A Little Hedging Can Go a Long Way to Protect Your Retirement Savings

What sounds like a hedge fund but is nothing like one? A hedged equity portfolio. This type of investment portfolio can help you avoid much of the pain of stock market losses even as you enjoy some of its gains.

“Don’t worry, the market always comes back.”

If you haven’t heard this comment yet — from a well-meaning friend or co-worker, or maybe a concerned financial professional — you almost surely will. We’re all hoping for the best but bracing for the worst as the market continues to react to political and economic uncertainty.

Your friends and colleagues aren’t wrong. Historically, the stock market always has come back, and investing in stocks has been a good way to grow retirement savings over the long term.

Sign up for Kiplinger’s Free E-Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

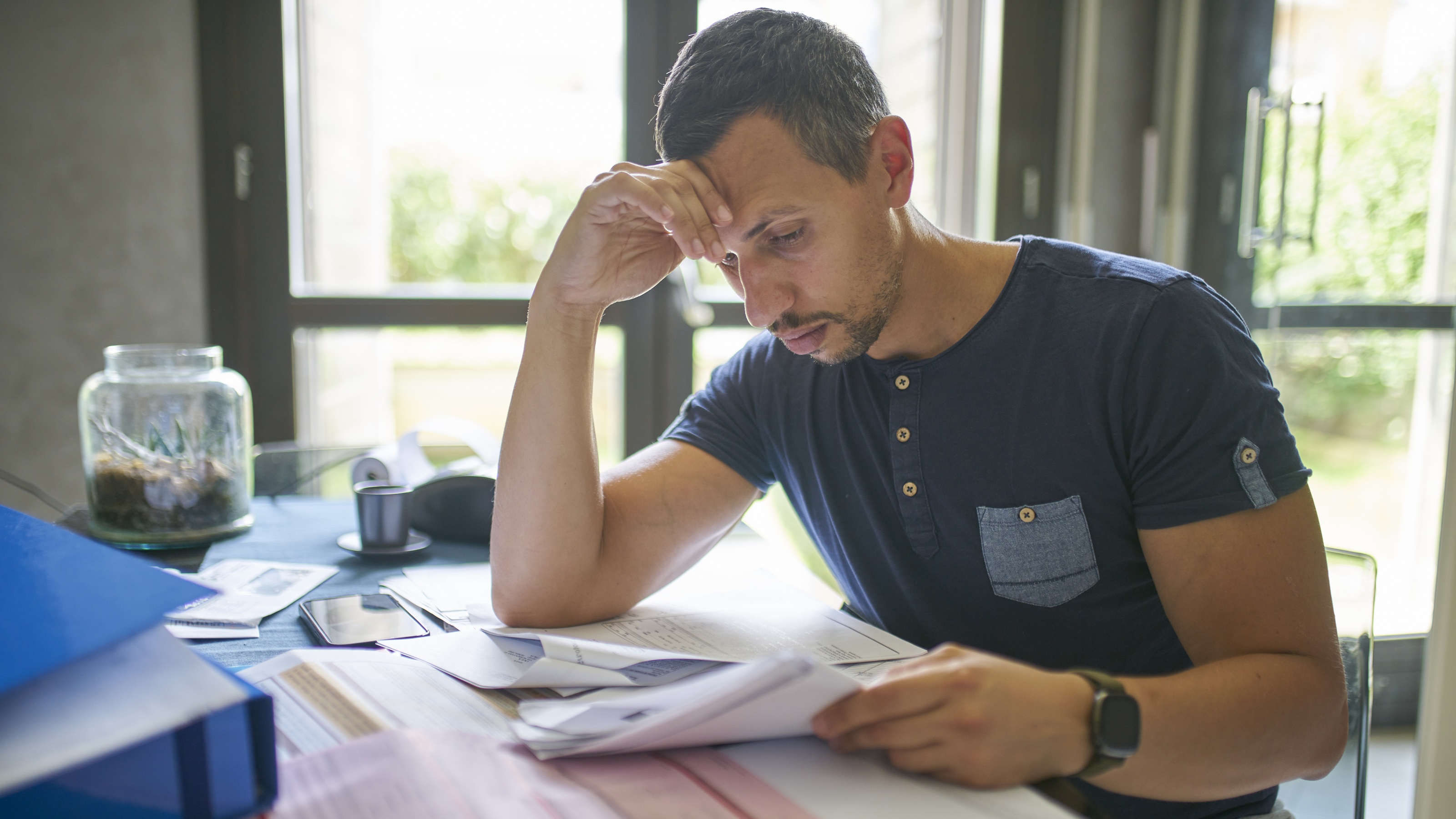

Of course, historical data doesn’t offer much comfort when the loss is personal, especially for investors who are in or approaching retirement and don’t have a lot of time to recover from this latest bear market. Waiting for the market to come back may not sound like much of a solution if you are retired or you’re planning to retire in the next few years and are depending on those assets for income.

Hedging isn’t the same as hedge funds

That is why it’s so important for retirees in particular to assess both their tolerance for risk and how much risk is in their portfolio. Considering how they can better protect their nest egg by building in hedges against future calamities could make a significant difference in the success of their financial plan.

If the word “hedge” just made you do a double take, don’t let it throw you. The term hedging is often confused with hedge funds, which sometimes use high-risk strategies with the goal of obtaining larger gains. Hedging in a retirement portfolio, on the other hand, is more about safety – it allows an investor to participate in the upside of the market while establishing some downside protection.

A Las Vegas example to help illustrate hedging

How does that work? Here’s one way to look at it. Imagine taking a weekend trip to Las Vegas with $1,000 to spend. If you carry the entire $1,000 into a casino and use it to gamble, you could win big — really big — but unfortunately you could also lose everything in one night. On the other hand, you could take just $100 into the casino and put the rest in your hotel room safe. If things go well at the casino, you still could win a bundle. But even if you lose it all, you still have $900 to enjoy the rest of your visit.

A hedged-equity portfolio works in much the same way. You might put 90% into more conservative investments, for example, for both income and safety, and allocate just 10% to a more aggressive strategy, such as buying S&P 500 call options. (For more on that, please read Buying Index Calls.)

There’s a risk involved with the allocation to stock options, and that’s the point. The risk of the call options is offset by the safety of bonds or other conservative investments, but the call options can provide the growth that is so important these days. When interest rates are low and Americans are living longer, many will retire without a pension to provide reliable income.

I like buying call options instead of stocks in this strategy because if you’re putting only 10% of your portfolio into the stock market, you’ll want to get the most return for the risk you’re taking. With call options, investors can multiply the power of their starting capital and, therefore, potentially increase the size of their profits. However, the concepts involved with trading options can be complicated, so it’s definitely something that should be done by a professional or an experienced investor.

A look at a hedged portfolio

Here’s an example of what a hedged portfolio could look like, compared with an unhedged portfolio:

Let’s say you had $1 million in an unhedged portfolio that was 100% invested in an S&P 500 index fund, which tracks the market. Let’s assume that in your first year of going all in, the stock market did extremely well. The S&P 500 went up more than 30%, and your portfolio saw all of that gain and grew to $1.3 million.

Pretty great, right?

But what if we went into a recession the next year, and the S&P 500 went down 50%? Your $1.3 million portfolio would turn into $650,000. In a matter of a few months, you would have lost everything you gained, plus $350,000 of your principal.

What would it look like if the portfolio was hedged?

A hedged-equity portfolio aims to capture 70% of the return of the market while attempting to limit losses to approximately 10% to 12% in any one year. That means if the S&P 500 returned 30%, you could see a 21% gain, and your portfolio after that first year would be worth $1,210,000.

However — and this is a pretty big “however” if you’re near or in retirement — if the next year the S&P went down 50%, and your hedged-equity portfolio succeeded in limiting your losses to 12%, your balance would be $1,064,800. You’d keep some of the gain from the year before and all of your principal. While there is no perfect investment strategy, it is important to understand that a hedging strategy may underperform in an up market. Conversely, a well-executed hedging strategy could outperform the market over time, especially a market that is highly volatile.

The bottom line for investors

For those who can’t afford, or can’t stomach, a major loss, a hedging strategy can serve as a worthy alternative to going all in on stocks and then simply hoping the market doesn’t crash.

The good news is you can put this strategy in place at any time. For instance, if you add hedges to your portfolio now, you’ll be providing protection in case it falls from here — but you’ll still participate in some of the upside if it rises sharply.

For those who can’t wait for the market to come back, there’s another saying that’s popular in the financial industry: It’s not what you make, it’s what you keep. That’s the mantra investors should be focused on as they transition their portfolio for retirement.

Kim Franke-Folstad contributed to this article.

Securities offered through World Equity Group, Inc., members FINRA and SIPC. Investment advisory services offered through BluePath Capital Management, LLC / DBA Nicholas Wealth Management. Nicholas Wealth Management and World Equity Group, LLC are separate entities.

The appearances in Kiplinger were obtained through a PR program. The columnist received assistance from a public relations firm in preparing this piece for submission to Kiplinger.com. Kiplinger was not compensated in any way.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

David Nicholas is president and founder of Nicholas Wealth Management (www.nicholaswealth.com). He maintains FINRA Series 7, 63 and 65 securities designations and has life and health insurance licenses in Georgia.

-

Stock Market Today: Stocks Slip Ahead of Big Earnings, Inflation Week

Stock Market Today: Stocks Slip Ahead of Big Earnings, Inflation WeekPerhaps uncertainty about tariffs, inflation, interest rates and economic growth can only be answered with earnings.

-

Ask the Editor — Tax Questions on "The One Big Beautiful Bill Act"

Ask the Editor — Tax Questions on "The One Big Beautiful Bill Act"Ask the Editor In this week's Ask the Editor Q&A, we answer tax questions from readers on the new tax law.

-

Stock Market Today: Stocks Slip Ahead of Big Earnings, Inflation Week

Stock Market Today: Stocks Slip Ahead of Big Earnings, Inflation WeekPerhaps uncertainty about tariffs, inflation, interest rates and economic growth can only be answered with earnings.

-

I'm a Financial Planner: Here Are Some Long-Term Care Insurance Tips for Every Age

I'm a Financial Planner: Here Are Some Long-Term Care Insurance Tips for Every AgeStrategies include adding riders to life insurance for younger individuals and considering hybrid or traditional long-term care policies for those in their mid-50s and 60s.

-

Engineering Reliable Retirement Income in 2025: An Expert Guide

Engineering Reliable Retirement Income in 2025: An Expert GuideFor dependable income, consider using a bucket strategy and annuities in tandem to promote structure, flexibility and peace of mind.

-

Crazy Markets Shouldn't Derail Your Retirement if You Follow This Financial Pro's Plan

Crazy Markets Shouldn't Derail Your Retirement if You Follow This Financial Pro's PlanBeing nervous about retiring in a volatile market is a red flag that you're relying too heavily on your investment portfolio, rather than a comprehensive plan.

-

Stock Market Today: Solid Signals Lift Stocks Despite Tariff Noise

Stock Market Today: Solid Signals Lift Stocks Despite Tariff NoiseMarkets are whistling over the White House in an ongoing display of corporate America's enduring ability to survive and advance.

-

Key to Financial Peace of Mind: Think 'What's Next?' Rather Than 'What If?'

Key to Financial Peace of Mind: Think 'What's Next?' Rather Than 'What If?'Even if you've hit your magic number for retirement, it's hard to stop worrying about money. Giving it a clear purpose is one way to reduce financial anxiety.

-

Three Estate Planning Documents a Business Owner Can't Afford to Skip

Three Estate Planning Documents a Business Owner Can't Afford to SkipA business owner's estate plan should protect the company and its employees as well as the entrepreneur's heirs. These three documents are critical.

-

Stock Market Today: Trump's Copper Comments Cause a Stir

Stock Market Today: Trump's Copper Comments Cause a StirMarkets remain resilient and monetary policy makers stand fast against a rising tide of new terms of trade, including around copper.