A Simple Guide to College Savings Plans

Among your best options for saving for your child's education are 529 plans, Coverdell ESAs and custodial accounts.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

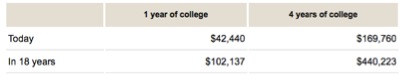

The grand estimated cost to send my hypothetical unborn child to my alma mater—the University of Arizona—in 18 years: $440,223! It's also close to the current median home price in San Diego.

See for yourself, and share in my misery:

Yes, the table to the left assumes that the cost of college will continue to increase by an average of 5% per year, as it has over the past decade, according to the College Board, and that I will be paying out-of-state tuition. But any way you slice it, college is expensive.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Now, do I really believe that I will be paying almost half a million dollars to send my future child to college? No. But that's another conversation.

I do believe, however, that most parents are underprepared for the cost of higher education. In my experience, they don't start saving early enough, they don't have an automated savings plan guiding them to their goal, and most importantly, they don't always take advantage of tax-efficient savings vehicles.

Before you start to panic, remember that you don't have to fund the full amount. Many families save only a portion of the projected costs and then use it as a "down payment" on the college bill, similar to the down payment on a home.

If you are ready to start saving for college—or you would like to improve your current savings plan—here are three vehicles for you to consider utilizing:

529 PLANS

Under a special rule, up to $70,000 ($140,000 for married couples) can be contributed to a 529 plan at one time without incurring gift taxes. In many states, your contributions are deductible on your state income tax return, too.

Similar to a Roth IRA or 401(k), any earnings in the account are deferred from federal, and in most cases, state taxes. Best of all, as long as the funds are used for qualified college expenses, withdrawals from the account are tax free!

Keep in mind, if your child does not attend college, and you withdraw the funds for another purpose, earnings will be taxed and a 10% penalty will be imposed. However, 529 rules allow you to change the beneficiary once per year. So, if your eldest child doesn't use the funds, you can utilize them for a younger child or another qualifying member of the family.

COVERDELL EDUCATION SAVINGS ACCOUNTS (ESA)

A Coverdell ESA is a tax-advantaged savings vehicle that lets you contribute up to $2,000 per year. The tax benefits are similar to a 529, but the ESA allows you to use the money for K-12 qualified expenses in addition to college. Although you have complete control over the investments in the account, Coverdell ESAs are not revocable. Distributions from the account are always paid to the beneficiary and cannot be paid back to you.

Coverdell ESAs have a number of limitations and nuances, so be sure to do your homework before jumping in headfirst.

UTMA/UGMA CUSTODIAL ACCOUNTS

A custodial account is a way for your child to hold assets in his or her name with you acting as the account owner until he or she reaches a designated age (typically 18 or 21). All contributions are irrevocable, and earnings and capital gains generated by investments in the account are taxed to the child each year.

Assets in the account can be used for college, but they don't have to be. Often times, parents or grandparents will fund a custodial account to give the child flexibility when they turn of age. On the other hand, some are reluctant to use these accounts because they are concerned the child might use the funds in an irresponsible manner.

We are all well aware of the rising costs of education. One easy way to help boost your savings is to consider participating in a program such as Upromise—a rewards program that directly benefits the college savings vehicle of your choice. Visit upromise.com for more information.

Please note, some college savings accounts may impact financial aid eligibility. Additionally, account fees vary from plan to plan, and if they're too high, can hinder your savings goals. Consult with your trusted adviser to choose a plan that is right for you.

See the original version of this article HERE.

Taylor Schulte, CFP® is founder and CEO of Define Financial, a San Diego-based fee-only firm. He is passionate about helping clients accumulate wealth and plan for retirement.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Taylor Schulte, CFP®, is founder and CEO of Define Financial, a fee-only wealth management firm in San Diego. In addition, Schulte hosts The Stay Wealthy Retirement Podcast, teaching people how to reduce taxes, invest smarter, and make work optional. He has been recognized as a top 40 Under 40 adviser by InvestmentNews and one of the top 100 most influential advisers by Investopedia.

-

Over 65? Here's What the New $6K 'Senior Deduction' Means for Medicare IRMAA Costs

Over 65? Here's What the New $6K 'Senior Deduction' Means for Medicare IRMAA CostsTax Breaks A new deduction for people over age 65 has some thinking about Medicare premiums and MAGI strategy.

-

U.S. Congress to End Emergency Tax Bill Over $6,000 Senior Deduction and Tip, Overtime Tax Breaks in D.C.

U.S. Congress to End Emergency Tax Bill Over $6,000 Senior Deduction and Tip, Overtime Tax Breaks in D.C.Tax Law Here's how taxpayers can amend their already-filed income tax returns amid a potentially looming legal battle on Capitol Hill.

-

5 Investing Rules You Can Steal From Millennials

5 Investing Rules You Can Steal From MillennialsMillennials are reshaping the investing landscape. See how the tech-savvy generation is approaching capital markets – and the strategies you can take from them.

-

I'm a Financial Planner: These Small Money Habits Stick (and Now Is the Perfect Time to Adopt Them)

I'm a Financial Planner: These Small Money Habits Stick (and Now Is the Perfect Time to Adopt Them)February gets a bad rap for being the month when resolutions fade — in fact, it's the perfect time to reset and focus on small changes that actually pay off.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.

-

To Love, Honor and Make Financial Decisions as Equal Partners

To Love, Honor and Make Financial Decisions as Equal PartnersEnsuring both partners are engaged in financial decisions isn't just about fairness — it's a risk-management strategy that protects against costly crises.

-

For More Flexible Giving, Consider Combining a Charitable Remainder Trust With a Donor-Advised Fund

For More Flexible Giving, Consider Combining a Charitable Remainder Trust With a Donor-Advised FundIf a charitable remainder trust puts too many constraints on your family's charitable giving, consider combining it with a donor-advised fund for more control.

-

These Thoughtful Retirement Planning Steps Help Protect the Life You Want in Retirement

These Thoughtful Retirement Planning Steps Help Protect the Life You Want in RetirementThis kind of planning focuses on the intentional design of your estate, philanthropy and long-term care protection.

-

A Wake-Up Call and a Healthy Dose of Terror: How to Survive Your First Days in Prison

A Wake-Up Call and a Healthy Dose of Terror: How to Survive Your First Days in PrisonThis young man needed to be scared straight after his mother expressed her fear that he was on a path to prison. Hearing these eight do's and don'ts worked.