The Value of A Holistic Approach to Financial Planning

New research shows a comprehensive approach can boost investment return over the long term.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Since our start in 1985, Mercer Advisors has firmly believed that investors have the most to gain by looking at their financial lives holistically – a mixture of investment advice, comprehensive planning, and life-driven goals. Recent research has put a value on this integrated approach.

Studies by Morningstar and Vanguard show financial advisers who provide wealth management best practices can add significant value beyond market performance. While the findings are hypothetical and are not actual investment results, both sets of research illustrate the value provided by comprehensive financial planning.

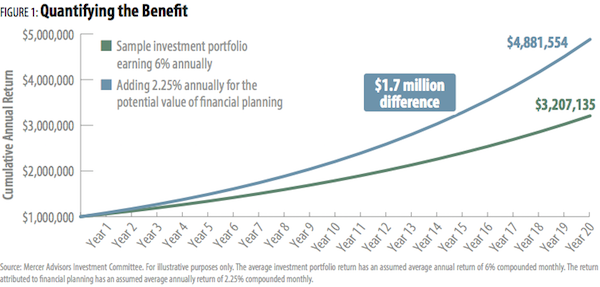

Our research shows that investors who follow best practices can earn an additional 1.50% to 3.00% annually. Splitting the difference between these statistics, Figure 1 shows how an additional 2.25% annual return could impact a portfolio over thirty years. (For illustrative purposes only.)

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

The average investment portfolio return has an assumed average annual return of 6% compounded monthly. The return attributed to financial planning has an assumed average annual return of 2.25% compounded monthly.

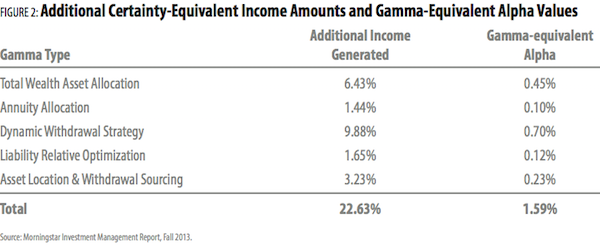

Morningstar says smart financial planning can translate to 1.5% more in annual average returns. Academics at Morningstar recently coined the term Gamma to define the potential valued added to a portfolio from intelligent financial decisions. In a white paper titled Alpha, Beta and Now….Gamma the authors stated, “Getting Gamma from financial planning best practices offers a much more certain and consistent return than seeking traditional alpha from choosing outperforming mutual funds.” Morningstar identified more than 100 financial planning techniques that can serve as sources of Gamma. They focused on five for their study: total wealth asset allocation, annuity allocation, dynamic withdrawal strategy, liability relative optimization, and asset location & withdrawal sourcing.

Figure 2 shows how properly implementing these value-added strategies can increase returns by as much as 1.59% annually. Of the five strategies, a dynamic withdrawal strategy had the highest potential Gamma. In addition to the five factors, Morningstar found that making informed Social Security claiming decisions could increase returns by another 0.74% annually.

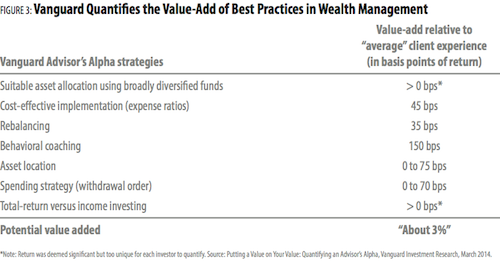

Vanguard finds working with an adviser can add up to 3% in net returns. Vanguard performed a similar study and concluded that financial advisers using wealth management best practices can add “about 3% in net returns” to their clients’ portfolios. Vanguard emphasized that while the value added will vary according to each client’s circumstances and from year to year, “It’s a number that is very real and can reinforce the importance of sticking to a plan and following sound financial advice.”

As detailed in Figure 3, clients can benefit from a qualified adviser who helps them invest in a low-cost, broadly diversified portfolio, maintain their target allocation, and draw down their savings tax efficiently. Successfully implementing all seven strategies can potentially add “about 3%” to an average client experience.

Notably, research finds that advisers can add the most value – “tens of percentage points of value-add, rather than mere basis points” – by helping clients stay the course during bear market lows and avoid performance chasing during market highs.

Best Practices at a Glance

Below are five strategies identified by this new area of best practices research. All of these potential return-enhancing strategies are practiced by Mercer Advisors:

Academic Portfolio Design

Research has found that asset allocation is the biggest driver of a portfolio’s return and risk. Best practice studies conclude that one of the advisor’s primarily responsibilities is to design a properly diversified investment portfolio tailored to each client’s personal needs, goals, and risk profile.

Ongoing Personal Guidance

Studies have shown that average investors often jump in and out of the market, buying at the euphoric highs and panic selling at the distressing lows. Not surprisingly, the returns the average investors earn on their investment portfolios are significantly lower than what the market offered. One of the most valuable services an advisor can provide is to help clients steer clear of money-losing ventures, like trying to time the market or chase returns.

Low-Cost Investing

Research has repeatedly documented that low costs lead to better investment performance. Advisers who implement investment plans with lower-cost funds can add significant value to their clients’ portfolios. Cost-effective implementation is especially important in times of low market returns, when fund expenses erode a higher proportion of returns.

Systematic Portfolio Rebalancing

A good financial adviser keeps the investment plan on track through systematic portfolio rebalancing. Regular rebalancing keeps positions within their target weights and enforces the discipline of buying low and selling high. Without guidance, many investors fail to rebalance their portfolios because it seems counterintuitive to sell winners and buy laggards.

Customized Distribution Planning

Research has shown the benefits of adjusting distributions based on the investment climate and a client’s remaining life expectancy. Advisers utilizing variable withdrawals strategies can help maximize how long their clients’ savings last. Customized distribution planning allows investors to increase spending during good markets, without having to cut back as much in down markets.

David has served as CEO of Mercer Advisors since 2008. He is responsible for the firm’s strategic vision, business plan execution, and organizational structure.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.

-

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure Them

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure ThemHow can advisers reassure clients nervous about their plans in an increasingly complex and rapidly changing world? This conversational framework provides the key.

-

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate Empire

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate EmpireSmall rental properties can be excellent investments, but you can use 1031 exchanges to transition to commercial real estate for bigger wealth-building.

-

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs In

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs InRoth conversions are all the rage, but what works well for one household can cause financial strain for another. This is what you should consider before moving ahead.