4 Steps to Finding the Best Funds for You

It's a big fund universe out there; here's how to narrow down your choices.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

In my previous articles, we've discussed the large role that luck plays in investing; creating our individual strategy; and some of the tools we can use to tease out luck from skill. We'll now put those tools to use.

Let's take a look at the large-cap domestic asset class in our hypothetical portfolio. This may be the largest allocation for many Americans, and there are many participants in this space. We could break our allocation into smaller components, and spread our allocation to large-cap U.S. value, large-cap U.S. growth or large-cap U.S. blend. I'd recommend keeping your options open in your initial screen.

Here are four steps to whittle down your options and make the best selection for you:

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

1. Your Initial Screen

First, you have to decide your minimum requirements for a fund. Let's say we want an investment with at least a three-year track history, the same manager at the helm for at least two years and a minimum of $75 million under management.

To screen for funds that meet these requirements, plus whatever other details you'd like to name, I'm partial to the fi360 database, a service provided by the Center for Fiduciary Studies—mainly used by professional advisers. You could start your search by using Morningstar.

Now, let's look for funds that rank highly, with four or five stars over three- and five-year periods on a consistent basis. In my sample search (conducted in October), I'm looking for top quartile funds across a variety of metrics, including alpha, which measures the active return on an investment. My search results in 38 initial qualifying funds out of the entire large-cap domestic stock universe.

The following are at the top of that list:

- First Trust Value Line Dividend ETF (symbol FVD)

- SPDR S&P Dividend ETF (SDY)

- Powershares QQQ ETF (QQQ)

- ClearBridge Large Cap Growth I (SBLYX)

Morningstar classifies the first two as large-value and the next two as large-growth. So your allocation requirement would affect what you might choose here. Let's assume that you have a need for large-growth fund and investigate the Clearbridge option.

2. Deeper Analysis

Let's assume you can actually buy this fund (it is an institutional fund with a high minimum purchase requirement; some custodians allow RIA firms to buy in smaller increments for their clients). Next, you want to take a deep dive into the data. I am going to use another tool typically used by us pros called Evestment. You could find most of this data on Morningstar and Google Finance.

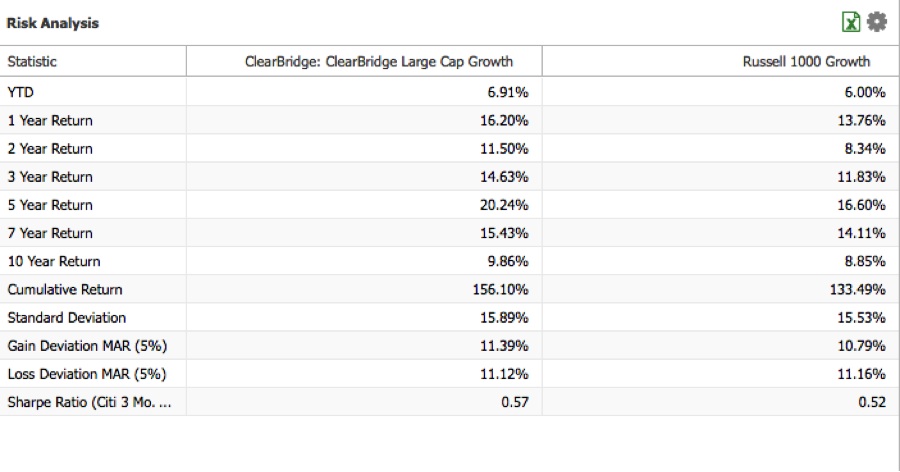

Here are some basic statistics (all fund data is as of September 30, 2016):

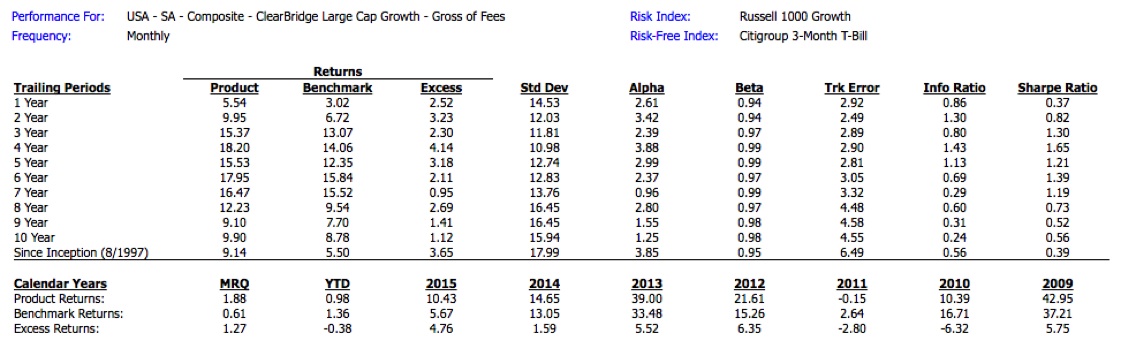

Looks promising so far! Let's look at some additional information, such as alpha, tracking error (deviation of the fund's prices from the benchmark's prices) and excess returns (how much better the fund performs—or not—compared with its benchmark):

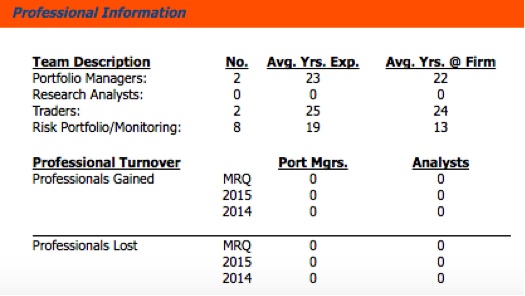

There is a pretty consistent record of alpha-generation, significant tracking error and returns consistently in excess of its benchmark. Not only that, the management team seems to meet our experience and tenure requirements:

3. Check the Company Filings

Visit the firm's website, where you can gain a wealth of additional information, including management and analyst commentary, top holdings, philosophy and strategy, expenses and more.

In the commentary of the Clearbridge fund, you can see that the current sector allocations are heavy on information technology, health care and consumer discretionary holdings with 66% of the portfolio in those three areas. Additionally, the strategy of this fund involves holding a core group of stocks, surrounded by a cyclical bucket and a select bucket of opportunistic holdings. This approach appears to be working for this manager, and it highlights where skill and process may have a positive impact on results.

As an investor, you need to be comfortable with the future of this strategy. Comfortable enough to forgo an indexing or low-activity approach in favor of this perceived skill.

4. Evaluate Costs

This fund charges between 0.81% and 1.11%, based on share class. Assuming you can get the lowest cost institutional class, you'll pay the manager 0.81%, which will be a potential drag on your returns.

You have to evaluate whether this fee is worth it. Compare the returns on this fund with its benchmark, the Russell 1000 Growth index (returns are reported net of fees). Considering that the iShares Russell 1000 Growth ETF (IWF) has an expense ratio of 0.20%, the added cost to buy the Clearbridge fund is 0.61% to 0.90%. Will it be worth it? Judging from the history and statistics, perhaps. Going back to 1997, the Clearbridge fund has shown excess returns of at least 1.07% in every year except six. So in 14 out of 20 years, the fund did better than its benchmark. That's a 70% chance, historically.

In conclusion, I hope I've given you some insight into the process you should follow to make an informed selection of an investment for your portfolio. The process is similar, but with many additional variables when looking at individual stocks and bonds.

If you are not inclined to do this work yourself, then either hire a reputable fee-only fiduciary adviser to help you or simply choose low-cost index funds. If you aren't in the investment business full-time, using index funds takes a lot of variables out of the equation, so that you can concentrate on your overall diversification strategy, cash flow, etc.

Doug Kinsey is a partner in Artifex Financial Group, a fee-only financial planning and investment management firm based in Dayton, Ohio.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Doug Kinsey is a partner in Artifex Financial Group, a fee-only financial planning and investment management firm in Dayton, Ohio. Doug has over 25 years experience in financial services, and has been a CFP® certificant since 1999. Additionally, he holds the Accredited Investment Fiduciary (AIF®) certification as well as Certified Investment Management Analyst. He received his undergraduate degree from The Ohio State University and his Master's in Management from Harvard University.

-

Timeless Trips for Solo Travelers

Timeless Trips for Solo TravelersHow to find a getaway that suits your style.

-

A Top Vanguard ETF Pick Outperforms on International Strength

A Top Vanguard ETF Pick Outperforms on International StrengthA weakening dollar and lower interest rates lifted international stocks, which was good news for one of our favorite exchange-traded funds.

-

Is There Such a Thing As a Safe Stock? 17 Safe-Enough Ideas

Is There Such a Thing As a Safe Stock? 17 Safe-Enough IdeasNo stock is completely safe, but we can make educated guesses about which ones are likely to provide smooth sailing.

-

Missed Your RMD? 4 Ways to Avoid Doing That Again (and Skip the IRS Penalties), From a Financial Planner

Missed Your RMD? 4 Ways to Avoid Doing That Again (and Skip the IRS Penalties), From a Financial PlannerIf you miss your RMDs, you could face a hefty fine. Here are four ways to stay on top of your payments — and on the right side of the IRS.

-

What Really Happens in the First 30 Days After Someone Dies (and Where Families Get Stuck)

What Really Happens in the First 30 Days After Someone Dies (and Where Families Get Stuck)The administrative requirements following a death move quickly. This is how to ensure your loved ones won't be plunged into chaos during a time of distress.

-

AI-Powered Investing in 2026: How Algorithms Will Shape Your Portfolio

AI-Powered Investing in 2026: How Algorithms Will Shape Your PortfolioAI is becoming a standard investing tool, as it helps cut through the noise, personalize portfolios and manage risk. That said, human oversight remains essential. Here's how it all works.

-

A Newly Retired Couple With a Portfolio Full of Winners Faced a $50,000 Tax Bill: This Is the Strategy That Helped Save Them

A Newly Retired Couple With a Portfolio Full of Winners Faced a $50,000 Tax Bill: This Is the Strategy That Helped Save ThemLarge unrealized capital gains can create a serious tax headache for retirees with a successful portfolio. A tax-aware long-short strategy can help.

-

5 Retirement Myths to Leave Behind (and How to Start Planning for the Reality)

5 Retirement Myths to Leave Behind (and How to Start Planning for the Reality)Separating facts from fiction is an important first step toward building a retirement plan that's grounded in reality and not based on incorrect assumptions.

-

I'm a Financial Adviser: Silence Is Golden, But It Hurts Your Heirs More Than You Think

I'm a Financial Adviser: Silence Is Golden, But It Hurts Your Heirs More Than You ThinkTalking to heirs about transferring wealth can be overwhelming, but avoiding it now can lead to conflict later. Here's how to start sharing your plans.

-

Will Your Children's Inheritance Set Them Free or Tie Them Up?

Will Your Children's Inheritance Set Them Free or Tie Them Up?An inheritance can mean extraordinary freedom for your loved ones, but could also cause more harm than good. How can you ensure your family gets it right?

-

I'm a Financial Adviser: This Is the Real Key to Enjoying Retirement With Confidence

I'm a Financial Adviser: This Is the Real Key to Enjoying Retirement With ConfidenceA resilient retirement plan is a flexible framework that addresses income, health care, taxes and investments. And that means you should review it regularly.