Take Convertible Bonds for a Spin

Stock investors can smooth the ride with these often overlooked hybrid securities.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Given recent market gyrations, it’s clear that more than a few investors are eyeing stocks nervously. After all, stock indexes touched all-time highs despite an economy in recession, a looming presidential election and widespread uncertainty over the timing and efficacy of a remedy for the COVID-19 pandemic.

If you’re feeling queasy about stocks, but you don’t want to miss out on future gains in an unpredictable stock market, consider adding convertible bonds to your portfolio. These hybrid securities combine elements of bonds and common stocks, ideally providing stock-like returns with the relative stability of bonds. Over the past 25 years, the Bank of America Merrill Lynch All US Convertibles index has returned an annualized 8.8%—slightly less than the 9.4% return of the S&P 500, but with 16% less volatility. (Returns are as of September 11.)

Like bonds, convertibles pay a fixed interest rate (typically less than the rate on the issuer’s common bonds) and aim to return their face value to the investor when they mature. But during periods outlined by the issuing company, investors can exchange the bonds for a predetermined amount of the issuer’s stock. The more a convertible’s underlying stock price rises, the more it makes sense for investors to make the conversion.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

As prices rise, a convertible tends to trade like a stock, its value moving in lock step with the underlying share price. Convertibles issued by companies whose stock prices are sinking tend to trade more like bonds, with prices driven more by movements in interest rates. The result is an “asymmetric” return profile, says Joe Wysocki, comanager of the Calamos Convertible fund, with convertibles effectively increasing investor exposure to stocks as they rally and limiting exposure when prices are falling.

Pick through the junk. One major drawback: Most issuers of these bonds carry “junk”-level ratings or aren’t rated at all, meaning investors run a real risk that the issuers will default on the debt. Convertibles also are complicated investments that can be difficult for individual investors to analyze, meaning that you should likely leave the picking and choosing to the pros.

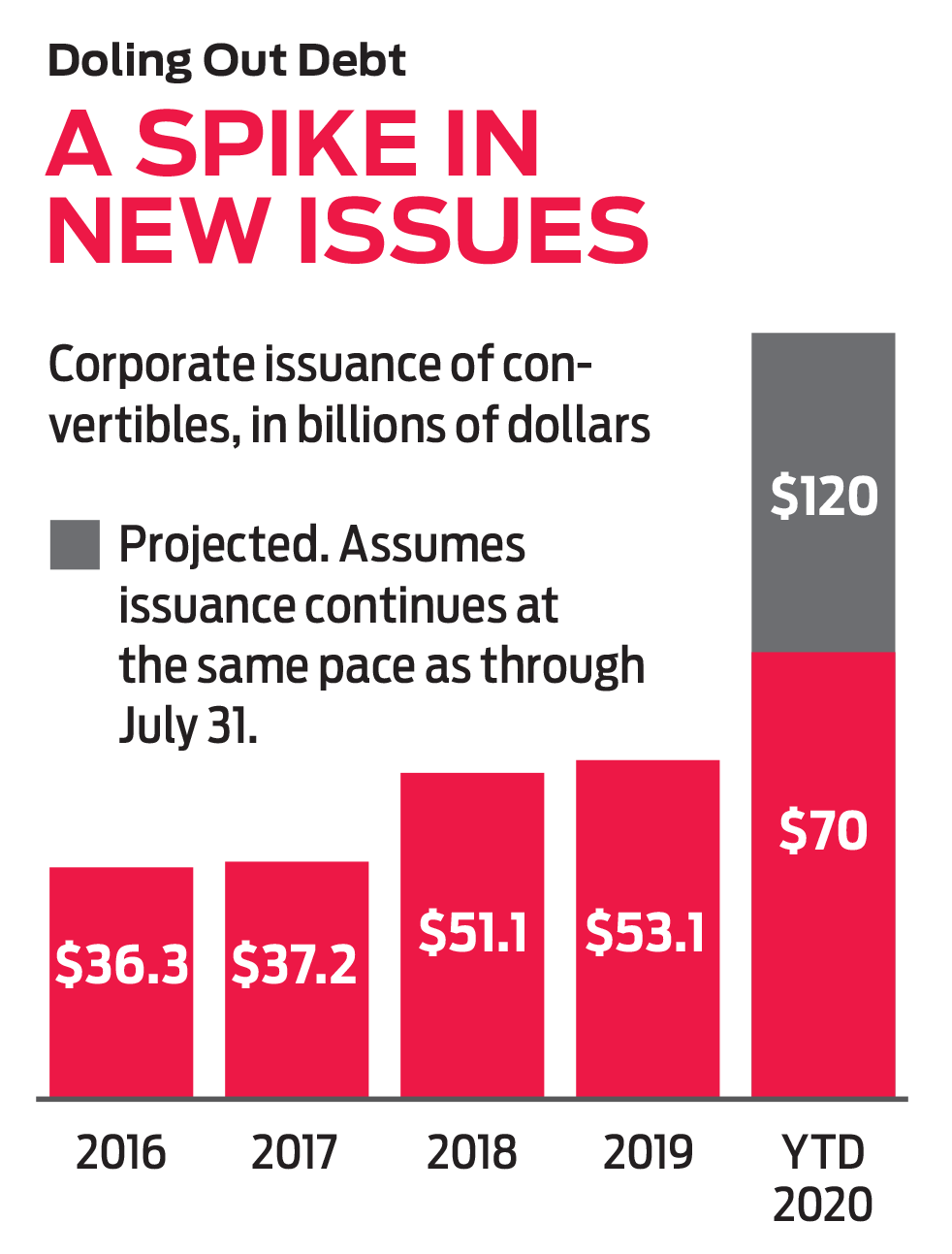

And the pros have had plenty to choose from of late. Companies—many of them looking for funding in the wake of the pandemic—have issued $70 billion worth of convertible bonds so far in 2020, up from $53 billion for the entirety of 2019. The boom in issuance has created unprecedented diversity in the convertible market, says Adam Kramer, comanager of Fidelity Convertible Securities (symbol FCVSX). Typically dominated by fast-growing tech and health care firms, such as Tesla (TSLA) and Illumina (ILMN), the BofA Merrill convertibles index has seen an influx of consumer firms, such as Burlington Stores (BURL) and Dick’s Sporting Goods (DKS), and beaten-down travel-and-leisure companies, such as Southwest Airlines (LUV) and Royal Caribbean (RCL).

Of the one-and-a-half dozen or so mutual funds specializing in convertibles currently, Fidelity’s fund is among the very few that don’t levy a sales charge, and it comes with the category’s lowest expense ratio, at just 0.51%. Kramer runs the fund aggressively, holding 13% of the fund’s assets in post-conversion common stock, compared with a 5% stock weighting among its average peer fund.

Consistently among the category’s top performers: AllianzGI Convertible (ANZAX). The fund’s managers tilt the portfolio toward more stock-like or bond-like convertibles depending on their overall view of the market. Longtime managers Douglas Forsythe and Justin Kass have steered the strategy adeptly. The fund’s 10-year return tops all other convertibles funds, and the portfolio has beaten its average peer in eight of the past 10 calendar years, including so far in 2020. The fund’s Class A shares carry a 5.5% sales charge, but you can purchase them without a load or transaction fee at several online brokerages.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Ryan joined Kiplinger in the fall of 2013. He wrote and fact-checked stories that appeared in Kiplinger's Personal Finance magazine and on Kiplinger.com. He previously interned for the CBS Evening News investigative team and worked as a copy editor and features columnist at the GW Hatchet. He holds a BA in English and creative writing from George Washington University.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

How to Watch the 2026 Winter Olympics Without Overpaying

How to Watch the 2026 Winter Olympics Without OverpayingHere’s how to stream the 2026 Winter Olympics live, including low-cost viewing options, Peacock access and ways to catch your favorite athletes and events from anywhere.

-

Here’s How to Stream the Super Bowl for Less

Here’s How to Stream the Super Bowl for LessWe'll show you the least expensive ways to stream football's biggest event.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.