The Magic of Moving Averages

This technical indicator can help predict where stocks are headed.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

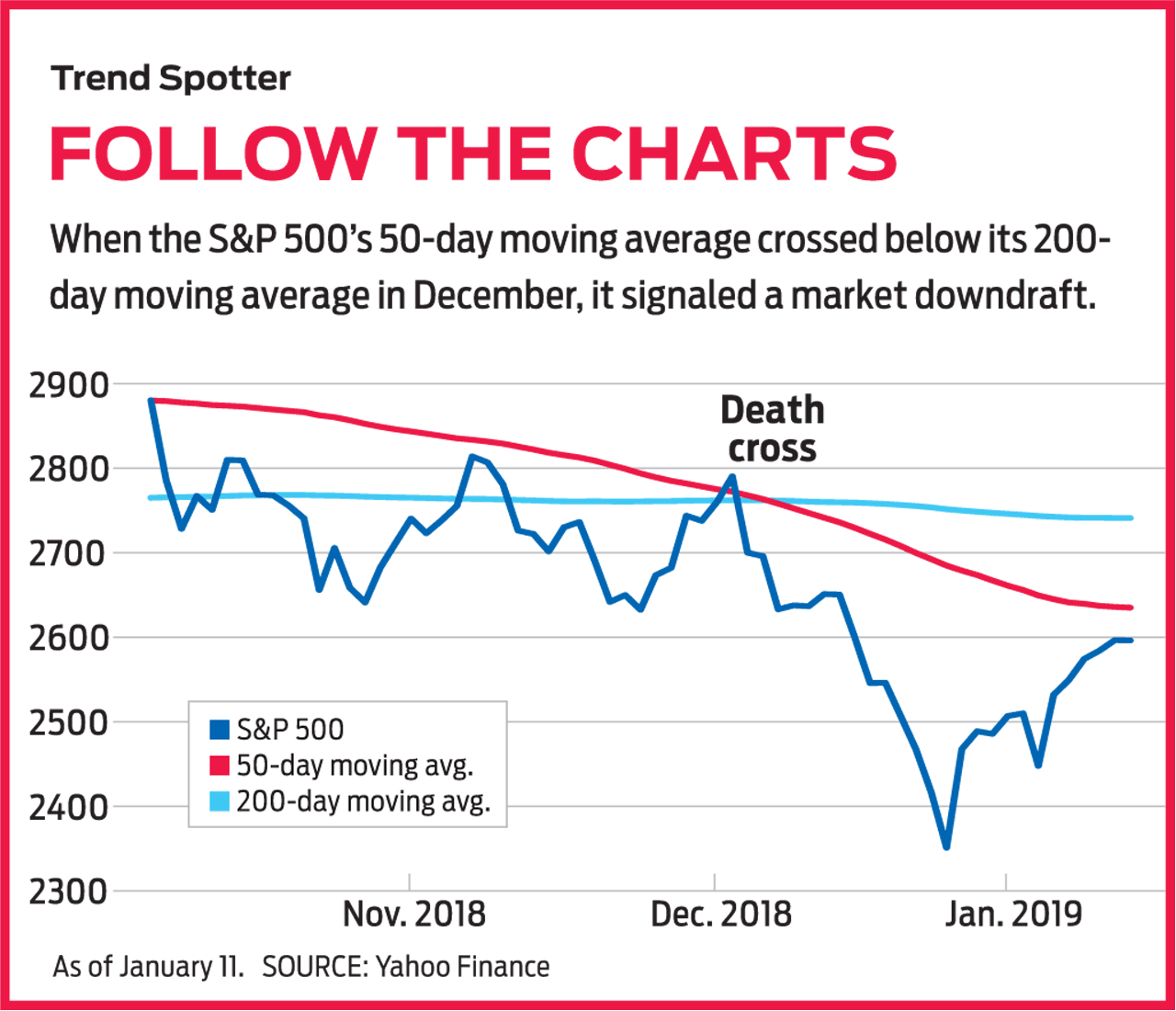

When price charts begin to look like jagged mountain ranges, it can be hard to map out which way stocks are headed. Enter the simple moving average. The tool is a staple of technical analysis—the practice of determining the direction of stock prices based on statistical patterns. It can sharpen the stock market picture, and, although a moving average won’t pinpoint peaks or troughs, it can tell you whether the momentum of a stock or an index is up or down.

A simple moving average is calculated by adding up a stock’s or an index’s daily closing prices over a given period—the most popular periods are 50 days and 200 days—and dividing by the number of days in that period. A moving average “effectively smooths out the noise of daily price swings, so that investors can see which way things are trending,” says William Delwiche, an investment analyst at financial services firm Baird. Moving averages can be superimposed on stock charts on nearly any brokerage website, as well as on free sites, such as Yahoo Finance.

Stock prices that diverge from the prevailing trend of a moving average can be a signal to buy or sell—or at least to become more bullish or bearish. When a stock’s price falls below its moving average, it’s considered a sign of a weakening trend and indicates heightened risk and uncertainty, says Mark Dodson, research director at investment management firm Cypress Capital. “Adopting a simple rule, such as not buying a stock until its price rises above its 50- or 200-day moving average, can help you avoid riding a company to the bottom,” he says.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

When a price rises above the moving average, investors should be more risk-tolerant and aggressive, Dodson adds. For example, Facebook’s 50-day moving average may be signaling better days ahead for the beleaguered social media stock. The stock has surrendered 18% since falling below its 50-day moving average last July, but it began trading above its average in early January. (Returns and other data in this story are through January 11.)

Crossed signals. More-advanced technical analysis focuses on the interaction between longer- and shorter-term moving averages. During a healthy bull market, for example, both the 50-day moving average and the 200-day moving average would be headed in the same direction, with the 50-day average higher than the 200-day indicator.

But when a 50-day moving average dips below an investment’s 200-day average, it results in a scary-sounding red flag: the “death cross.” That’s what happened with Standard & Poor’s 500-stock index in early December. The death cross is a “definite sell signal,” says Louise Yamada, author of the newsletter TechPoints, as it indicates that a short-term pullback may be devolving into a long-term downturn. The inverse, the “golden cross,” is considered a buy signal.

But the death cross is far from being a perfect indicator of prolonged market slides. Although the S&P 500 came perilously close to a bear market in late December, it has since turned around, so it remains to be seen whether the most recent instance was prescient or a false alarm. Though a cross in December 2007 presaged the worst of the ’07–’09 bear market, crosses in 2011 and 2015 signaled market slides that never became full-fledged bears.

For fundamentals-based investors—those who rely on data such as corporate earnings and economic growth—poring over stock charts can seem like reading tea leaves. But technical signals can be a valuable tool to get a sense of the market’s underlying trends, as long as investors understand that they’re only part of a larger toolbox, says Delwiche. “Don’t try to turn these signals into foolproof market-timing devices,” he says.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Ryan joined Kiplinger in the fall of 2013. He wrote and fact-checked stories that appeared in Kiplinger's Personal Finance magazine and on Kiplinger.com. He previously interned for the CBS Evening News investigative team and worked as a copy editor and features columnist at the GW Hatchet. He holds a BA in English and creative writing from George Washington University.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

Small Caps Step Up, Tech Is Still a Drag: Stock Market Today

Small Caps Step Up, Tech Is Still a Drag: Stock Market TodayEarly strength gave way to AI skepticism again as a volatile trading week ended on another mixed note.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Strong Jobs Report Leaves Markets Flat: Stock Market Today

Strong Jobs Report Leaves Markets Flat: Stock Market TodayInvestors, traders and speculators are taking time to weigh the latest labor market data against their hopes for lower interest rates.

-

Dow Hits New High Ahead of January Jobs Report: Stock Market Today

Dow Hits New High Ahead of January Jobs Report: Stock Market TodayA weak reading on December retail sales was in focus ahead of Wednesday's delayed labor market data.

-

Tech Stocks Fuel Strong Start to the Week: Stock Market Today

Tech Stocks Fuel Strong Start to the Week: Stock Market TodayThe blue-chip Dow Jones Industrial Average extended its run above 50,000 on Monday and there are plenty of catalysts to keep the 30-stock index climbing.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.