Five Ways to Ponzi-Proof Your Retirement

Even seasoned investors can fall prey to a crook, or a financial professional who just isn't very good. So take these measures to protect yourself.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Most investors worry about losing their money to the market — not to their financial professional.

They assume the person they hired to manage their nest egg will be trustworthy, capable and always looking out for their best interests. So when they hear about “bad apples” who take clients to the cleaners, they get nervous. And rightly so.

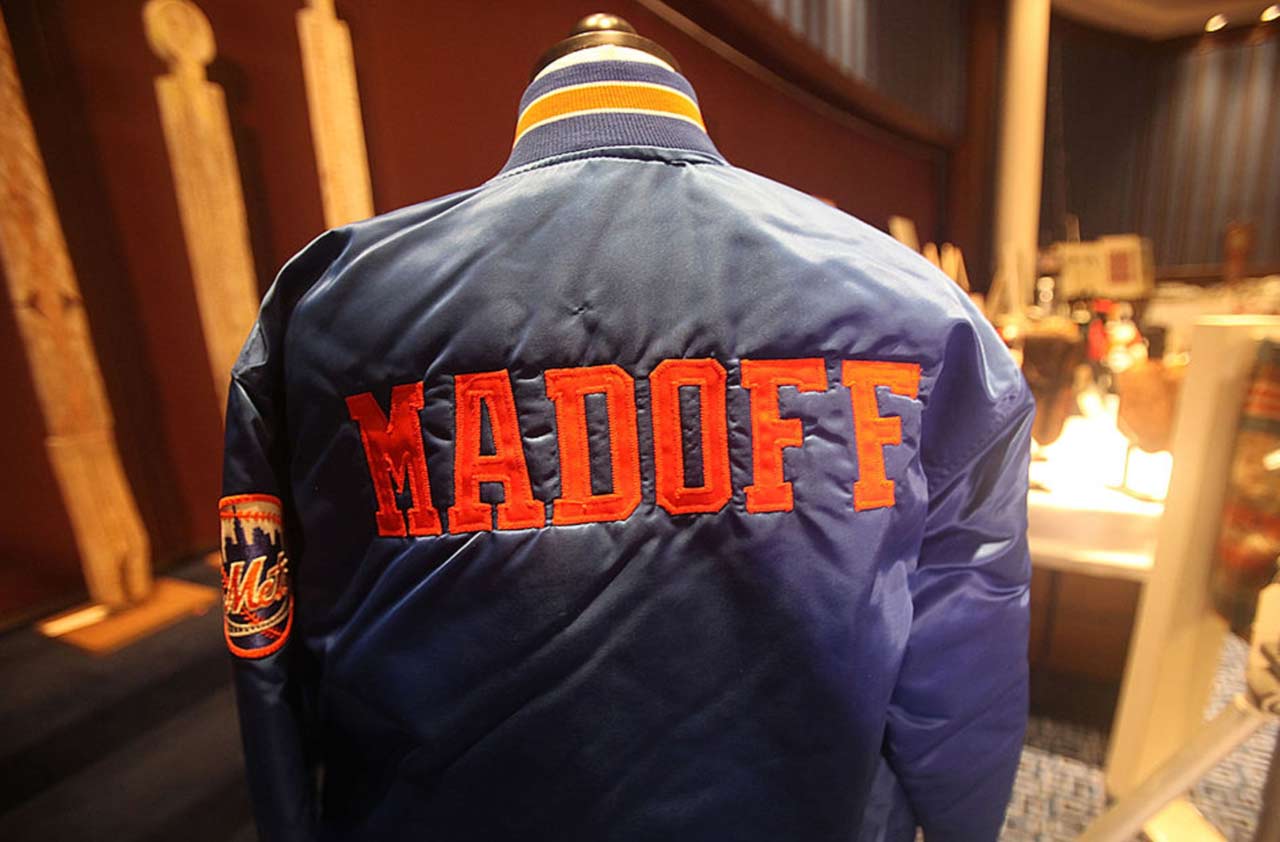

There aren’t that many Bernard Madoffs and Kenneth Starrs out there bilking clients out of billions of dollars, thank goodness. But even everyday investors with average-sized portfolios are in danger of running into scams and schemes that could drain their life savings. And, as with any line of work, there are some financial professionals who just aren’t very good at the job.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

So how can you be sure your adviser is honest, knowledgeable and doing his or her best to keep your money safe? Here are a few things you can do to protect yourself:

1. Hire a fiduciary.

There are two standards that regulate the financial industry: suitability and fiduciary. A broker who works under the suitability standard must reasonably believe that the recommendations he makes are suitable for the client’s needs; he doesn’t have to disclose conflicts of interests or all the fees involved in a transaction. A fiduciary, on the other hand, has a duty of loyalty and care; he must act in the best interest of his client and be transparent about all fees and conflicts.

The Department of Labor’s recently implemented fiduciary rule requires all financial professionals to use the higher standard when giving retirement advice, but this protection has not been extended to all transactions. Some advisers will switch hats depending on who they’re working for or what they’re working on, so I believe that to avoid confusion, your best bet is to go with someone who is a fiduciary only.

There are several ways to identify if an adviser is fiduciary. One of the best ways is by doing a broker check on Finra’s website at www.finra.org. The broker check will tell you if an individual is an IA (investment adviser) or a registered rep. If the individual is an IA, they are a fiduciary. If they are a registered rep, they are a broker. Unfortunately, in our industry, an individual can be both — the benefit for them to do both is that they are able to collect a commission and wrap their fees, which in our opinion, is a conflict of interest.

Another way to tell that an individual is a fiduciary is that they are fee-based and work for an RIA (registered investment adviser) firm. Their marketing will include a disclosure that states they are working for an RIA.

2. Be sure your money is held by a third-party custodian.

Bernie Madoff was operating under the fiduciary label when he stole billions from his clients. One thing that helped him get away with it for so long is that he did not have a custodian — a financial institution that holds customers’ securities for safekeeping to minimize the risk of theft or loss. And because he had complete control of his clients’ money, he could carry on unchecked. What’s the lesson for investors? Never write a check to an individual or an individual’s firm; it should always be written to that third-party custodian with an account registered in your name — not your adviser’s name or anyone else’s.

3. Tamp down your greed.

Don’t be sucked in by the promises of huge returns sometimes found when investing in private placements. The temptation can be strong to keep investing in something that isn’t registered and performs well initially. We frequently see this in the oil and gas fields and with non-publicly traded real estate investment trusts (REIT). Be disciplined, and know the risks associated with these types of investments. If you are determined to get in, make sure it is a small percentage of your net worth. Retirement is a time to be hitting singles and doubles, not home runs. When you swing for the fences, you’re more likely to strike out. If something sounds too good to be true, be skeptical.

4. Stay vigilant.

Remember: Some of the brightest minds and most sophisticated investors in the world have fallen for Ponzi schemes. One of the challenges of investing is that you often don’t know you’ve made a mistake until it’s too late. This can be especially devastating in retirement, because you no longer have time on your side when it comes to bouncing back from a loss.

Don’t give your adviser free rein over your money, and always look at your statements. When looking at your statements, we recommend checking the titling on the account and making sure it is owned in your name exclusively and confirm that it is being held by a well-known third-party custodian. You should also pay attention to any unusual transactions, including excessive fees and any distributions.

5. Look for a money manager who is GIPS compliant.

The voluntary Global Investment Performance Standards (GIPS) are based on fundamental principles of full disclosure and fair representation of investment performance results. Firms that are GIPS compliant are encouraged to comply with all applicable requirements for any reports, guidance statements, Q&As, handbooks, etc. You can check out a list of GIPS-compliant firms by clicking here.

Of course, the best way to prevent the theft of your money is to get as much education as you can.

I use this analogy all the time: When you were younger and your car needed a repair, you could grab your tools and fix it. Today if your car broke down, you probably wouldn’t be able to take care of it yourself. Cars are just too complicated and expensive. The same is true of the investment world. Thirty years ago, preparing for retirement was much easier. A person likely had a pension as well as Social Security, and investing was much more straightforward than it is today. So, you’re probably going to need help — and that means putting your money and your trust in someone else’s hands.

But that doesn’t mean you should stop paying attention.

If you don’t understand something an adviser suggests, ask questions. If you have a bad feeling about a recommendation, say no. And if you think something isn’t proper, and may even be illegal, get a second opinion.

It’s your right, because it’s your money.

Kim Franke-Folstad contributed to this article.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kirk Cassidy is president of Senior Planning Advisors and Strategic Investment Advisors. Cassidy is an Investment Adviser Representative and a fiduciary with a Series 65 securities license and life insurance licenses. He is a national speaker who teaches retirement planning in a university setting.

-

Over 65? Here's What the New $6K 'Senior Deduction' Means for Medicare IRMAA Costs

Over 65? Here's What the New $6K 'Senior Deduction' Means for Medicare IRMAA CostsTax Breaks A new deduction for people over age 65 has some thinking about Medicare premiums and MAGI strategy.

-

U.S. Congress to End Emergency Tax Bill Over $6,000 Senior Deduction and Tip, Overtime Tax Breaks in D.C.

U.S. Congress to End Emergency Tax Bill Over $6,000 Senior Deduction and Tip, Overtime Tax Breaks in D.C.Tax Law Here's how taxpayers can amend their already-filed income tax returns amid a potentially looming legal battle on Capitol Hill.

-

5 Investing Rules You Can Steal From Millennials

5 Investing Rules You Can Steal From MillennialsMillennials are reshaping the investing landscape. See how the tech-savvy generation is approaching capital markets – and the strategies you can take from them.

-

When Estate Plans Don't Include Tax Plans, All Bets Are Off: 2 Financial Advisers Explain Why

When Estate Plans Don't Include Tax Plans, All Bets Are Off: 2 Financial Advisers Explain WhyEstate plans aren't as effective as they can be if tax plans are considered separately. Here's what you stand to gain when the two strategies are aligned.

-

Counting on Real Estate to Fund Your Retirement? Avoid These 3 Costly Mistakes

Counting on Real Estate to Fund Your Retirement? Avoid These 3 Costly MistakesThe keys to successful real estate planning for retirees: Stop thinking of property income as a reliable paycheck, start planning for tax consequences and structure your assets early to maintain flexibility.

-

I'm a Financial Planner: These Small Money Habits Stick (and Now Is the Perfect Time to Adopt Them)

I'm a Financial Planner: These Small Money Habits Stick (and Now Is the Perfect Time to Adopt Them)February gets a bad rap for being the month when resolutions fade — in fact, it's the perfect time to reset and focus on small changes that actually pay off.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.