to reset and focus on small changes that actually pay off.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.

-

To Love, Honor and Make Financial Decisions as Equal Partners

To Love, Honor and Make Financial Decisions as Equal PartnersEnsuring both partners are engaged in financial decisions isn't just about fairness — it's a risk-management strategy that protects against costly crises.

-

For More Flexible Giving, Consider Combining a Charitable Remainder Trust With a Donor-Advised Fund

For More Flexible Giving, Consider Combining a Charitable Remainder Trust With a Donor-Advised FundIf a charitable remainder trust puts too many constraints on your family's charitable giving, consider combining it with a donor-advised fund for more control.

-

These Thoughtful Retirement Planning Steps Help Protect the Life You Want in Retirement

These Thoughtful Retirement Planning Steps Help Protect the Life You Want in RetirementThis kind of planning focuses on the intentional design of your estate, philanthropy and long-term care protection.

-

A Wake-Up Call and a Healthy Dose of Terror: How to Survive Your First Days in Prison

A Wake-Up Call and a Healthy Dose of Terror: How to Survive Your First Days in PrisonThis young man needed to be scared straight after his mother expressed her fear that he was on a path to prison. Hearing these eight do's and don'ts worked.