Skill Versus Luck in Investing

Having a disciplined investment strategy in place can help increase your odds of success.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Have you ever looked through a kaleidoscope? You know, one of those tube-shaped objects with mirrors and colored glass that make beautiful patterns when you rotate it? I'm going to ask you to try looking at your world differently, and consider the various roles that luck and skill play in almost every outcome. We're going to use a new tool, a "skilleidoscope," that will help us identify where skill is actually present.

In his book, The Success Equation, Michael J. Mauboussin explains how events are affected by both luck and skill, and how to determine the impact of each on an activity or outcome. I highly recommend it to anyone with a curious mind and suggest adding it to your list of mental models. The examples the book cites are delineated by life, business, sports and investing. As a financial planner, I am primarily interested in how Mr. Mauboussin's conclusions apply to the world of investing.

Over the last few decades, theories in finance have focused on identifying factors that are predictable and can help us decide which particular investments give us a better chance at succeeding. Succeeding in investment management usually means getting a return commensurate with the risk we bear or a better return than what is expected by comparing to a reliable benchmark.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

The biggest controversy these days is the "active versus passive" debate. Passive is defined as low-cost, highly liquid investments such as index mutual funds and low-activity exchange traded funds (ETFs). These funds generally require little day-to-day management and generally just try to match a published index. Therefore, their management fees are very low.

Active funds involve managers and teams attempting to do better than their benchmarks through different strategies, such as using sector weighting, focused portfolios, segments of the market, style investing, global investing, etc. They tend to have relatively high management fees. The argument is that if you are paying those higher fees, you should expect better results. Otherwise, why spend the money paying for active management? And that is a common sense position, particularly when you realize that over periods of time, very few actively-managed funds outperform their benchmarks.

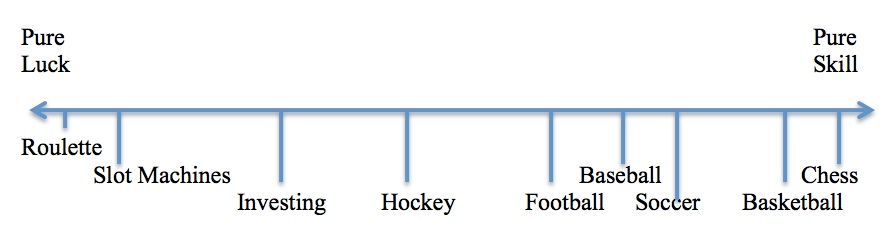

The Success Equation attempts to break out the element of skill from luck in investing. The author has developed what he calls the "luck versus skill continuum," as shown below, based on extensive statistical analysis.

You can readily see where investing fits on this scale—unfortunately near the "pure luck" endeavors (as is the world of business, where he makes the case that a CEO experiencing success at one firm is hardly assured of success at his or her next venture).

Some of the factors that influence our perception of success in investing include the following:

- Time frame: Someone with a lousy process can end up winning in the short run due to pure luck. Our tendency is then to project this lucky outcome into the future, and the probability of failure is the same as it was prior to the last "success."

- Bad luck overcoming skill: An accomplished money manager with a thorough and informed process can fail in the short run due to events outside of his or her control (i.e. dividend stocks gain favor at the expense of non-dividend payers; interest rates affect the market; investors run the technology sector through the roof at the expense of more solid companies; market sentiment shifts to small companies; etc.).

- Limitations of good luck: A manager possessing a high skill level and is the beneficiary of good luck is suddenly faced with the eventuality of that luck running out. His or her returns are bound to revert to the mean or average.

- Confusing compensation with skill: Incentives and rewards can reinforce a bad process. Think of the manager who is compensated for return and associates the return with skill when it is really the result of a lucky stretch for his or her style of investing (i.e. internet stocks in the late '90s and the proponents of "new and better" valuation metrics).

Added to the fact that we have largely efficient markets, we also have an increasingly growing pool of highly-skilled talent in the investment business. It is therefore becoming extremely difficult for any one manager to outperform his or her benchmark on a consistent basis.

At a meeting in Chicago last year, I had an opportunity to ask Dr. Eugene Fama, the father of the efficient market hypothesis, how we can explain those few standouts, such as Warren Buffet, if the markets are truly efficient and remove any potential for outperformance (amongst all participants combined). He answered that there are those few who have the requisite talent and skill to add value over time, but the problem is that we don't know who they are in advance, nor how long their advantage will last, so trying to select them is an exercise in futility.

So where does this leave us? Is there any hope in finding outstanding managers and investment opportunities? I would answer that there is, but you have to have a repeatable and disciplined process in place, and not deviate from it. Mr. Mauboussin also recommends that you use checklists to stay consistent in your approach.

In conclusion, I highly recommend reading this book and starting to apply its concepts in your everyday life as soon as possible. It will make a profound difference in how you see the world.

Doug Kinsey is a partner in Artifex Financial Group, a fee-only financial planning and investment management firm based in Dayton, Ohio.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Doug Kinsey is a partner in Artifex Financial Group, a fee-only financial planning and investment management firm in Dayton, Ohio. Doug has over 25 years experience in financial services, and has been a CFP® certificant since 1999. Additionally, he holds the Accredited Investment Fiduciary (AIF®) certification as well as Certified Investment Management Analyst. He received his undergraduate degree from The Ohio State University and his Master's in Management from Harvard University.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.

-

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure Them

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure ThemHow can advisers reassure clients nervous about their plans in an increasingly complex and rapidly changing world? This conversational framework provides the key.

-

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate Empire

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate EmpireSmall rental properties can be excellent investments, but you can use 1031 exchanges to transition to commercial real estate for bigger wealth-building.

-

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs In

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs InRoth conversions are all the rage, but what works well for one household can cause financial strain for another. This is what you should consider before moving ahead.