Is Your Portfolio Really Diversified?

Your investments should be spread across a variety of stocks and bonds and cover a range of asset managers, asset classes and geographical locations.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Diversification is simple to understand. In the context of managing your portfolio, it is (simply) about investing in diverse securities so as to lower the risk of the portfolio. Ever since Nobel Prize winner Harry Markowitz wrote his seminal paper "Portfolio Selection" in 1952, finance professionals (and increasingly lay people) have understood that the true risk of an asset is its contribution to the risk of a portfolio.

In a recent survey run by my firm, Insight Financial Strategists, 41% of investors reported that they believe having their net worth in a single mutual fund is sufficient diversification. After all, even the most concentrated mutual fund typically has several dozen stocks. However, many mutual funds diversify within a single asset class in a single country, such as, large-company stocks in the U.S.

Others will concentrate their portfolio on a few securities, sometimes with very unfortunate results. For instance, between September 1, 2015, until November 17, 2015, the Sequoia fund (symbol SEQUX) lost 26.3% of its value largely due to its high concentration in a single stock, Valeant (VRX). Looking at the price evolution of VRX below, and knowing that SEQUX had more than 30% invested in VRX, it is not surprising that the mutual fund tumbled.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

In practice, diversification is hard to implement. There are many levels of diversification. Some of them are:

- by individual securities;

- by asset manager;

- by asset class; and

- by geography.

Ideally, an investor will want to diversify so that the various investments are not correlated with one another, have low correlation or even have negative correlation. For instance, according to data from portfolio analytics firm Kwanti, Goldman Sachs (GS) and JP Morgan (JPM) have an 89% correlation based on monthly returns. In other words, buying GS and JPM in the same portfolio only provides a low diversification value.

In another example, JPM and Walmart (WMT) have a negative correlation of -0.14%, based on monthly returns, according to data from Kwanti. I don't know that I would necessarily want to buy either JPM or WMT. However, this pair provides good diversification from one another.

Most of us end up investing in mutual funds and exchange-traded funds, not in individual securities. The same principle applies there. Having a single large cap mutual fund that tracks Standard & Poor's 500-stock index may not be sufficient diversification.

Sure, the S&P 500 ETF provides more than one security and is, therefore, diversified. But in general, most of the securities within a single asset class will be highly correlated with one another (such as with JPM and GS). With that, you would be protecting yourself against the risk inherent in any given company in the portfolio, but not against risks inherent to the asset class or other factors.

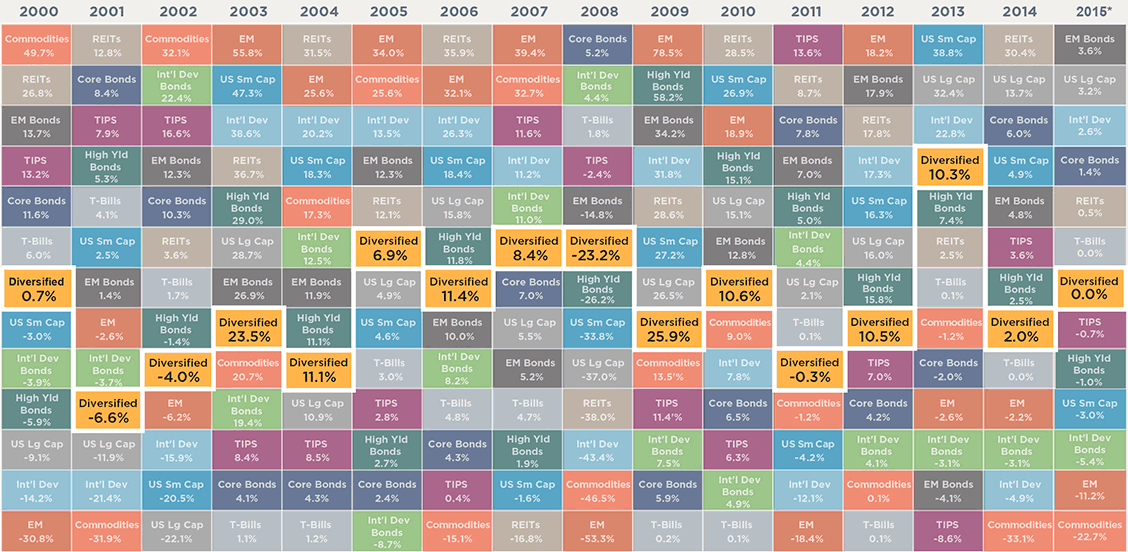

Ideally, you would want to be diversified across asset classes, across regions of the world and across asset managers. The following jelly bean chart from Schwab demonstrates the benefits of a wide diversification program: the ranking of the assets by performance changes seemingly randomly from year to year. A fully diversified portfolio is intended to avoid the peaks and valleys of individuals asset classes while providing a more middle-of-the-road return experience.

Is your portfolio diversified? A detailed analysis from a fee-only Certified Financial Planner can give you the full scoop on your portfolio and provide suggestions to mitigate the risks that you are exposed to. Like any other sound advice, apply it now, not later.

Chris Chen CFP® CDFA is the founder of Insight Financial Strategists LLC, a fee-only investment advisory firm in Waltham, MA. He specializes in retirement planning and divorce financial planning for professionals and business owners.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Chris Chen CFP® CDFA is the founder of Insight Financial Strategists LLC, a fee-only investment advisory firm in Newton, Mass. He specializes in retirement planning and divorce financial planning for professionals and business owners. Chris is a member of the National Association of Personal Financial Advisors (NAPFA). He is on the Board of Directors of the Massachusetts Council on Family Mediation.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.

-

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure Them

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure ThemHow can advisers reassure clients nervous about their plans in an increasingly complex and rapidly changing world? This conversational framework provides the key.

-

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate Empire

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate EmpireSmall rental properties can be excellent investments, but you can use 1031 exchanges to transition to commercial real estate for bigger wealth-building.

-

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs In

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs InRoth conversions are all the rage, but what works well for one household can cause financial strain for another. This is what you should consider before moving ahead.