3 Retirement Tax Mistakes You Can't Afford to Make

The way you get your income changes once you retire. Make sure your tax strategies change as well, or you could be paying Uncle Sam a lot more than you bargained for.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

It’s easy to assume that financial choices boil down to one’s preferences. While personal preferences, goals and priorities should drive most financial decisions, they often can convert a good intention into a mistake. Conversely, those mistakes may lead you astray: Setting the wrong goals, adopting the wrong strategies, and utilizing the wrong tactics. When the stakes are high (aka retirement), unfortunately, many mistakes may become unfixable.

Most soon-to-be and recent retirees don’t think about taxes when heading into retirement. This is a major problem. If this is you, don’t worry. Keeping taxes at the forefront of your retirement planning will help you not only avoid the following three mistakes, but allow you to take advantage of the opportunities they may present.

Mistake #1: Not grasping how your taxes will change in retirement

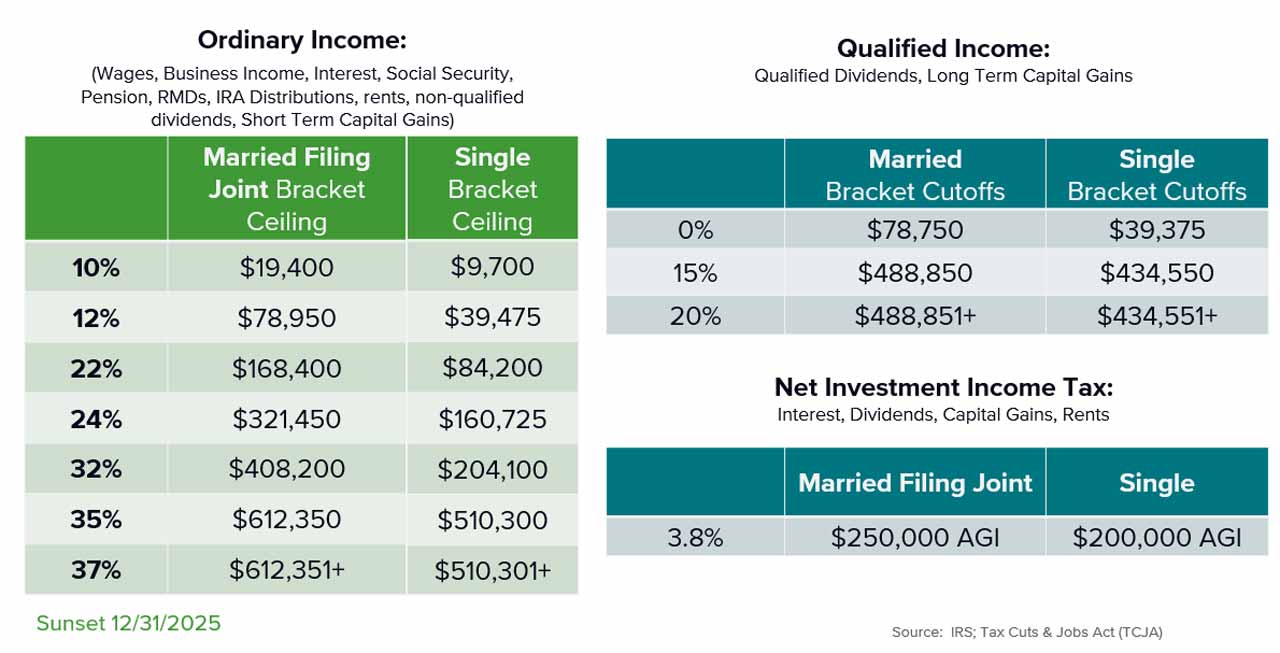

The type of tax you pay is the first key way your taxes change during retirement. While working, most of your income likely comes from wages and is taxed as “ordinary income.” Most of your earnings come from a regular paycheck and bonus and are taxed at the ordinary income tax rates shown in Figure 1 below.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

When you retire, however, you’ll likely replace your lifestyle spending with multiple sources of cash flow, all of which are potentially taxed in different ways with different rates. 1.) Social Security benefits, pension benefits and distributions from retirement accounts, like traditional IRAs, are all taxed at ordinary rates. 2.) Qualified dividends and long-term capital gains will be taxed at lower capital gains rates. 3.) Distributions from tax advantaged accounts like Roth IRAs may not be taxed at all.

Figure 1: 2019 Income & Capital Gains Tax Rates

These different tax treatments create the opportunity to potentially create the same after-tax cash flow with less pre-tax income. This means that you may be able to stretch out the value of your retirement nest egg longer than you anticipated.

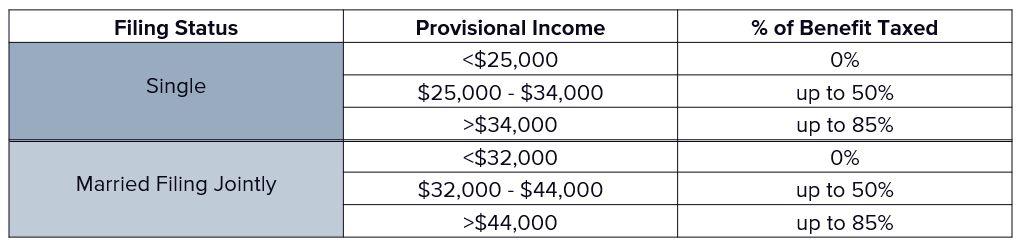

For example, qualified withdrawals from tax-advantaged accounts like Roth IRAs are tax free and do not count as income. A portion of your Social Security may be able to avoid taxation if you keep your “provisional income” within certain ranges as shown in Figure 2. If some of your income comes from taxable accounts you may benefit from a lower 0% or 15% capital gains tax, reducing the total amount of tax you owe. On the other hand, if all of your income is coming from a tax-deferred account like a traditional IRA, your situation might be even worse as withdrawals from tax-deferred accounts are taxed as ordinary income.

Figure 2: Social Security Benefits Taxed based on Provisional Income

How you pay taxes also changes during retirement. While working, your employer makes this easy by withholding income tax from your earnings. In retirement, however, most cash flow sources do not automatically have withholding, which means you’ll underpay your tax due without some proactive efforts on your part. Failure to set aside enough to pay your tax bill could mean you have to withdraw more money than you had planned.

To solve this potential problem, setting up withholding on recurring income sources (Social Security, pensions and distributions from retirement accounts) is a core first step to ensuring sustainable retirement income. While modifying withholding on Social Security and pensions can be cumbersome, withholding on IRA distributions is a super-efficient method to manage this quagmire. Depending on your custodian, up to 100% of a distribution can be allocated to federal or state income taxes, which avoids the need to make estimated tax payments. But just make sure to watch out, as those tax withholding distributions are still taxable!

Mistake #2: Failing to create tax diversification

Diversification is a familiar term. In an investment context, diversification can help mitigate your risk and ensure your investments are on track to manage your retirement goals. But diversification is also important when it comes to your taxes both while working and in retirement. Tax diversification means owning assets in different types of accounts so you have the flexibility to better balance the tax impact of utilizing those assets to pursue your financial objectives.

Since not all investments are treated equally by the IRS, it’s helpful to categorize the tax treatment of investments into three groups — taxable, tax-deferred and tax-advantaged.

- Tax-deferred. You get an income tax deduction on your investment now, your earnings grow tax-free, and taxes are deferred until distributions begin, generally by age 70.5. Examples include traditional IRAs and 401(k)s.

- Taxable. Investments made after taxes where any earnings are fully taxable at year end. Examples include taxable brokerage accounts.

- Tax-advantaged. Contributions are made after taxes, your earnings grow tax-free, and there is no tax due on distributions, assuming certain requirements are met. Examples include Roth IRAs and Roth 401(k)s.

Most workers incorrectly over-prioritize saving in tax-deferred accounts, such as 401(k)s and 403(b)s, because they are easily accessible through employers, and they offer an immediate tax deduction and corresponding current cash flow benefit. The thought of how this will benefit you 10, 20 or 30 years down the road is usually not considered.

Why is this a problem? Because, what you see is not what you get. Just because you have $1 million in an IRA, doesn’t mean you have $1 million to spend. Tax-deferred accounts come with tax liabilities upon distribution, so after federal and state taxes it is more likely you’ll only get to spend closer to 50% to 70% of what you see on your statement.

So what is a worker or retiree to do? Workers need to take advantage of smart saving strategies. They need to understand what strategies are available through their employers and ensure they are correctly funding the right programs at the right times. Similarly, if you have a side gig or are self-employed, you need to understand that additional opportunities exist to save for retirement beyond what might be offered by your employer, including the taxable and tax-advantaged examples above.

Retirees need to create tax-efficient retirement cash flow and evaluate whether and when Roth IRA conversions make sense in order to create the tax diversification they may currently lack.

Roth conversions are one of the most effective tools for paying off Uncle Sam and reallocating assets into the tax advantaged bucket. These opportunities are more prevalent prior to when required minimum distributions (RMDs) start at age 70.5, but certainly can make sense even after this age when preparing your net worth for a future transition to your heirs.

Mistake #3: Getting stuck with big RMDs

Saving in 401(k)s, 403(b)s and IRAs is like chewing bubble gum: The chew is good (tax deduction), the taste is great (tax free growth), but when you eventually spit it out, it’s probably going to get stuck in your shoe (big RMDs). Getting stuck with big RMDs is really the combination of the first two mistakes: You saved too much in tax-deferred accounts and never created any tax diversification for yourself.

An RMD is the minimum amount you must withdraw from your retirement accounts each year and starts at age 70.5. It generally starts out at 3.6% of the account balance and grows each year as you age (nice birthday present, I know).

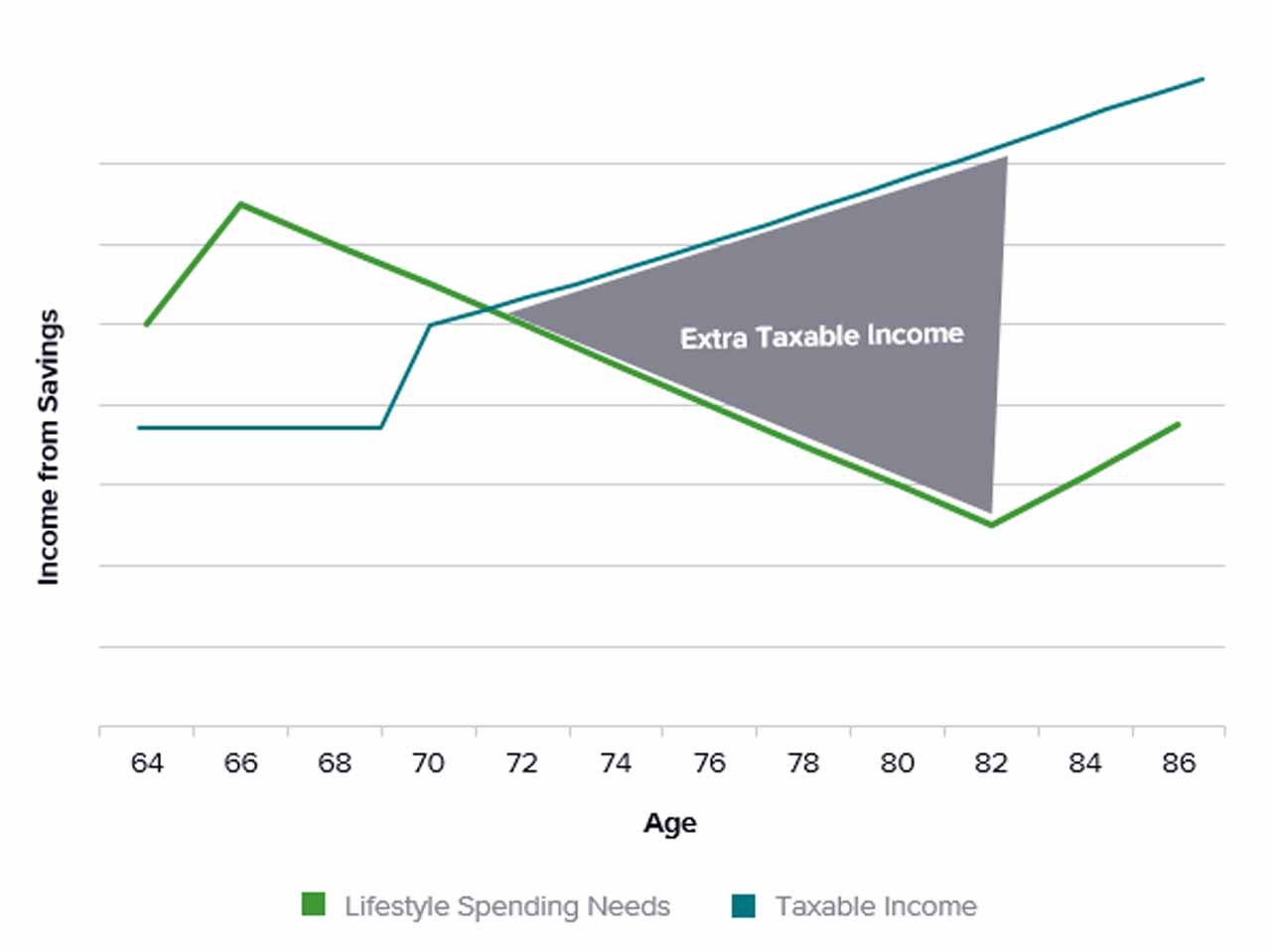

Figure 3: Spending Needs vs. Taxable Income

The green line in Figure 3 represents your expected spending in retirement. Most retirees often find that their spending is higher in early retirement as they finally have the time to knock off many items on their bucket lists. Inevitably though, spending does typically decline as life slows down.

The teal line represents taxable income. While retirement is first funded from Social Security, pension and retirement savings, taxable income kicks up a notch when RMDs start at 70.5. For many retirees, they had already established a consistent lifestyle prior to this time. Consequently, as the chart shows, the amount of income you pay tax on ends up being greater than the amount of cash flow you need to meet your lifestyle. This is the RMD problem: having to pay tax on assets you don’t need to spend to live your lifestyle.

In other words, you are paying taxes for no reason. This is why tax diversification and being aware of how your retirement will be taxed is so important. The RMD problem is best addressed before it starts (planning pre-70.5 to create tax diversification as discussed above). For the charitably minded, qualified charitable distributions (QCDs), allow you to send payments directly from your IRA to the charitable organization(s) of your choice. Those donations then count toward your RMD. This reduces your adjusted gross income and corresponding tax liability. This special treatment does not apply to donations made after the distribution has been received.

A Comprehensive Financial Plan is the Key to Avoiding these Tax Mistakes

Paying unnecessary tax is not a prudent use of your hard-earned savings. When working with an adviser, make sure you are addressing the opportunities specific to your situation and crafting a strategy to create tax diversification, tax-efficient retirement income and integrating this with your estate plan. Consider these questions as part of your discussion:

- Is the 0% capital gains tax rate a possibility for my situation? What can I do to intentionally position myself to take advantage of it?

- Is my portfolio structured to minimize taxable income/gains annually?

- What is my annual Roth conversion strategy?

The opinions voiced in this article are for general information only and are not intended to provide specific advice or recommendations for any individual. This information is not intended to be a substitute for specific individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax adviser. No strategy assures success or protects against loss.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Brian Vnak is Vice President, Wealth Enhancement Group, advising clients on income, gift, trust and estate tax issues.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure Them

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure ThemHow can advisers reassure clients nervous about their plans in an increasingly complex and rapidly changing world? This conversational framework provides the key.

-

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate Empire

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate EmpireSmall rental properties can be excellent investments, but you can use 1031 exchanges to transition to commercial real estate for bigger wealth-building.

-

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs In

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs InRoth conversions are all the rage, but what works well for one household can cause financial strain for another. This is what you should consider before moving ahead.

-

The 8 Stages of Retirement: An Expert Guide to Confidence, Flexibility and Fulfillment, From a Financial Planner

The 8 Stages of Retirement: An Expert Guide to Confidence, Flexibility and Fulfillment, From a Financial PlannerRetirement planning is less about hitting a "magic number" and more about an intentional journey — from understanding your relationship with money to preparing for your final legacy.

-

5 Mistakes to Avoid in the 5 Years Before You Retire, From a Financial Planner

5 Mistakes to Avoid in the 5 Years Before You Retire, From a Financial PlannerWhen retirement is in reach, financial planning gets serious — and there's a heightened risk of making serious mistakes, too. Here are five common slipups.