One Retirement Risk You May Have Overlooked

No one wants to think their retirement security could depend on some stock market luck. But in a way, unless you've accounted for what's known as sequence of returns risk, bad luck could dash your dreams.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

There’s a serious retirement risk out there that you might not have heard of, and it could have the power to determine the kind of retirement you will have. Have you thought about how sequence of returns affects your retirement?

The sequence of returns, or the order of the returns in your portfolio, does not matter until you start taking withdrawals out of an account. During your accumulation years while you’re working, you are not subject to this risk because you are not withdrawing money. But when you retire (during your distribution phase) you will be.

First, you must have a mind shift when going into retirement. You must go from an accumulation-only mindset to a distribution, preservation and an accumulation mindset. Just simply rolling your 401(k) into a portfolio and putting more of your assets in fixed income tools, like bonds, is not how you will eliminate sequence of returns risk.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Sequence of returns risk is a result of the timing of withdrawals from a retirement account that can have a negative impact on the overall rate of return on the investment. This may seriously hurt a retiree who depends on the income stream from a lifetime of investing.

What is sequence of returns?

Sequence of returns is pretty much a matter of luck, meaning if you retire during a bull market and start taking withdrawals, your assets will most likely last longer than if you retired and started taking income from an account during a bear market. Considering that the current bull market is the longest in history, this concept could be more important than ever right about now.

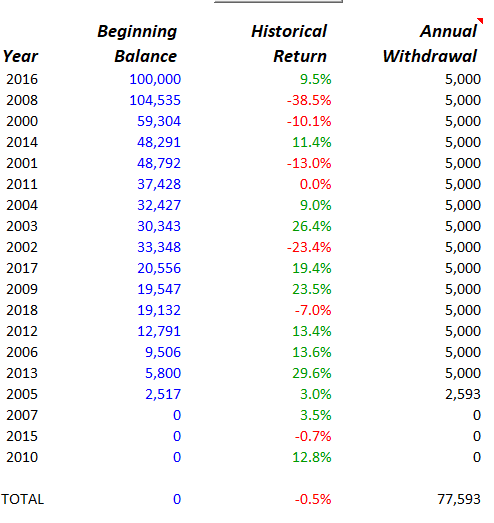

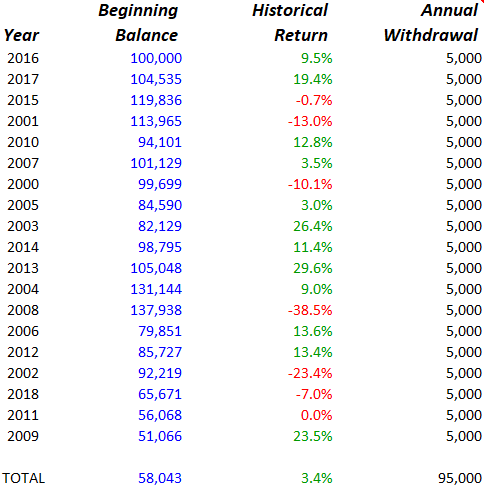

Ever wonder why different people have different opinions of investing in the market during retirement? Look at the hypothetical examples showing having $100,000 in the market during a 10-year period and withdrawing 5% each year. You will see that the order of the returns of the market plays a big role in the final outcome. Keep in mind, both of these women experienced the same, real-world rates of return for their portfolios, just in a different order.

An Example: Two women with the same returns, but one goes broke

Initial Balance: $100,000

Withdrawal Rate: 5.00%

Betty Example No. 1

JoAnne Example No. 2

Note: This hypothetical example is for informational purposes only and is not indicative of past, nor intended to predict future performance of any Index or annuity product.

Is it fair to say that the sequence of returns JoAnne experienced may have provided a better result with the market than Betty ? If you look back, you will see they both started with $100,000 however, Betty ran out of money after 15 years, withdrawing a total of $77,593, while JoAnne has withdrawn $95,000 over the same amount of time and still has $58,043 left in her account.

What can you do to protect yourself from sequence of returns risk?

- Use the right tools for the right job. For income, do not put money into a vehicle like the stock market where the sequence of returns plays a big part. Instead, put it into an investment that will guarantee you a payout for life, like an annuity. By guaranteeing your living and lifestyle expenses are covered, you can put your other assets into investments that you won’t be pulling money from on a consistent basis, such as ETFs and bonds.

- Separate your assets into buckets that work for you differently. For example, secure liquid funds needed for large purchases in the beginning years of retirement in a stable vehicle in one bucket of assets, such as a bank account, money market account or CDs. In the next bucket, supplement your Social Security with other products that provide lifetime income, such as annuities. In a third bucket, determine your probable long term care costs and put money in a hybrid long term care product that does not have ongoing costs. That way you will have your long-term care needs covered down the road. All of your remaining assets should be put into an investment vehicle like ETFs, equities, bonds and mutual funds for future growth to keep up with inflation and taxes.

- Meet with a financial professional looking out for your best interest who is a fiduciary.

Did you know one of the biggest concerns for retirees is running out of money — even over death? Why risk your income in retirement based on the order of the returns of the market?

Protecting yourself against sequence of return risk means being prepared for the worst-case scenario. Don’t assume that you will have a bull market during all your retirement years.

Amy Buttell contributed to this article.

Licensed Insurance professional. Investing involves risk, including the loss of principal. No Investment strategy can guarantee a profit or protect against loss in a period of declining values. Any references to protection benefits or lifetime income generally refer to fixed insurance products, never securities or investment products. Insurance and annuity products are backed by the financial strength and claims-paying ability of the issuing insurance company.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Matthew Schuller is the president and founder of BrightPath Wealth Management. He takes his responsibility as a fiduciary seriously, because he knows how much good wealth management can mean for clients. He has eight years of experience working for a large financial products wholesaler, where he has helped advisers and insurance agents tailor products to their clients' portfolios.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure Them

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure ThemHow can advisers reassure clients nervous about their plans in an increasingly complex and rapidly changing world? This conversational framework provides the key.

-

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs In

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs InRoth conversions are all the rage, but what works well for one household can cause financial strain for another. This is what you should consider before moving ahead.

-

The 8 Stages of Retirement: An Expert Guide to Confidence, Flexibility and Fulfillment, From a Financial Planner

The 8 Stages of Retirement: An Expert Guide to Confidence, Flexibility and Fulfillment, From a Financial PlannerRetirement planning is less about hitting a "magic number" and more about an intentional journey — from understanding your relationship with money to preparing for your final legacy.

-

5 Mistakes to Avoid in the 5 Years Before You Retire, From a Financial Planner

5 Mistakes to Avoid in the 5 Years Before You Retire, From a Financial PlannerWhen retirement is in reach, financial planning gets serious — and there's a heightened risk of making serious mistakes, too. Here are five common slipups.

-

I'm a Financial Planner: This Retirement Strategy Helps Plot a Stress-Free Path to Cash Flow

I'm a Financial Planner: This Retirement Strategy Helps Plot a Stress-Free Path to Cash FlowDividing funds into a safety bucket, an income bucket and a growth bucket can help to cover immediate expenses, manage cash flow and promote growth.

-

Your Most Overlooked Retirement Investment: Luxuriating in Doing Nothing

Your Most Overlooked Retirement Investment: Luxuriating in Doing NothingWhen you take the time to rest and breathe, your brain starts to focus on what matters most in your new stage of life.