Should You Enroll in Medicare If You Are Still Working?

The size of your employer is a key factor in determining the answer.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

You're turning 65 but still working and covered by your employer's health insurance plan. Should you enroll in Medicare? The answer to that question is not as simple as it may appear.

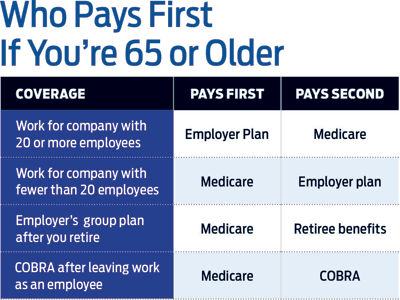

The size of your employer could determine in part whether you enroll in Medicare Part B, which covers outpatient services. If your employer has 20 or more employees, your employer's insurance will be your primary coverage. As long as you're still working, neither you nor your spouse -- if your spouse is older than 65 and covered by your plan -- need to enroll in Part B. When you leave your job, you and your spouse can enroll in Part B during a special enrollment period, which lasts for eight months after you stop working.

You can always drop your employer coverage while you're still working and enroll in Part B. (Stick with your employer plan if your spouse is not eligible for Medicare.) You should compare benefits and costs of your employer coverage and Medicare. If you're considering traditional Medicare, consider costs for Part B, a Part D prescription-drug plan and a Medigap supplemental insurance plan.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

If your employer has fewer than 20 employees, you should enroll in Medicare as soon as you are eligible because it becomes the primary payer. As secondary payer, your employer's plan will not pay for any expenses covered by Medicare. If your spouse is on your employer plan, she or he can continue on your employer plan until age 65 as long as you keep the plan for yourself as secondary coverage. Here are other questions to consider.

If my employer is the primary payer, should I enroll in Part B anyway? It usually doesn't make sense to pay premiums for both plans, unless your spouse needs coverage. Because of a complex formula that Medicare uses to determine how much it will pay for services when it's a secondary payer, the program will not necessarily fill in all the gaps between what a provider charges and what your employer pays.

Should I keep my employer coverage if I work for a small company? Ask the employer's insurance company what kind of gap coverage it offers as a secondary payer to Medicare. Smaller plans often limit the choice of providers. Unless your spouse needs coverage, you're better off buying a private Medigap plan.

If I leave my job after 65 with retiree health benefits until I turn 70, do I need to enroll in Part B? Corporate retiree health benefits are always secondary to Medicare -- even if you have not enrolled in Medicare. Retiree health plans differ on the amount of gap coverage they provide, so it's a good idea to check with the benefits administrator. You may be better off with a Medigap plan. If your spouse is younger than 65 and on your employer plan, find out whether the retiree health plan will continue to provide full coverage.

It's essential to enroll in Part B as soon as you are no longer employed. It's the end of your employment -- not the end of your retiree health benefits -- that determines your enrollment period. If you're older than 65 when you leave work and miss your eight-month special enrollment period, you could find yourself without coverage for many months.

Say you leave your job in October and stay on your retiree health plan. You don’t enroll in Medicare during your special enrollment period, which ends June 30. Your former employer’s health plan finally realizes that you’re eligible for Medicare and stops paying claims. You can’t enroll in Medicare until January, and coverage won’t start for another six months—that’s 12 months without coverage.

Like retiree health benefits, COBRA is a secondary payer to Medicare. It provides coverage under your employer plan for up to 18 months to the retired worker and up to 36 months for a spouse. (You’ll pay full cost for the coverage plus a 2% administrative fee.) Be sure to enroll in Medicare during your special enrollment period after leaving your job.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

We're 64 with $4.3 million and can't agree on when to retire.

We're 64 with $4.3 million and can't agree on when to retire.I want to retire now and pay for health insurance until we get Medicare. My wife says we should work 10 more months. Who's right?

-

Missed an RMD? How to Avoid That (and the Penalty) Next Time

Missed an RMD? How to Avoid That (and the Penalty) Next TimeIf you miss your RMDs, you could face a hefty fine. Here are four ways to stay on top of your payments — and on the right side of the IRS.

-

What Really Happens in the First 30 Days After Someone Dies

What Really Happens in the First 30 Days After Someone DiesThe administrative requirements following a death move quickly. This is how to ensure your loved ones won't be plunged into chaos during a time of distress.

-

9 Types of Insurance You Probably Don't Need

9 Types of Insurance You Probably Don't NeedFinancial Planning If you're paying for these types of insurance, you might be wasting your money. Here's what you need to know.

-

Amazon Resale: Where Amazon Prime Returns Become Your Online Bargains

Amazon Resale: Where Amazon Prime Returns Become Your Online BargainsFeature Amazon Resale products may have some imperfections, but that often leads to wildly discounted prices.

-

457 Plan Contribution Limits for 2026

457 Plan Contribution Limits for 2026Retirement plans There are higher 457 plan contribution limits in 2026. That's good news for state and local government employees.

-

Medicare Basics: 12 Things You Need to Know

Medicare Basics: 12 Things You Need to KnowMedicare There's Medicare Part A, Part B, Part D, Medigap plans, Medicare Advantage plans and so on. We sort out the confusion about signing up for Medicare — and much more.

-

The Seven Worst Assets to Leave Your Kids or Grandkids

The Seven Worst Assets to Leave Your Kids or Grandkidsinheritance Leaving these assets to your loved ones may be more trouble than it’s worth. Here's how to avoid adding to their grief after you're gone.

-

SEP IRA Contribution Limits for 2026

SEP IRA Contribution Limits for 2026SEP IRA A good option for small business owners, SEP IRAs allow individual annual contributions of as much as $70,000 in 2025, and up to $72,000 in 2026.

-

Roth IRA Contribution Limits for 2026

Roth IRA Contribution Limits for 2026Roth IRAs Roth IRAs allow you to save for retirement with after-tax dollars while you're working, and then withdraw those contributions and earnings tax-free when you retire. Here's a look at 2026 limits and income-based phaseouts.

-

SIMPLE IRA Contribution Limits for 2026

SIMPLE IRA Contribution Limits for 2026simple IRA For 2026, the SIMPLE IRA contribution limit rises to $17,000, with a $4,000 catch-up for those 50 and over, totaling $21,000.