5 Bear Market Lessons Learned from 20 Years as a Financial Adviser

When stock markets are tanking, jumping, shaking and diving, here's what works for investors and retirement savers, and what doesn't.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

It was a brutal start for stock investors in 2020. February and March saw some of the worst one-day point drops in the Dow’s history. April may be just as volatile. As bad as it is, there are lessons we can learn from the recent stock market downturn that can help us in the future.

These lessons, or themes as I call them, have popped up before in past bear markets. Investors are wise to learn from their mistakes. Here are five lessons, or themes, I've learned from my 20 years of managing clients through past stock market crashes:

1. Asset allocation does work

I find many investors don't spend enough time getting the right mix of stocks to bonds. We call this asset allocation. That is a mistake. All the major equity markets were down for the first quarter, but U.S. Treasury bonds held up. Lesson learned, spend time on your asset allocation. Make sure your mix of stocks and bonds is appropriate for how much risk or downside you can stomach. There are several online risk calculators that can help. My firm uses stress testing software to see how a client's portfolio behaved in past crashes.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

2. Diversification can work too

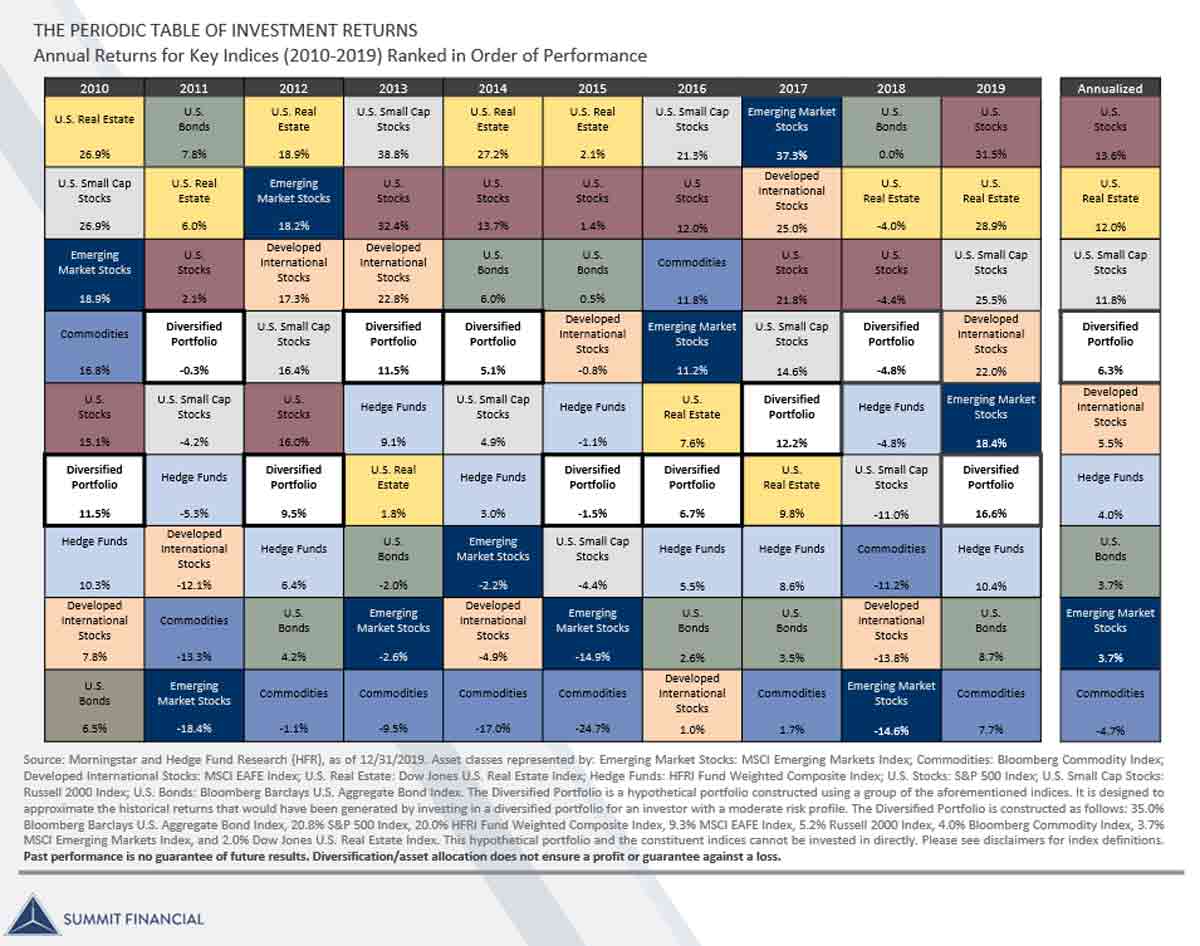

So far gold did well when the stock market didn't. We saw this in 2008-09 as well. That may not always be the case, but gold does have a history of shining at the right times. True, gold does have its disadvantages, namely it doesn't pay dividends and there are costs to owning it directly. The point is diversification — owning different assets that hopefully perform differently — can smooth out the overall return over time. The table below shows how a diversified portfolio performed over the years. Notice the diversified portfolio (in the white boxes below) is never the best nor the worst performer: Its performance has always fallen somewhere in the middle.

Figure 1

3. Not all bonds are created equal

Many investors — and portfolio managers — stretched for higher yields and bought riskier bonds. Riskier bonds didn't behave like bonds on the way down, however, but more like equities. In times of extreme market duress and panic selling — risk off , as we call it in the industry — the only bond that has held up is the U.S. Treasury. My advice: Make sure your bonds are bonds and not equities.

4. Hedging strategies can help

Owning some downside protection is appreciated in market panics. Institutional investors know this. That is why many of them hedge their positions. One type of hedging involves holding stocks — we call this being "long the market" — and "shorting" a small percentage of the market. Shorting hopes to profit when the market falls. Hedging is costly, involves risk and often limits your upside. It is not for everyone. However, most long-short equity strategies did hold up during the downturn. For this reason, I may recommend a small percentage of a client's account be invested in retail long-short equity mutual funds.

5. Guarantees are appreciated in market downturns

In times of great uncertainty, when panic overtakes us all, and the toilet paper is missing from the shopping aisles, it is reassuring to have some guarantees in life. Recently when the Dow lost almost 13% in one day, I was grateful my whole life insurance has a guaranteed account, that is peace of mind.

I am also grateful my clients owned annuities with guarantees. Some annuities provide guaranteed income, while others a guaranteed return. Either way, guarantees are nice to have in times of extreme market panic.

Final thoughts

There are many lessons learned from the recent stock market sell-off. These five have helped me get through past bear markets. While I can't guarantee what the next bear market will look like, there is a good chance these five themes will pop up again. It's like that old adage, fool me once.

Disclaimer: Investment advisory and financial planning services are offered through Summit Financial, LLC, an SEC Registered Investment Adviser, 4 Campus Drive, Parsippany, NJ 07054. Tel. 973-285-3600 Fax. 973-285-3666. This material is for your information and guidance and is not intended as legal or tax advice. Legal and/or tax counsel should be consulted before any action is taken.

Investment advisory and financial planning services are offered through Summit Financial LLC, an SEC Registered Investment Adviser, 4 Campus Drive, Parsippany, NJ 07054. Tel. 973-285-3600 Fax. 973-285-3666. This material is for your information and guidance and is not intended as legal or tax advice. Clients should make all decisions regarding the tax and legal implications of their investments and plans after consulting with their independent tax or legal advisers. Individual investor portfolios must be constructed based on the individual’s financial resources, investment goals, risk tolerance, investment time horizon, tax situation and other relevant factors. Past performance is not a guarantee of future results. The views and opinions expressed in this article are solely those of the author and should not be attributed to Summit Financial LLC. Links to third-party websites are provided for your convenience and informational purposes only. Summit is not responsible for the information contained on third-party websites. The Summit financial planning design team admitted attorneys and/or CPAs, who act exclusively in a non-representative capacity with respect to Summit’s clients. Neither they nor Summit provide tax or legal advice to clients. Any tax statements contained herein were not intended or written to be used, and cannot be used, for the purpose of avoiding U.S. federal, state or local taxes.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Michael Aloi is a CERTIFIED FINANCIAL PLANNER™ Practitioner and Accredited Wealth Management Advisor℠ with Summit Financial, LLC. With 21 years of experience, Michael specializes in working with executives, professionals and retirees. Since he joined Summit Financial, LLC, Michael has built a process that emphasizes the integration of various facets of financial planning. Supported by a team of in-house estate and income tax specialists, Michael offers his clients coordinated solutions to scattered problems.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.

-

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure Them

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure ThemHow can advisers reassure clients nervous about their plans in an increasingly complex and rapidly changing world? This conversational framework provides the key.