2 IRA Changes to Consider Right Now, Thanks to the SECURE Act

Quick: Who did you list as your IRA beneficiary? If you answered your children or grandchildren, not your spouse, you might want to change that ASAP.

Do you have a traditional IRA that you plan on passing on to your heirs one day? Sweeping new retirement legislation may have just pulled the rug out from under certain aspects of that plan for many Americans.

The SECURE Act, signed into law in December 2019, is among the most prolific retirement legislative changes we have seen in more than a decade. Inherited IRA and updated RMD provisions in this legislation could impact your retirement and estate plans, so read on to find out two tax-smart steps you might want to take now:

- Consider naming your spouse (not your children or grandchildren) as your primary beneficiary for your IRA.

- Weigh implementing a strategy to start converting your traditional IRA to a Roth over time.

But first, some background on what exactly changed with the passage of the SECURE Act and how that could directly affect you and your heirs.

Sign up for Kiplinger’s Free E-Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

No free lunch: Inherited IRAs have new rules

The SECURE Act comes with two major benefits for retirement savers, which is great news for them. However, these benefits come at a cost, which will be paid for by their heirs:

- Benefit: There’s no longer an age limit for contributing to an IRA. Previously, those over 70½ were prohibited from contributing. Eliminating the age limit opens new doors for retirement savers to grow their accounts.

- Benefit: The age at which required minimum distributions kicks in has been pushed to 72, up from 70½ previously. By delaying the withdrawal requirement, savers’ accounts will continue to grow, which will ultimately make their savings grow as large as possible for themselves and their heirs.

- Cost: The “stretch IRA,” a popular wealth transfer strategy associated with inherited IRAs, has been eliminated for most beneficiaries other than spouses. The stretch IRA was a technique where non-spouse beneficiaries of an IRA could stretch the IRS-mandated required distributions over their lifetime — giving them more time for tax-deferred savings. Now, instead of stretching those RMDs out, non-spouse beneficiaries must clean out the entire value of the account within 10 years of the IRA owner’s death. Accelerating the payments from traditional IRAs could drive up the tax bills for these beneficiaries significantly.

So, what can you do about that? Here are two possibilities:

Tip #1: Consider Naming Your Spouse First as Your Beneficiary

Previously with an inherited IRA, it was logical to select a beneficiary who was younger than your spouse — especially if your spouse was not dependent on the income in your IRA and the money was ultimately going to be passed to the next generation. This allowed for additional tax-favored growth of the balance that remained in the account. Some people named their grandchildren or great-grandchildren as account beneficiaries to even further reduce the required distributions that accompany the inherited traditional or Roth IRA assets.

With the passage of the SECURE Act, this could be a good time to reconsider that strategy. Naming a spouse as the primary beneficiary of your IRAs instead of a non-spouse will allow them to continue tax-favored growth without having to follow the aggressive 10-year timeline for withdrawals. Although they are still subject to RMDs from that account based on their life expectancy, those withdrawals will likely be less than what would be required under a 10-year withdrawal plan.

To further reduce the impact of taxes for their heirs, the surviving spouse could use that RMD income to make gifts to their heirs while they are still living. The surviving spouse could also take the withdrawal and use the income to contribute to a taxable account that would receive a step-up in cost basis at the time of their death, leaving their heirs with an account largely free of any tax consequence.

Consider and compare these two inherited IRA strategies for spouse vs. non-spouse:

- A 67-year-old inherits $1 million in a traditional IRA from their spouse. The account is assumed to earn 5% and their tax rate is assumed to be 12%. They live for 10 years and begin to take required withdrawals at age 72. At age 77 they die and pass the remaining IRA assets to their 55-year-old child. The child has an assumed income tax rate of 24% and must begin taking withdrawals from the account so the account can be depleted within 10 years. This results in total income from the account of $1.5 million.

- Now, consider the same family and the same IRA, but the IRA goes to the adult child directly, instead of the surviving spouse. Under that scenario, the child – who would be 45 when the first parent dies -- inherits the $1 million traditional IRA. The account is assumed to earn 5% and they are currently in the same 24% tax bracket as assumed above. They must begin withdrawals immediately, and the account must be fully depleted within 10 years. The total amount of income generated from the account is approximately $1.2 million – or about $300,000 less than if the surviving spouse had inherited the IRA before finally passing it down to the child.

Net net: Under the new legislation, rethink your plans for inherited IRAs. There is often a significant benefit to naming a spouse as a beneficiary and then allowing that asset to be passed to the next generation versus giving it directly to the child.

Tip #2: Converting Your Traditional IRA to a Roth

Now might be a good time to consider a Roth conversion. When you convert a traditional IRA to a Roth, you typically roll over assets from an IRA into a Roth. When you do this you pay taxes on the withdrawal but your remaining assets grow tax free post conversion. While Roth conversions have been an option for retirees for some time, it may now be more beneficial than ever. With the SECURE Act, the delay in RMDs will likely result in larger account balances, which could mean more tax liability upon withdrawal, especially if your non-spousal beneficiaries are already in their peak earning years.

Passing on a Roth account has typically been a favored way to pass money to the next generation. Under the SECURE Act, a Roth IRA must still be distributed within 10 years. However, since the distributions from a Roth account are tax free, your beneficiaries can let the Roth account grow and then take the entire distribution in year 10 with no tax consequences. Now that the income schedule has accelerated for beneficiaries, it may be even more advantageous to pass along Roth assets as opposed to traditional assets.

Thinking about whether to convert your traditional IRA assets to a Roth? You should consider your current tax bracket as well as your beneficiary’s. If you think your beneficiary will be in a higher tax bracket than you are now (for example, your children in their prime working years), then it may make sense to convert your traditional IRA to a Roth now and pay the tax at your lower rate (as opposed to your children taking distributions after your death at their higher tax rate). Of course, it is important to factor in the impact that paying a large tax bill today can have on your own retirement. The last thing you want is for your estate planning efforts to put your own retirement plans in jeopardy.

Inherited IRA Planning Next Steps

The passage of new retirement legislation in the SECURE Act will go a long way in helping savers and retirees from outliving their income. It does come at a cost, however. So, if you have inherited IRAs as part of your wealth-transfer plan, now is the time to reconsider the named beneficiaries of your IRA. It is also a good time to consider if you should begin the conversion of your traditional IRA assets to a Roth.

For more on the SECURE Act, watch The SECURE Act Explained: Retirement Tips to Do Now.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Rhian is the CEO of Silvur, an award-winning retirement platform that works with credit unions and community banks to support members age 50+. Rhian is a frequent contributor to top financial publications including Forbes, Kiplinger, Barrons, CNBC and Yahoo! Finance.

-

Callable CDs Have High Rates. We Still Don't Recommend You Get Them

Callable CDs Have High Rates. We Still Don't Recommend You Get ThemInvestors must carefully consider the trade-offs, as falling interest rates could lead to reinvestment at a lower yield and make selling on the secondary market difficult.

-

High Mortgage Rates Are Holding My Retirement Hostage: Can I Still Downsize and Retire?

High Mortgage Rates Are Holding My Retirement Hostage: Can I Still Downsize and Retire?We ask retirement wealth advisers what to do.

-

Five Big Beautiful Bill Changes and How Wealthy Retirees Can Benefit

Five Big Beautiful Bill Changes and How Wealthy Retirees Can BenefitHere's how wealthy retirees can plan for the changes in the new tax legislation, including what it means for tax rates, the SALT cap, charitable giving, estate taxes and other deductions and credits.

-

I'm a Financial Planner: Here Are Five Smart Moves for DIY Investors

I'm a Financial Planner: Here Are Five Smart Moves for DIY InvestorsYou'll go further as a DIY investor with a solid game plan. Here are five tips to help you put together a strategy you can rely on over the years to come.

-

'Drivers License': A Wealth Strategist Helps Gen Z Hit the Road

'Drivers License': A Wealth Strategist Helps Gen Z Hit the RoadFrom student loan debt to a changing job market, this generation has some potholes to navigate. But with those challenges come opportunities.

-

Financial Pros Provide a Beginner's Guide to Building Wealth in 10 Years

Financial Pros Provide a Beginner's Guide to Building Wealth in 10 YearsBuilding wealth over 10 years requires understanding your current financial situation, budgeting effectively, eliminating high-interest debt and increasing both your income and financial literacy.

-

Five Mistakes to Avoid in Your First Year of Retirement

Five Mistakes to Avoid in Your First Year of RetirementRetirement brings the freedom to choose how to spend your money and time. But choices made in the initial rush of excitement could create problems in the future.

-

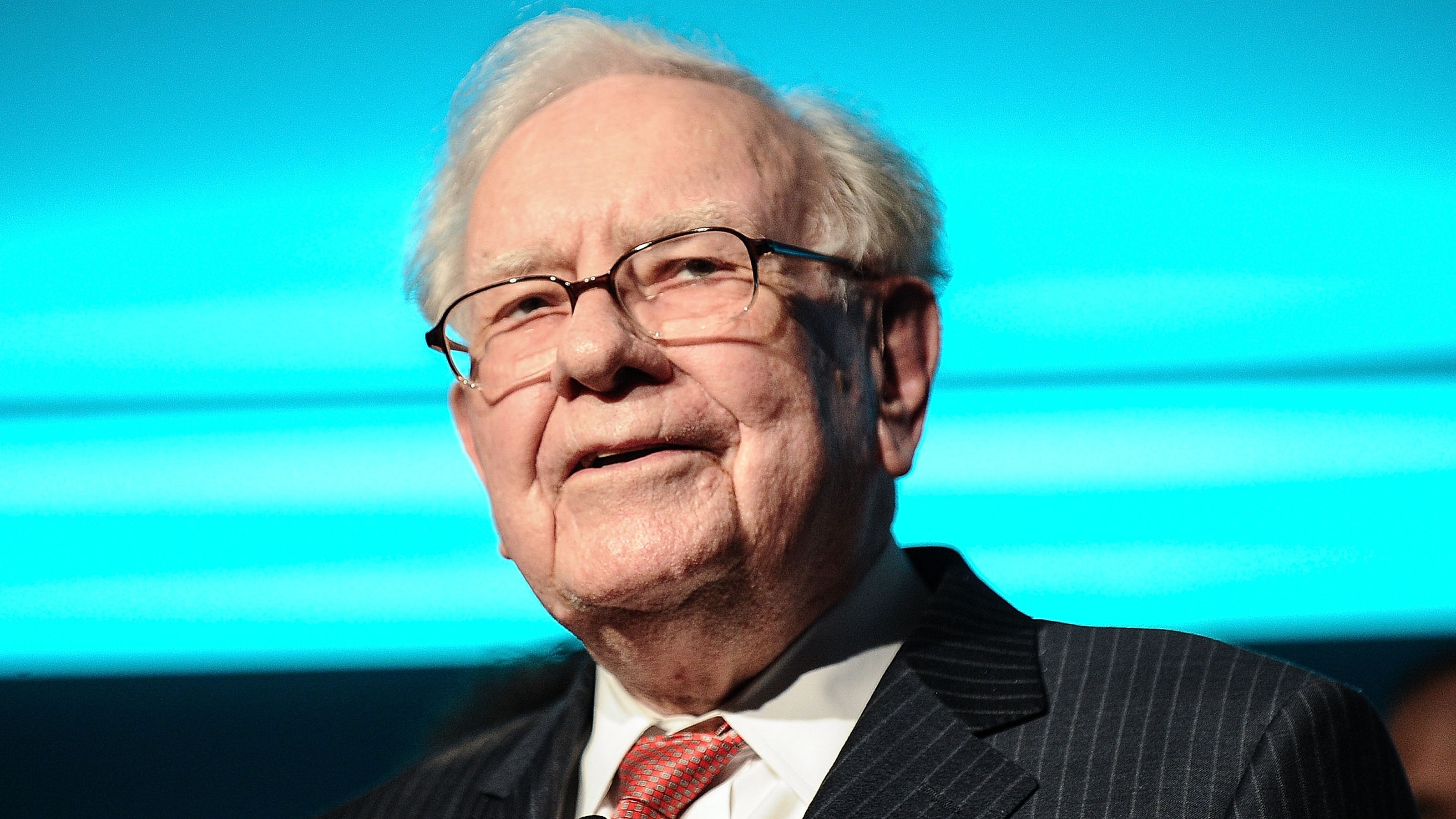

I'm an Investing Expert: This Is How You Can Invest Like Warren Buffett

I'm an Investing Expert: This Is How You Can Invest Like Warren BuffettBuffett just invested $15 billion in oil and gas, and you can leverage the same strategy in your IRA to potentially generate 8% to 12% quarterly cash flow while taking advantage of tax benefits that are unavailable in any other investment class.

-

How Much Income Can You Get From an Annuity? An Annuities Expert Gets Specific

How Much Income Can You Get From an Annuity? An Annuities Expert Gets SpecificHere's a detailed look at income annuities and the factors that determine your payout now and in the future.

-

Your Paycheck Stops in Retirement, But Your Life Doesn't: An Expert Guide to Planning for a Confident Future

Your Paycheck Stops in Retirement, But Your Life Doesn't: An Expert Guide to Planning for a Confident FutureSocial Security will replace only about 40% of your salary, on average. A solid financial plan will help you plug the gap so you can rest easy in retirement.