Amplify Online Retail: A Bet on How We Will Shop

This ETF invests in fast-growing internet retailers around the world.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The pandemic brought business at many stores to a near-screeching halt. But some online retailers thrived during the quarantine—including Overstock.com (symbol, OSTK), where April sales were up 120% compared with April 2019.

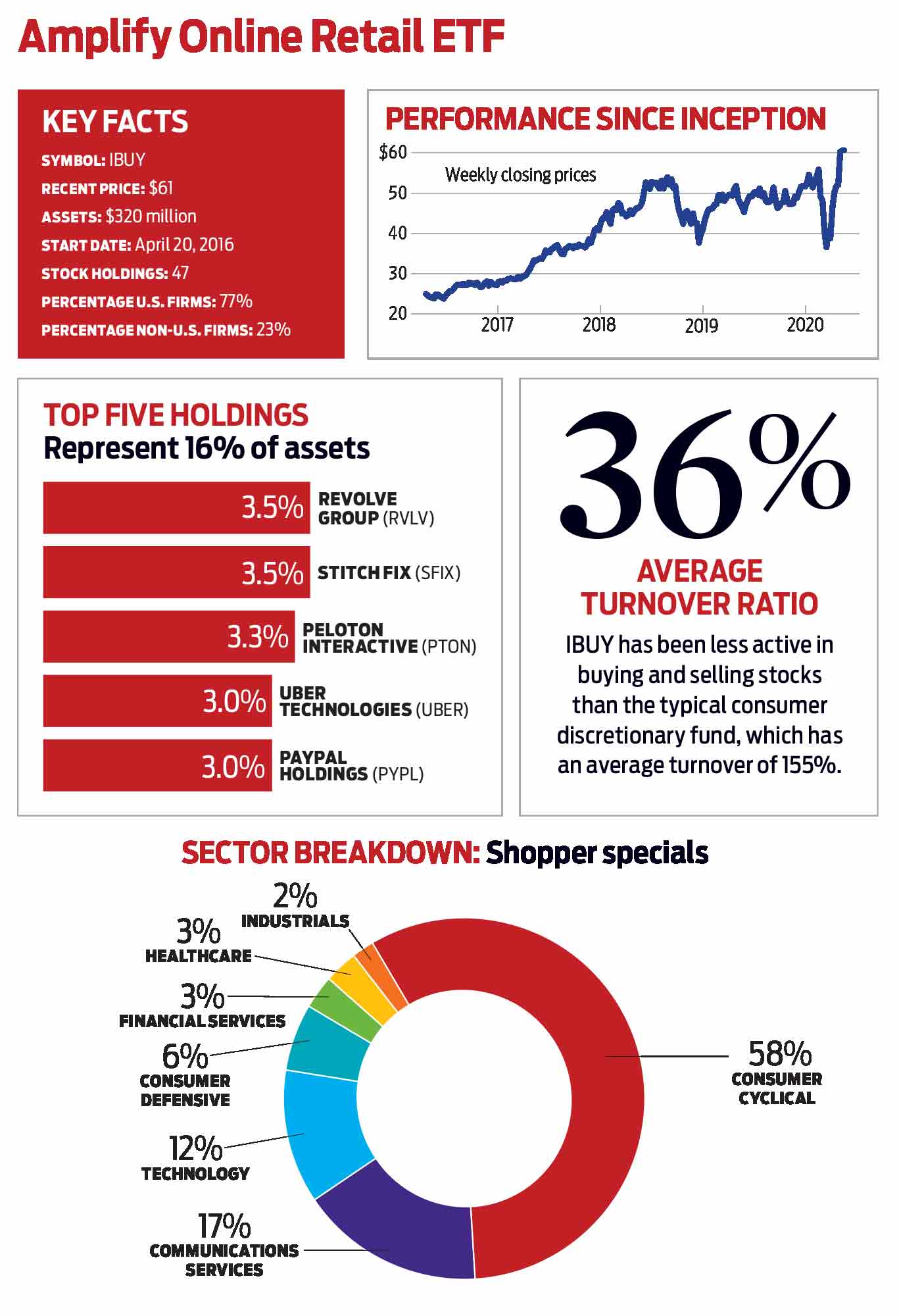

That helps explain why the Amplify Online Retail (IBUY) exchange-traded fund, which owns shares of Overstock, posted a 25.7% return over the past 12 months. That beat 99% of its peers (funds that focus on consumer-spending stocks). Over the same stretch, the broad market eked out a 2.5% gain. Two of the ETF’s best performers, Stamps.com (STMP) and Shopify (SHOP), each notched triple-digit percentage gains over the past 12 months.

The fund tracks an index of U.S. and foreign companies that generate at least 70% of annual revenues or $100 billion in annual sales from internet-based retail, travel or services. The 47 stocks that match the ETF’s parameters are weighted equally, so the shares of Latin American online auction and e-payment firm Mercado Libre (MELI) or Peloton Interactive (PTON), for instance, get as much play as shares of Chinese e-commerce giant Alibaba Group Holding (BABA) or Amazon.com (AMZN), the biggest online retailer in the world. The fund is rebalanced twice a year.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

In the U.S., online sales account for 11% of total retail sales; in China, roughly 35%; and in Europe, nearly 10%, on average. “It’s still early in the game” for online retail, says Christian Magoon, chief executive of Amplify. Retail e-commerce sales worldwide are expected to increase to $6.5 trillion in 2022 from $3.5 trillion in 2019, according to Statista.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Nellie joined Kiplinger in August 2011 after a seven-year stint in Hong Kong. There, she worked for the Wall Street Journal Asia, where as lifestyle editor, she launched and edited Scene Asia, an online guide to food, wine, entertainment and the arts in Asia. Prior to that, she was an editor at Weekend Journal, the Friday lifestyle section of the Wall Street Journal Asia. Kiplinger isn't Nellie's first foray into personal finance: She has also worked at SmartMoney (rising from fact-checker to senior writer), and she was a senior editor at Money.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

How Inflation, Deflation and Other 'Flations' Impact Your Stock Portfolio

How Inflation, Deflation and Other 'Flations' Impact Your Stock PortfolioThere are five different types of "flations" that not only impact the economy, but also your investment returns. Here's how to adjust your portfolio for each one.

-

Why I Still Won't Buy Gold: Glassman

Why I Still Won't Buy Gold: GlassmanOne reason I won't buy gold is because while stocks rise briskly over time – not every month or year, but certainly every decade – gold does not.

-

Should You Use a 25x4 Portfolio Allocation?

Should You Use a 25x4 Portfolio Allocation?The 25x4 portfolio is supposed to be the new 60/40. Should you bite?

-

Retirement Income Funds to Keep Cash Flowing In Your Golden Years

Retirement Income Funds to Keep Cash Flowing In Your Golden YearsRetirement income funds are designed to generate a reliable cash payout for retirees. Here are a few we like.

-

10 2024 Stock Picks From An Investing Expert

10 2024 Stock Picks From An Investing ExpertThese 2024 stock picks have the potential to beat the market over the next 12 months.

-

Special Dividends Are On The Rise — Here's What to Know About Them

Special Dividends Are On The Rise — Here's What to Know About ThemMore companies are paying out special dividends this year. Here's what that means.

-

How to Invest in AI

How to Invest in AIInvestors wanting to know how to invest in AI should consider these companies that stand to benefit from the boom.

-

Why I Still Like Emerging Markets

Why I Still Like Emerging MarketsPeriods of global instability create intriguing possibilities in emerging markets. Here are a few.