3 Reasons to Convert an IRA to a Roth

You may have heard about this strategy or thought about giving it a try but aren't sure if it's right for you. To find out, here are the basics of how it works and who is best suited to this tax-planning possibility.

IRAs and 401(k)s are a tremendous way to grow your nest egg for retirement. You avoid paying taxes on the money you put into these accounts during the time you are working and are most likely in a higher income tax bracket. The idea is to defer paying taxes until you are in retirement, no longer earning an income, and potentially in a lower tax bracket. The tax advantages allow you to turbocharge your growth.

This strategy works beautifully when you actually are in a lower tax bracket in retirement, however, sometimes this is not the case. What if you will actually be in a higher tax bracket when you begin pulling money from your IRA in retirement?

There are three compelling reasons why your tax rates may very well be higher for you in the future, and if that is the case, you’ll want to consider a Roth IRA conversion to lower your tax hit. When you convert money in your IRA or 401(k), which has never been taxed, to a Roth IRA or a Roth 401(k), you’ll pay income taxes at your current rate on the conversion amount, but once the money is in a Roth it grows tax-free and can be withdrawn tax free.

Sign up for Kiplinger’s Free E-Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

I’ll first address the reasons why you could be in a higher tax bracket in retirement. I’ll then look at how to estimate how much to consider converting from your IRA/401(k) to a Roth IRA/401(k), as well as some common mistakes to avoid.

3 Reasons Why Your Tax Rates May Be Higher in Retirement

No. 1: Rates could go back up in 2026

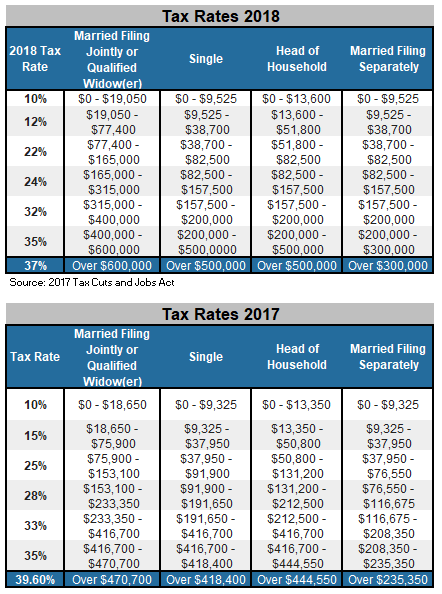

First of all, our tax brackets were just overhauled. By looking at the following two charts you can see how the 2017 Tax Cuts and Jobs Act has cut tax rates.

However, these lower rates aren’t set in stone. Unless Congress acts, these rate cuts are set to expire at the end of 2025, and in 2026 the rates will bump back up to those we had in 2017. So, you can make a political guess here. If you think Democrats, who were largely against the tax cuts in the first place, will be in charge when the votes are cast in 2025, it is likely these tax rates could increase. This line of thinking would suggest that we have an eight-year window to take advantage of the lower brackets and to convert your IRA money to a more tax-advantaged Roth IRA.

Reason No. 2: At age 70½ RMDs could kick you into a higher bracket

Next, remember that at age 70½ you’ll face required minimum distributions (RMDs) from your IRA. The distribution requirement is based on the size of your IRA at that time and each year thereafter. These distributions are taxed as income. Basically, the government is saying, “We haven’t taxed that money yet, but we plan to tax all of it before you die.”

If you hit age 70½ and your IRA is very large, the required distribution could push you into a much higher tax bracket than what you had been in during the early years of retirement leading up to age 70½. For example, let’s assume you are retired and age 65. Let’s also assume that you live on Social Security, a pension, and you are taking withdrawals from your after-tax brokerage account while your IRA continues to grow untapped. Since the money in your after-tax brokerage account has already been taxed and isn’t treated as income when withdrawn, you may be in one of the lower tax brackets.

If you haven’t taken withdrawals before age 70½ your IRA may be very large. The required distribution amount is based on your IRA balance and your age. For example, at age 70½ your RMD will be just under 4% of the value of your IRA(s). You don’t have to spend the withdrawal, but you do have to move it out to another account … and you do have to pay income taxes (federal and state) on it in the process. This distribution, when added to your other sources of income, could put you in a higher tax bracket. What’s worse: Your IRA distribution could even cause more of your Social Security income to be taxed.

With some planning and foresight, you could reduce your IRA balance through annual Roth IRA conversions so that at age 70½ and beyond your IRA is not so large and the taxes aren’t so hefty. Often a good strategy is to convert a little IRA money to a Roth each year after retirement and continue doing so until age 70½.

Reason No. 3: Death of a spouse during retirement

If you are married it is inevitable that there will come a point when one spouse will pass away and the surviving spouse will be left to manage the money. When this occurs, a tax bracket change also occurs. The surviving spouse will move from the joint to the single tax bracket (again refer to the chart above). What would happen to your tax bracket right now if you moved your income from the joint to the single tax bracket? If you are retired, your income sources would not likely change that much. You could find yourself with similar income sources but in the single bracket. The result: You would be subject to much higher tax rates.

At the death of the first spouse, the surviving spouse will often roll the IRA money from the deceased spouse’s IRA into their own IRA. However, if they are over age 70½, IRA distributions are still required, and are now taxed in a single bracket instead of joint. That could increase the tax rate significantly. Once again, with some planning it would be wise to reduce the IRA through Roth conversions throughout retirement to reduce the IRA balance and ultimately the tax burden when the bracket changes.

How Much Should You Convert?

Remember, it is not an all or none decision. If you are in a lower tax bracket now than you’ll be when you plan to take IRA withdrawals during retirement, then it makes sense to convert some money from a traditional IRA or 401(k) to a Roth IRA or Roth 401(k). Often the best strategy is to convert some of your IRA each year. This is almost a given if you are in one of the lower two tax brackets. Here are the steps to take to determine how much to convert.

Step 1: Calculate your taxable income (total income minus the standard deduction or itemized deductions). The 1040 tax calculator at www.dinkytown.net is a great resource for accomplishing this step.

Step 2: After determining your taxable income, what tax bracket are you in? (Check the 2018 tax chart.)

Step 3: Find the top of your tax bracket. For example, for a joint filer the top of the 12% bracket is $77,400.

Step 4: Take the number at the top of your bracket and subtract your taxable income. The difference is the amount you can convert without being bumped up into the next higher bracket.

For example, let’s say that you file jointly and your taxable income is $50,000. That puts you in the 12% tax bracket. The income level at the top of the 12% bracket is $77,400. So you have $27,400 to go before you inch into the 22% bracket ($77,400-$50,000). This means you could convert $27,400 from your IRA to your Roth IRA without jumping into the next tax bracket. The amount you convert, $27,400, would be taxed at 12%.

If you retire at 60, and tax rates stay where they are, and you repeated this process each year until age 70½, you could convert $274,000. That money, now in the Roth, will grow tax-free. In addition, the balance of your IRA will be $274,000 lower at age 70½, so your required distributions will be less. In addition, the growth that would have occurred on the $274,000 in your IRA will now be in your Roth growing tax-free.

Mistakes to Avoid

Mistake No. 1. Don’t convert if you have to take money out of your IRA to pay the federal and state income taxes on the conversion. Rather, make sure you have enough cash in another source (i.e., use money in a bank account or and already taxed brokerage account).

Mistake No. 2. Don’t convert if you don’t have enough time to leave money growing tax-free in the Roth IRA to make back the amount you paid in taxes in the year of conversion. Of course, this depends primarily on how fast the money is growing. If you have about 10 years before you plan on spending the money you are most likely safe.

Mistake No. 3. Don’t convert too much at a time. You don’t want to end up jumping into a much higher tax bracket.

Now is a good time to consider Roth IRA conversion strategies since we are approaching the end of the year and you likely have a pretty good idea of what your total income will be for 2018. If you like the idea of converting some of your IRA to a Roth IRA you also may want to check with your CPA to obtain a second opinion.

Converting money from your IRA to a Roth IRA is a good strategy if tax rates will be higher for you in future years when you withdraw your IRA money than they are for you now. With income tax rates as low as they are now, 2018 may be a good year to begin using this strategy.

The Bottom Line

This Roth IRA strategy comes with many possible benefits, including:

- You can convert any amount you want. There are no income restrictions.

- Roth IRAs are not subject to Required Minimum Distribution rules like traditional IRAs are, which means you are not forced to take money out each year after you turn age 70 ½.

- Your beneficiaries will receive your Roth IRA proceeds, tax-free, when the time comes.

- The 10% early withdrawal penalty does not apply to Roth conversions.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Ray LeVitre is an independent fee-only Certified Financial Adviser with over 20 years of financial services experience. In addition he is the founder of Net Worth Advisory Group and the author of "20 Retirement Decisions You Need to Make Right Now."

-

Stock Market Today: President Trump Reboots the Tariff Trade

Stock Market Today: President Trump Reboots the Tariff TradeA broad consensus that markets hate uncertainty more than anything else is being tested on an almost daily basis in 2025.

-

Electric Car Owners Can’t Avoid Road Taxes in 2025

Electric Car Owners Can’t Avoid Road Taxes in 2025New Taxes Hawaii launched its new EV road usage fee in July. Here’s why some states are implementing similar new electric vehicle taxes across the nation.

-

The Hidden Costs of Caregiving: Crisis Goes Well Beyond Financial Issues

The Hidden Costs of Caregiving: Crisis Goes Well Beyond Financial IssuesMany caregivers are drained emotionally as well as financially, leading to depression, burnout and depleted retirement prospects. What's to be done?

-

Cash Balance Plans: An Expert Guide to the High Earner's Secret Weapon for Retirement

Cash Balance Plans: An Expert Guide to the High Earner's Secret Weapon for RetirementCash balance plans offer business owners and high-income professionals a powerful way to significantly boost retirement savings and reduce taxes.

-

Five Things You Can Learn From Jimmy Buffett's Estate Dispute

Five Things You Can Learn From Jimmy Buffett's Estate DisputeThe dispute over Jimmy Buffett's estate highlights crucial lessons for the rest of us on trust creation, including the importance of co-trustee selection, proactive communication and options for conflict resolution.

-

I'm a Financial Adviser: For True Diversification, Think Beyond the Basic Stock-Bond Portfolio

I'm a Financial Adviser: For True Diversification, Think Beyond the Basic Stock-Bond PortfolioAmid rising uncertainty and inflation, effective portfolio diversification needs to extend beyond just stocks and bonds to truly manage risk.

-

I'm a Retirement Psychologist: Money Won't Buy You Happiness in Your Life After Work

I'm a Retirement Psychologist: Money Won't Buy You Happiness in Your Life After WorkWhile financial security is crucial for retirement, the true 'retirement crisis' is often an emotional, psychological and social one. You need a plan beyond just money that includes purpose, structure and social connection.

-

Retiring Early? This Strategy Cuts Your Income Tax to Zero

Retiring Early? This Strategy Cuts Your Income Tax to ZeroWhen retiring early, married couples can use this little-known (and legitimate) strategy to take a six-figure income every year — tax-free.

-

Ditch the Golf Shoes: Your Retirement Needs a Side Gig

Ditch the Golf Shoes: Your Retirement Needs a Side GigA side gig in retirement can help combat boredom, loneliness and the threat of inflation eroding your savings. And the earlier you start planning, the better.

-

Roth IRA Conversions in the Summer? Why Now May Be the Sweet Spot

Roth IRA Conversions in the Summer? Why Now May Be the Sweet SpotConverting now would enable you to spread a possible tax hit over more than one payment while reducing future taxes.