Nvidia (NVDA) Earnings Preview: Red-Hot Chipmaker Must Post Pristine Results

Nvidia’s stock has rallied for years on AI and cloud computing, but Thursday’s Q3 earnings report is an important test.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Investors expect big things from Nvidia Corporation (NVDA, $212.03) when the graphics chipmaker reports third-quarter results after Thursday’s closing bell. And considering Nvidia’s stock has more than tripled over the past year, it had better not disappoint.

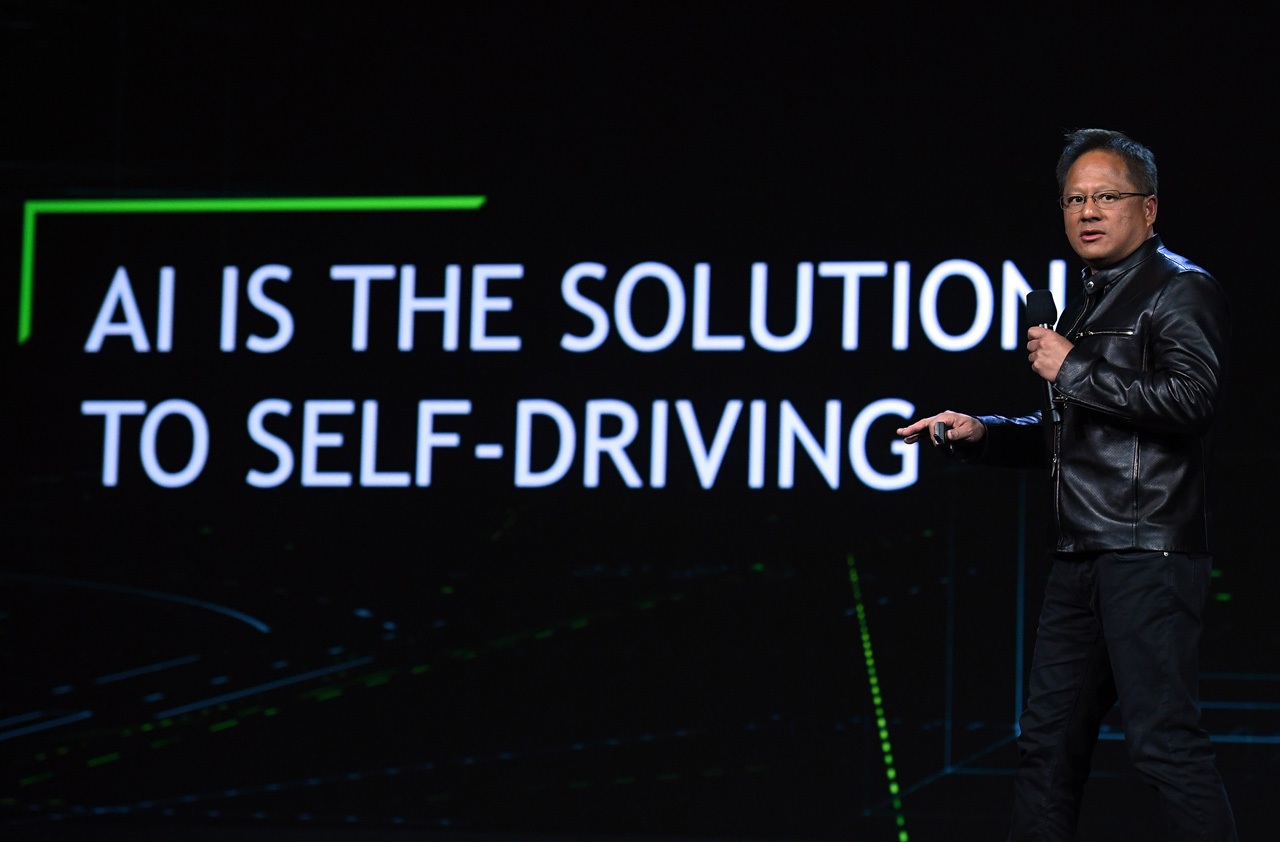

Nvidia has been on a remarkable run since the start of 2016 thanks to explosive growth in artificial intelligence. It turns out the company’s graphics chips aren’t just great for PC gaming. They’re also integral to running data centers for cloud computing and have a place in technologies such as self-driving cars.

For instance, Nvidia’s data center business more than doubled year-over-year in the second quarter. And NVDA shares got a jolt in early October after the chipmaker announced a new Drive PX Pegasus artificial-intelligence chip designed to enable the highest level of autonomous driving. The company says the Pegasus chip is “roughly the size of a license plate” and “can replace the entire trunk full of computing equipment used in today’s Level 5 autonomous prototypes.”

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

In the past two years, the expansion of these applications has sent NVDA shares up nearly 650%. Heck, the stock has more than doubled in 2017 alone.

Nvidia has been the world’s largest maker of PC graphics processing units (GPUs) for ages, but the rise of cloud-based computing and other applications lit a fire under shares. When a list of major customers reads like a who’s who of tech giants – Alphabet (GOOGL), Facebook (FB), Microsoft (MSFT) and Amazon (AMZN) all rely on Nvidia hardware in their data centers – you can understand why the market is so high in the name.

Indeed, the company’s success has actually forced once-bitter rivals into one another’s arms.

In a bid to compete with Nvidia, Advanced Micro Devices (AMD) and Intel (INTC) announced a partnership Monday, Nov. 6, to create a laptop-computer chip that combines an Intel processor with an AMD graphics unit. The idea is to catch up in notebooks built to handle graphically complex games, which is an area of growth.

What Wall Street Expects of Nvidia

Nvidia’s performance puts the onus on the graphics chipmaker to deliver perfection whenever it posts results.

A stock this hot can stumble when a company fails to meet or beat analysts’ expectations. Consider the quick declines in Nvidia’s stock this August despite beating profit and revenue estimates. The company’s crime? More than doubling its data center revenues and growing its automotive business by 19.3% – results that still fell short of Wall Street’s lofty bar.

Happily for Nvidia’s shareholders, third-quarter expectations don’t look too tough to meet. Consensus expectations are for 13% earnings growth to 94 cents per share on 17.9% revenue growth to $2.36 billion. Those are strong rates of expansion, to be sure, but both fall well under the pace Nvidia set in the prior two quarters.

Analysts may not have set the bar particularly high for the third quarter, but longer-term, they expect great things from Nvidia. They forecast revenue to jump 30% in fiscal 2018, according to data from Thomas Reuters. Average annualized earnings growth is pegged at 13% a year for the next five years.

The market is so excited about Nvidia’s growth prospects that Wall Street analysts are having a hard time keeping up.

SunTrust Robinson Humphrey analyst William Stein upgraded the stock to “Buy” back in July on expectations for upside across most of Nvidia’s business. He then released another note in early October hiking his price target on NVDA to $200, which the stock eclipsed in a couple weeks.

With several growing businesses at its back, it’s reasonable to expect yet another good quarter from the chip giant.

“We expect the company to benefit from growing strength in the artificial intelligence (AI) space,” say analysts at Zacks Equity Research. “Moreover, the company’s innovative product pipeline along with strength in gaming and high-end notebook GPUs keep it well positioned.”

Nvidia is by no means a cheap stock, trading at 53 times forward earnings on that long-term growth forecast of 13% mentioned above, according to data from Thomson Reuters. A valuation as stretched as that is an invitation to a pullback on anything but a pristine earnings report.

Whether Nvidia can pull it off remains to be seen, but a stumble seems unlikely. More importantly, it wouldn’t necessarily change an otherwise bullish bigger picture.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Dan Burrows is Kiplinger's senior investing writer, having joined the publication full time in 2016.

A long-time financial journalist, Dan is a veteran of MarketWatch, CBS MoneyWatch, SmartMoney, InvestorPlace, DailyFinance and other tier 1 national publications. He has written for The Wall Street Journal, Bloomberg and Consumer Reports and his stories have appeared in the New York Daily News, the San Jose Mercury News and Investor's Business Daily, among many other outlets. As a senior writer at AOL's DailyFinance, Dan reported market news from the floor of the New York Stock Exchange.

Once upon a time – before his days as a financial reporter and assistant financial editor at legendary fashion trade paper Women's Wear Daily – Dan worked for Spy magazine, scribbled away at Time Inc. and contributed to Maxim magazine back when lad mags were a thing. He's also written for Esquire magazine's Dubious Achievements Awards.

In his current role at Kiplinger, Dan writes about markets and macroeconomics.

Dan holds a bachelor's degree from Oberlin College and a master's degree from Columbia University.

Disclosure: Dan does not trade individual stocks or securities. He is eternally long the U.S equity market, primarily through tax-advantaged accounts.

-

Over 65? Here's What the New $6K 'Senior Deduction' Means for Medicare IRMAA Costs

Over 65? Here's What the New $6K 'Senior Deduction' Means for Medicare IRMAA CostsTax Breaks A new deduction for people over age 65 has some thinking about Medicare premiums and MAGI strategy.

-

U.S. Congress to End Emergency Tax Bill Over $6,000 Senior Deduction and Tip, Overtime Tax Breaks in D.C.

U.S. Congress to End Emergency Tax Bill Over $6,000 Senior Deduction and Tip, Overtime Tax Breaks in D.C.Tax Law Here's how taxpayers can amend their already-filed income tax returns amid a potentially looming legal battle on Capitol Hill.

-

5 Investing Rules You Can Steal From Millennials

5 Investing Rules You Can Steal From MillennialsMillennials are reshaping the investing landscape. See how the tech-savvy generation is approaching capital markets – and the strategies you can take from them.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

Tech Stocks Fuel Strong Start to the Week: Stock Market Today

Tech Stocks Fuel Strong Start to the Week: Stock Market TodayThe blue-chip Dow Jones Industrial Average extended its run above 50,000 on Monday and there are plenty of catalysts to keep the 30-stock index climbing.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.