One Simple Step to Get Good Investment Advice

You don't have to wait for the Labor Department to enact its new fiduciary rule. Make your adviser sign the pledge at the bottom of this column.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

By now it's certainly no surprise that the Department of Labor has issued its long awaited missive on fiduciary duty. With over 1,000 pages, there is a lot to absorb; however, I believe the DOL has done a Solomon-like job of streamlining, simplifying and clarifying the rule. Although, like many other supporters of the fiduciary concept, I would have liked to see something stronger, I do believe the actions of the DOL will absolutely make the system fairer.

The result is amazing and to be applauded, especially given the realities of today's political constraints. Multiple millions of dollars have been spent lobbying against the implementation of a DOL rule. Michael Piwowar, a commissioner of the Securities and Exchange Commission, opines that the rule "seems to ignore the chorus of voices that questioned whether it will restrict middle-class families' and minority communities' access to professional financial advice by making retirement advice unaffordable." Senator Johnny Isakson of Georgia stated, "This fiduciary rule will harm countless Georgians who have worked hard to make sure they make wise financial decisions for their families' futures. For families across the country, this rule is essentially the Obamacare for retirement planning, and I will do everything I can to overturn this rule."

The argument that small investors (i.e. the "countless Georgians") will lose access to advice is balderdash. First, brokers do not provide advice. If they did, they would have to do so as investment advisers and would already be held to a fiduciary standard. Second, there is a large universe of fiduciary advisers who are ready, willing and able to provide substantive advice. Third, as we've already seen, traditional commission-based platforms will quickly find a way to continue to operate under the new rule; for example, see LPL Cuts Prices, Account Minimums Ahead of DOL Fiduciary Rule.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

In fact, firms are provided significant latitude in how they adhere to the new rule. As the DOL noted, "Rather than create a highly prescriptive set of transaction-specific exemptions, the Department instead is publishing exemptions that flexibly accommodate a wide range of current types of compensation practices, while minimizing the harmful impact of conflicts of interest on the quality of advice."

However, the rule does have its shortcomings. While IRAs may be subject to fiduciary standards, the old suitability standard—with all of the potential conflicts of interest—will still hold true for non-IRA accounts.

Also, advisers can expect to hear more from their compliance officers. Under the current suitability standard, if there is a dispute, the ultimate responsibility for proving the claim rests on the shoulders of the client. Under a fiduciary standard, the responsibility shifts to the adviser. This is a distinction not lost on compliance departments. As a consequence, I believe the enforcement of fiduciary standards will not be a result of detailed rules and micro-managing regulators, but rather the actions of firm compliance departments and ultimately the results of arbitration and court rulings.

I believe the DOL rule is a seminal event that will significantly improve the investment outcome of individual investors for decades to come. My friend Bob Veres, publisher of Inside Information and longtime industry observer, best summed it up:

"…overall, the new rule fundamentally (and with pretty [much] zero exception) requires the broker… to act as a fiduciary. That brings a lot of people into the principles-based universe, which is alien territory for the brokerage firms… My take is that the DOL was a bit sly about its concessions, making it harder for the wirehouse arguments to prevail in court should there be (as I think there WILL be) a legal challenge to these provisions.

That means that this is a milestone for the planning profession, a stake in the ground further than anyone has gone before in the fiduciary requirement space."

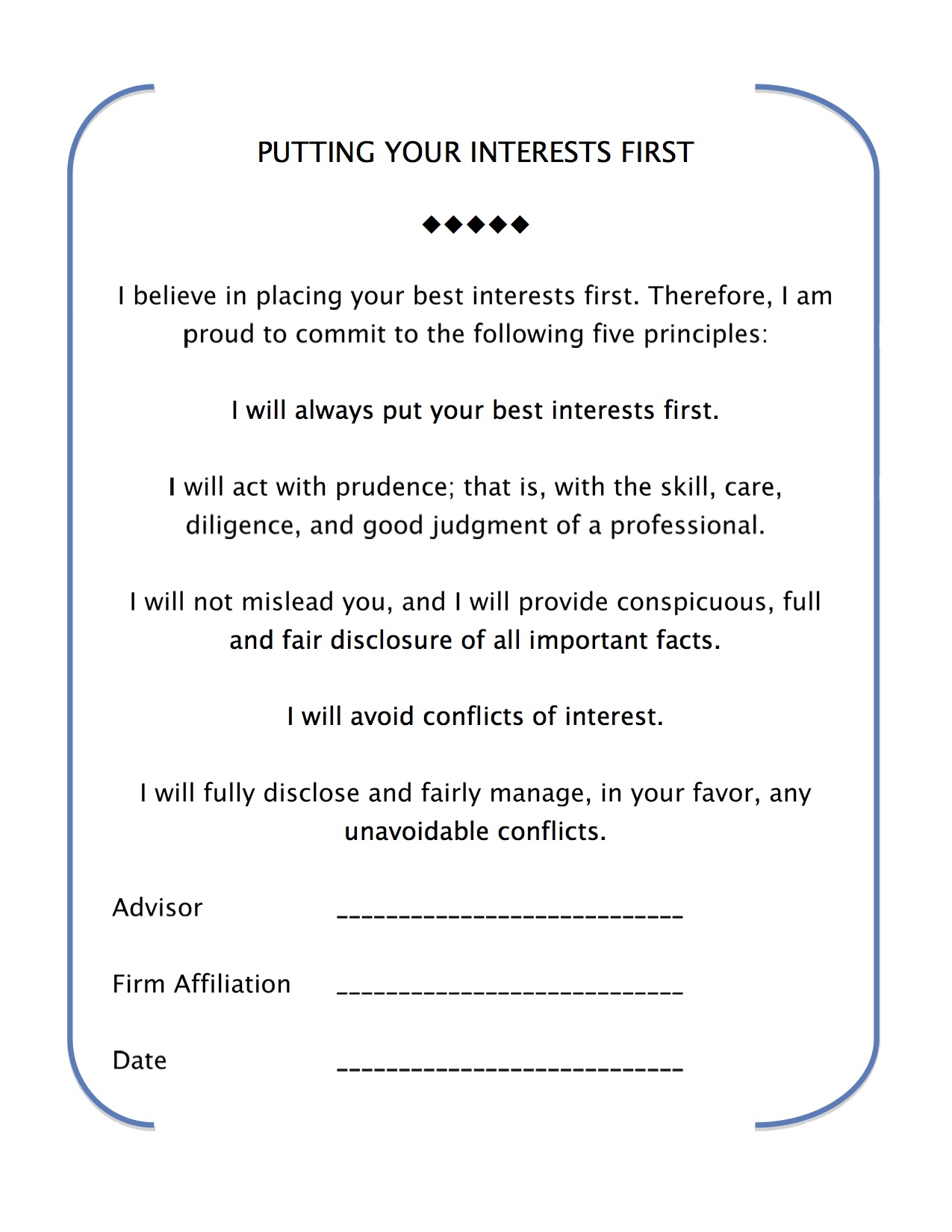

Finally, as legislators, businesses and the courts go about interpreting and implementing the more than 1,000 pages, individual investors might happily ignore the activity by simply having their advisor sign the Committee for the Fiduciary Standard's mom-and-pop ">fiduciary oath (see below or click on the link for a printable version of the oath). With that signed and in hand, you will at least know that your relationship with your adviser is structured so that your interest comes first, even with your non-IRA accounts.

Harold Evensky, CFP, is Chairman of Evensky & Katz, a fee-only wealth management firm and Professor of Practice at Texas Tech University.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Harold Evensky, CFP® is Chairman of Evensky & Katz, a fee-only investment advisory firm and Professor of Practice in the Personal Financial Planning Department at Texas Tech University. Evensky served as Chair of the TIAA-CREF Institute Advisor Board, Chair of the CFP Board of Governors and the International CFP Council. He is on the advisory board of the Journal of Retirement Planning and is the Research Columnist for Journal of Financial Planning. Evensky is co-author of The New Wealth Management and co-editor of The Investment Think Tank and Retirement Income Redesigned. Mr. Evensky has received numerous awards over the years. The most recent is Investment Advisor Magazine, 2015 IA 35 for 35 recognizing the advisor advocates, investors, politicians and thought leaders have stood out over the past 35 years and will influence financial services for decades to come. Don Phillips of Morningstar called Mr. Evensky the dean of financial planning in America.

-

Over 65? Here's What the New $6K 'Senior Deduction' Means for Medicare IRMAA Costs

Over 65? Here's What the New $6K 'Senior Deduction' Means for Medicare IRMAA CostsTax Breaks A new deduction for people over age 65 has some thinking about Medicare premiums and MAGI strategy.

-

U.S. Congress to End Emergency Tax Bill Over $6,000 Senior Deduction and Tip, Overtime Tax Breaks in D.C.

U.S. Congress to End Emergency Tax Bill Over $6,000 Senior Deduction and Tip, Overtime Tax Breaks in D.C.Tax Law Here's how taxpayers can amend their already-filed income tax returns amid a potentially looming legal battle on Capitol Hill.

-

5 Investing Rules You Can Steal From Millennials

5 Investing Rules You Can Steal From MillennialsMillennials are reshaping the investing landscape. See how the tech-savvy generation is approaching capital markets – and the strategies you can take from them.

-

When Estate Plans Don't Include Tax Plans, All Bets Are Off: 2 Financial Advisers Explain Why

When Estate Plans Don't Include Tax Plans, All Bets Are Off: 2 Financial Advisers Explain WhyEstate plans aren't as effective as they can be if tax plans are considered separately. Here's what you stand to gain when the two strategies are aligned.

-

Counting on Real Estate to Fund Your Retirement? Avoid These 3 Costly Mistakes

Counting on Real Estate to Fund Your Retirement? Avoid These 3 Costly MistakesThe keys to successful real estate planning for retirees: Stop thinking of property income as a reliable paycheck, start planning for tax consequences and structure your assets early to maintain flexibility.

-

I'm a Financial Planner: These Small Money Habits Stick (and Now Is the Perfect Time to Adopt Them)

I'm a Financial Planner: These Small Money Habits Stick (and Now Is the Perfect Time to Adopt Them)February gets a bad rap for being the month when resolutions fade — in fact, it's the perfect time to reset and focus on small changes that actually pay off.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.