Empowering People to Discover Financial Freedom

Sponsored Content From Financial Service Directory

“Everything we do, every decision we make, is with one goal in mind –a bright financial future foreach member.”

BCU President/CEO Michael G. Valentine

When corporate giants Target Corporation and UnitedHealth Group looked for ways to elevate their status as great workplaces and help employees enjoy financial freedom, each turned to BCU, one of the nation’s Top 100 credit unions.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

After carefully vetting many other excellent financial services providers, both chose to partner with BCU,a renowned leader in the workplace banking model.Brent Bordson, Benefits Manager for Target, explains,“By partnering with BCU, we bring more financial perks and products directly to our valued team members than we could have afforded on our own.”

Aspiring to be the leading provider of financial freedom in America’s best workplaces, BCU is one of the fastest growing Credit Unions in the last 40 years. Beginning with its roots serving Baxter Healthcare employees and their families, BCU now has partnerships with nearly 90 Company Partners and serves more than 250,000 members throughout the United States and Puerto Rico, www.bcu.org/Member-Center/Membership-Eligibility.

“The one thing our Company Partners have in common is a commitment to helping their employees and their families,” says BCU President/CEO Michael G. Valentine, whose long list of accomplishments in the financial services industry placed him into the esteemed Credit Union Executives Society Hall of Fame in 2017.

Here Today For Your Tomorrow

Valentine is quick to point out that, while BCU partners with America’s best workplaces, Company Partners have no ownership stake in the Credit Union. BCU is a not-for-profit whose members are the owners, and they strive to make sure you always feel like one.

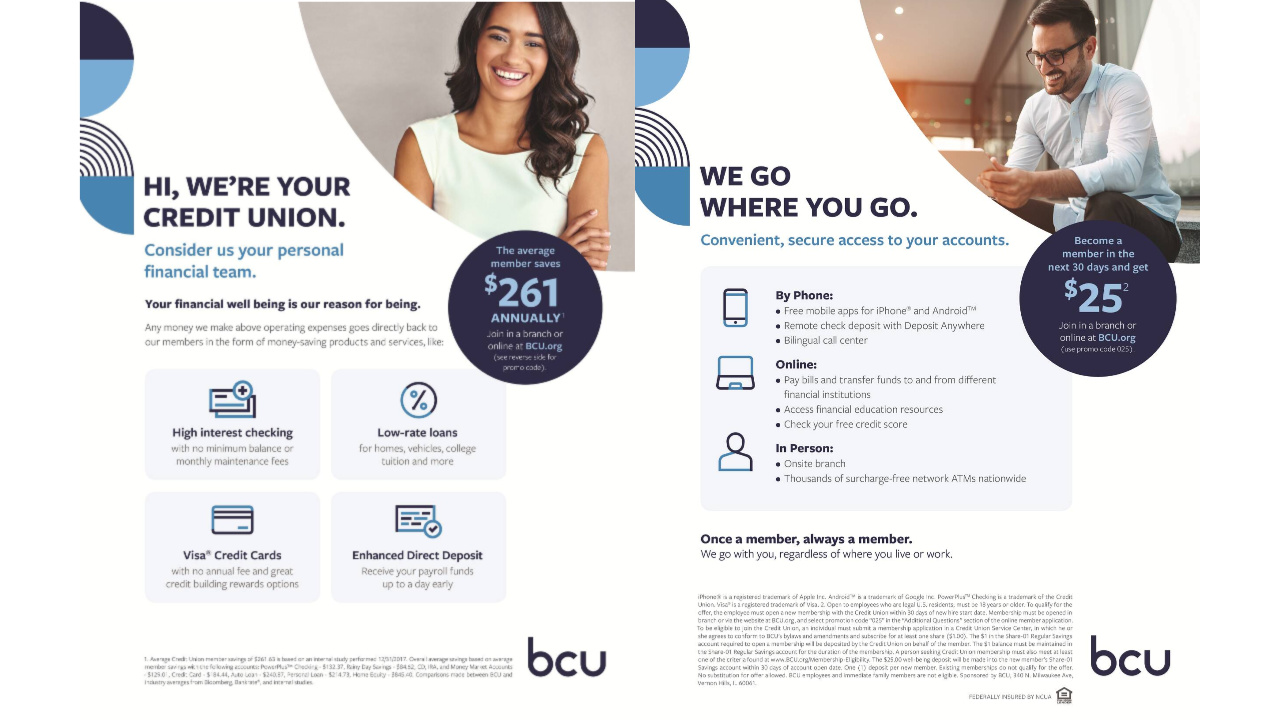

“We work exclusively for our members, and often that work begins by adding special services and bundle products toaddress specific needs a Company Partner has,” explains Valentine. “For example, the Enhanced Direct Deposit™ option allows employees to receive payroll and other electronic deposits up to one day ahead of their scheduled payday, an important benefit that has resulted in fewer employees depending on expensive payday loans. Our disaster relief programs help members who have suffered unexpected emergencies. We also specialize in designing customized products for Company Partners such as relocation services and student loan consolidation plans to help employees avoid borrowing from their 401k.”

Creating the best bank-at-work experience possible is due to the dedicated efforts of BCU’s esteemed volunteer Board of Directors. With no stockholders to pay, earnings flow right back into the pockets of members in the form of lower interest rates on loans, very competitive rates of return on savings, little or no-fees, exceptional member service, and advanced Digital Banking tools.

“Everything we do, every decision we make, is with one goal in mind – a bright financial future for each member,” Valentine adds. “I have had the pleasure of witnessing, firsthand, the impact that BCU has on the employees of Baxter and my family for more than 25 years. I am confident that BCU will continue to be an indispensable benefit to other great companies, just as they have been for Baxter all these years,” adds Harry Kraemer, former Chairman & CEO, Baxter International Inc.

Exceptional Member Service - It’s Non-negotiable

Valentine has had a birds-eye view of the organization’s growth for more than three decades. He began working with BCU in 1984, just a few years after its foundation. At the time, it employed a staff of seven and had about $10 million in assets.Today, the Credit Union has over 650 employees and nearly $4 billion in assets. BCU has frequently earned the title of TopWorkplace and is named a Forbes’ Best-In-State Credit Union for 2019, but the ranking Valentine most values is the loyalty of its members.

A remarkable 82 out of 100 members said they are likely to recommend BCU to others - a score that’s considered world class. It’s a compelling endorsement of the Credit Union’s member experience, considering the typical bank averages a score of 40-50.

“This level of member loyalty is a direct reflection of the personal relationships that have always defined our culture, and it starts with the employees. Each member of the BCU staff shares in building a modern, fun, inclusive and family-oriented brand that’s grounded in exceptional service. Our members truly become a part of our extended family,” says Valentine. “It’s not enough for us to offer better rates and services. Each member can expect that we will know them by name and understand their story. We value every relationship.”

This content was provided by Financial Service Directory. Kiplinger is not affiliated with and does not endorse the company or products mentioned above.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Timeless Trips for Solo Travelers

Timeless Trips for Solo TravelersHow to find a getaway that suits your style.

-

A Top Vanguard ETF Pick Outperforms on International Strength

A Top Vanguard ETF Pick Outperforms on International StrengthA weakening dollar and lower interest rates lifted international stocks, which was good news for one of our favorite exchange-traded funds.

-

Is There Such a Thing As a Safe Stock? 17 Safe-Enough Ideas

Is There Such a Thing As a Safe Stock? 17 Safe-Enough IdeasNo stock is completely safe, but we can make educated guesses about which ones are likely to provide smooth sailing.

-

What You Need to Know About Sustainable Investing

What You Need to Know About Sustainable InvestingSponsored Content from Domini Impact Investments

-

A Look at the World’s Rarest Precious Metal and its Growing International Market

A Look at the World’s Rarest Precious Metal and its Growing International MarketSponsored Content from the Osmium Institute

-

Raising a glass to an investment in wine

Raising a glass to an investment in wineSponsored Content from Cult Wines

-

Here's How to Invest in the Robotic Chefs That Are Ready to Take Over the Fast Food Game

Sponsored Content from Miso Robotics

-

The Best-Kept Secret to Income Investing

Sponsored Content from Aberdeen

-

How families, financial professionals and communities win by investing in education

A 2021 roundtable on the positive impact of 529 plans

-

A Unique Perspective on Real Estate Investing

Sponsored Content from RAD Diversified

-

The positive impact of 529 college savings plans

Terms and Privacy Policy