What is WRONG with Your Financial Planning 'Picture'?

For a revealing reality check, take your finances and turn them into a one-page visual representation. This exercise could bring you some much-needed clarity as you near retirement.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Remember back to your elementary school days when your teacher passed out the “What’s Wrong with the Picture” test. Your job was to scan the page to, find those items that were either missing from or not supposed to be in the picture.

It looked something like this:

You got a time limit and the number of items you needed to identify to complete the activity. You focused on your paper, doing your best to spot the items, and ultimately tried to be the first person to place your pencil down, a sure sign to the rest of the class that you “did it” and you were “first.”

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

How does this little grade school exercise relate to financial planning? Well, if you took all the pieces of your financial life and put them down on a single piece of paper, after carefully scanning the page for items that don’t “fit,” you might be surprised at what jumps out at you.

Changing Workplace Creates Retirement Complications

Complicated finances are a fact of life these days. Today, according to the Bureau of Labor Statistics, workers hold 10 different jobs before age 40, and that number is projected to grow. Employers have changed their financial structures to remain competitive in our global economy — by doing away with pensions, company paid health insurance, and gold watches after 30+ years of service. In addition, science, technology and innovations have disrupted many jobs and industries, changing the labor outlook and giving many U.S. workers a scarcity mindset of “… Will I have a job and if so, what job will I have?”

Today, everything is a rush, hurry up to get here, hurry up to get there, and it’s time for bed to do all over again.

How the Picture Test Works: One Couple’s story.

To illustrate how our “What’s Wrong with the Picture” test could help you with your own retirement planning, let’s take a look at a fictional couple — Bill & Donna — and their son, Johnny:

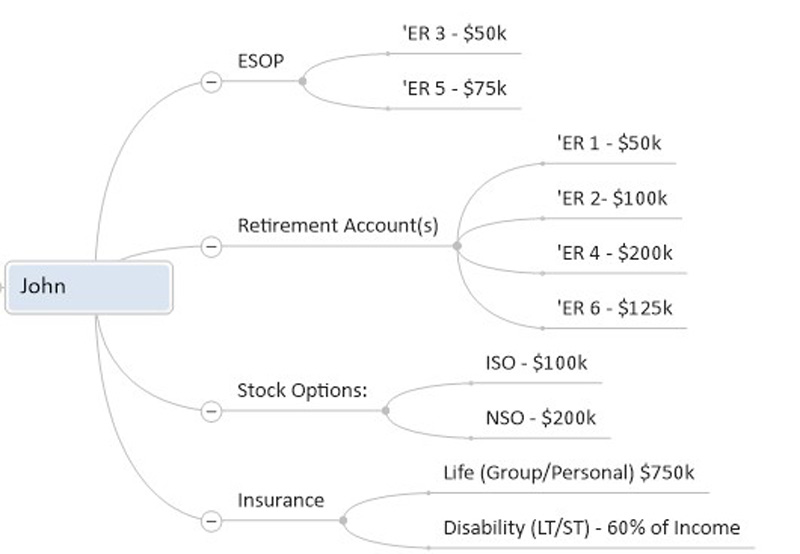

- Bill has worked at six different jobs in technology, and at each job he elected 10% of his income to be invested for his future. Each employer offered a unique benefit package for employee retention, from company-sponsored retirement plans to Employee Stock Ownership Plans (ESOP), stock options such as Non-Qualified (NSO) and Incentive Stock Options (ISO) , and non-qualified bonus plans. When transitioning from one employer to the next, some companies went through mergers, name changes and acquisitions. Some of the benefit plan departments offered continuity with insurance plans via life and disability.

- Meanwhile, Donna has worked at five different jobs in the medical field at various hospitals. After their child was born, Donna stayed home until little Johnny was in pre-school. Then, Donna returned to the workforce. During Donna’s working years she opted to put 7% of her gross income into plans similar to Bill’s and left things where they were.

Today, Bill and Donna are five years from retirement, and they decided that it would be wise to review their financial affairs. My business partner and I took their financial data and analyzed it to create the following financial “picture” to discuss with Bill and Donna.

Bill’s picture: [‘ER = Employer, ISO = Incentive Stock Options, and NSO = Non-Qualified Stock Options]

We Take the Financial Picture and Turn it into Talking Points

Upon looking at Bill’s financial picture, we can use it as a guide to engage Bill and Donna in a conversation. The goal is to best understand each asset, account and their details before we make any recommendations. Our customized picture helps keep the couple engaged and NOT overwhelmed.

Perhaps we can ask a few questions with regards to Bill’s retirement accounts and stock options, such as:

- Can you tell me why you have four separate qualified retirement accounts? What investment options are in your retirement accounts — how are you allocated — what are you paying in fees and how has your performance been in each account relative to their respective benchmarks?

- Have you updated the primary and contingent beneficiaries on all qualified retirement accounts? If so, who are they? How recent are your beneficiary choices on file?

- What is your income tax plan for the stock options? How concentrated is your wealth in the company stock? Do you have full understanding of the rules in your stock plan if you leave your employer?

- Are we missing anything? Does this give you a good picture of where you are? Do you have any questions for us?

The feedback that we have received upon going through this type of process during our meeting has been so rewarding. In essence, the picture can act as a quasi-balance sheet and if we add the income and expenses to the picture we have a quasi-income statement.

Consider, how your life would be if you could shrink down the complexity of accounts, paperwork, statements to ONE PAGE — how easy would it be for you to determine “WHAT IS MISSING from this picture? or What does NOT FIT?”

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Dennis D. Coughlin, CFP, AIF, co-founded CG Capital with Christopher C. Giambrone in 1999. He has been in practice since 1996 and works with individuals nearing retirement and those whom have already retired. Proud of his humble upbringing, Dennis shares his advice with the same core principles that he was raised with. When not in the office, you will find him with his family enjoying the outdoors.

-

Over 65? Here's What the New $6K Senior Bonus Deduction Means for Medicare IRMAA

Over 65? Here's What the New $6K Senior Bonus Deduction Means for Medicare IRMAATax Breaks A new deduction for people over age 65 has some thinking about Medicare premiums and MAGI strategy.

-

U.S. Congress to End Emergency Tax Bill Over $6,000 Senior Deduction and Tip, Overtime Tax Breaks in D.C.

U.S. Congress to End Emergency Tax Bill Over $6,000 Senior Deduction and Tip, Overtime Tax Breaks in D.C.Tax Law Here's how taxpayers can amend their already-filed income tax returns amid a potentially looming legal battle on Capitol Hill.

-

5 Investing Rules You Can Steal From Millennials

5 Investing Rules You Can Steal From MillennialsMillennials are reshaping the investing landscape. See how the tech-savvy generation is approaching capital markets – and the strategies you can take from them.

-

When Estate Plans Don't Include Tax Plans, All Bets Are Off: 2 Financial Advisers Explain Why

When Estate Plans Don't Include Tax Plans, All Bets Are Off: 2 Financial Advisers Explain WhyEstate plans aren't as effective as they can be if tax plans are considered separately. Here's what you stand to gain when the two strategies are aligned.

-

Counting on Real Estate to Fund Your Retirement? Avoid These 3 Costly Mistakes

Counting on Real Estate to Fund Your Retirement? Avoid These 3 Costly MistakesThe keys to successful real estate planning for retirees: Stop thinking of property income as a reliable paycheck, start planning for tax consequences and structure your assets early to maintain flexibility.

-

I'm a Financial Planner: These Small Money Habits Stick (and Now Is the Perfect Time to Adopt Them)

I'm a Financial Planner: These Small Money Habits Stick (and Now Is the Perfect Time to Adopt Them)February gets a bad rap for being the month when resolutions fade — in fact, it's the perfect time to reset and focus on small changes that actually pay off.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.