Use the Holidays to Talk With Your Family About Personal Finance

Tough topics -- such as advance directives and saving for retirement -- are best approached face to face.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The holiday season is often the time when families gather together. Here’s a suggestion: Why not take this opportunity to engage in a meaningful conversation with your family members about how you’d like them to be as well prepared as possible for the future?

Two essential concerns that often get short shrift among families are disciplined saving for retirement and advance health care directives. The substance of what you can potentially discuss (if you haven’t already!) impacts every generation. If these concerns are tackled now, you’re likely to prevent huge misunderstandings later. Even more importantly, you’ll be helping your family to safeguard their health decisions and enjoy a more secure retirement.

“Gen Up, Gen Down”

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

You might think of this exchange in terms of “Gen Up, Gen Down.” From the vantage point of the older generation (Gen Down), the conversation can include advising your kids on the best strategies to save and invest for retirement, along with familiarizing them with your own carefully considered (and documented) end-of-life directives.

If you’re a younger family member (Gen Up), and are unaware of your parents’ wishes concerning advance care planning, this discussion could be about urging them to lay the foundation for end-of-life choices that are well understood—and that, as a consequence, can be honored. And, by the way, a great starting point is to talk about what you’re doing or planning to do to help make these recommendations a reality.

Saving for the Future

If you’re reading this article from the perspective of a parent with one or more children in their 20s and 30s, a critical concern should be whether they’ve started saving for their retirement.

Thanks to the phenomenon of increasing longevity, your own retirement savings will likely need to stretch across several decades. For many parents, that means less of a legacy to leave their children. For young adults at the beginning of their working lives, saving for retirement is more critical than ever. Those savings could be virtually all they can count on to support their own retirement down the road.

Specifically, here’s what you should be asking your children: Are you saving the maximum amount that you can under today’s tax laws? And placing it in an IRA so it can grow tax-free?

This is the question you might be asking yourselves: If my kids are struggling with contributing the full amount—can I afford to help support their IRA contributions?

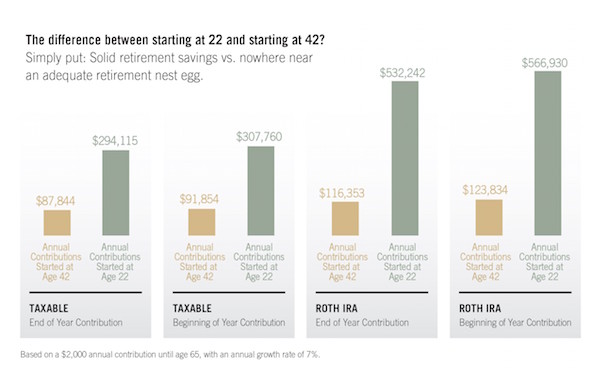

The graphic below illustrates what a mighty difference it makes when people start early in socking away the contribution (we’ve used $2,000 of earned income, but it usually has been adjusted for inflation annually) in a Roth IRA. With a Roth IRA, that savings can be invested and grow tax-free.

As illustrated above, if begun at age 22, a $2,000 Roth IRA contribution when made at the beginning of each tax year, based on an annual growth rate of 7%, will grow, tax-free, to $566,930 when the account holder turns 65—44 years later. Postponing that process for 20 years (beginning it at age 42) means the end amount will be just $123,834. By way of contrast, that same amount, if not invested in an IRA (and exposed to a 30% tax rate and subsequent 4.9% tax growth), would amount to $307,760 after 44 years.

The difference between starting at 22 and starting at 42? Simply put: Solid retirement savings vs. nowhere near an adequate retirement nest egg.

Compound Interest: The 8th Wonder of the World

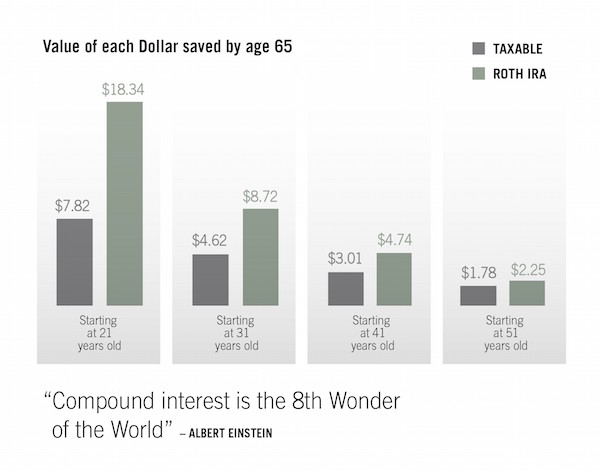

Some attribute the observation “Compound interest is the 8th Wonder of the World” to Albert Einstein. Regardless of who authored it, the point made is profound. Compounding is why there’s such an enormous disparity in the results achieved between starting to save and invest in your early 20s versus starting further on. It’s tremendously important that Gen Y starts saving and investing now. The diagram below presents the compounding argument (based on a 7% annual rate of return) in an unadorned way:

As a parent, if you have the financial means to help your kids be better positioned for their futures, I can’t think of a more effective way to accomplish this than to kick in a portion of the current maximum allowable to their IRAs each year. Starting this holiday season. But regardless of whether or not you can afford to help out financially, persuading them of the value of this discipline is a huge gift in itself.

Advance Directives

Conversations about end-of-life choices are often characterized as “uncomfortable” or “difficult.” Every family is different; in my experience, these discussions give people who care about one another the opportunity to discuss what truly matters to them—along with the potential to make future outcomes significantly better.

Advance Directives legally document your wishes and values should you become too incapacitated to make health care decisions. A great starting point for the Advance Directives conversation is to talk about what you’ve already done to make your wishes clear. Whether you’re a parent having this conversation with your children, or an adult child raising this subject with older parents: Have you formalized your own Advance Directive? Unfortunately, medical crises happen to people of every age.

Every adult should take the time to prepare an Advance Directive. By doing so, you’re directing your own destiny—while helping to protect family members from carrying the burden of making critical medical decisions for you. It’s a “gift” to yourself and to your family that’s well worth sharing during the holidays, or any time of the year.

Russ Hill CFP®, AIFA® is CEO and Chairman of Halbert Hargrove, based in Long Beach, CA. Russ specializes in investing, financial planning and longevity-awareness solutions.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Russ Hill CFP®, AIFA® is CEO and Chairman of Halbert Hargrove Global Advisors LLC, an independent registered advisory firm based in Long Beach, CA. He has led the firm for more than 40 years, specializing in investing, financial planning and longevity-awareness solutions. Russ is heavily involved with Stanford University's Center on Longevity, and has helped to launch the Center's symposiums and Design Challenges on aging-related challenges.

-

Over 65? Here's What the New $6K 'Senior Deduction' Means for Medicare IRMAA Costs

Over 65? Here's What the New $6K 'Senior Deduction' Means for Medicare IRMAA CostsTax Breaks A new deduction for people over age 65 has some thinking about Medicare premiums and MAGI strategy.

-

U.S. Congress to End Emergency Tax Bill Over $6,000 Senior Deduction and Tip, Overtime Tax Breaks in D.C.

U.S. Congress to End Emergency Tax Bill Over $6,000 Senior Deduction and Tip, Overtime Tax Breaks in D.C.Tax Law Here's how taxpayers can amend their already-filed income tax returns amid a potentially looming legal battle on Capitol Hill.

-

5 Investing Rules You Can Steal From Millennials

5 Investing Rules You Can Steal From MillennialsMillennials are reshaping the investing landscape. See how the tech-savvy generation is approaching capital markets – and the strategies you can take from them.

-

When Estate Plans Don't Include Tax Plans, All Bets Are Off: 2 Financial Advisers Explain Why

When Estate Plans Don't Include Tax Plans, All Bets Are Off: 2 Financial Advisers Explain WhyEstate plans aren't as effective as they can be if tax plans are considered separately. Here's what you stand to gain when the two strategies are aligned.

-

Counting on Real Estate to Fund Your Retirement? Avoid These 3 Costly Mistakes

Counting on Real Estate to Fund Your Retirement? Avoid These 3 Costly MistakesThe keys to successful real estate planning for retirees: Stop thinking of property income as a reliable paycheck, start planning for tax consequences and structure your assets early to maintain flexibility.

-

I'm a Financial Planner: These Small Money Habits Stick (and Now Is the Perfect Time to Adopt Them)

I'm a Financial Planner: These Small Money Habits Stick (and Now Is the Perfect Time to Adopt Them)February gets a bad rap for being the month when resolutions fade — in fact, it's the perfect time to reset and focus on small changes that actually pay off.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.

-

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure Them

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure ThemHow can advisers reassure clients nervous about their plans in an increasingly complex and rapidly changing world? This conversational framework provides the key.