It Just Feels Like a Double-dip Recession

With housing continuing to wallow at the bottom and millions of pink-slipped workers still unemployed, it seems as if the economy is sliding back into recession. But is it?

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

The economy seems especially fragile these days, as if the United States is teetering on the edge of recession. That’s the way it is when GDP is gaining at a rate of 2% or less, as it has been for some months: There are stronger areas — Texas, North Dakota, Milwaukee, Washington, D.C., and San Jose, Calif., for example. And some weaker areas, including much of California as well as Nevada, Phoenix, Atlanta and Tampa, Fla.

With industries, the same spotty pattern prevails. Orders roll in for makers of medical devices, earth-moving equipment and a variety of exports. But housing and real estate are still in deep distress. Similarly, job seekers face a mixed picture: More than enough jobs for petroleum engineers, accountants and medical technicians. But teachers and other public sector employees are being laid off. And for the 7 million workers who lost their jobs during the downturn and still aren’t able to find work, the recession hasn’t ended. They continue to suffer.

But the odds of actually returning to recession — at least six months of declining national production — are still relatively low. Many of the economic hits this spring were one-time events and aren’t likely to be reprised — or at least they aren’t likely to pile one on top of another again. The combination of tornadoes ripping through broad swaths of the country, widespread Mideast turmoil sending gasoline prices near $4 a gallon, and the one-two punch of disasters in Japan was extraordinary.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

The next few weeks will provide key signals about what’s ahead — indications of whether growth is in real danger of reversing course or will just continue weakly. The July 8 employment report for June, for example, needs to show much more vigor. Sustained economic growth requires net job gains of about 150,000 a month. So far this year, the average is just 72,000; for May, it was only 54,000. Also critical: no further slowing of manufacturing. (A July 1 purchasing managers survey will tell the story.) And an upward tick in June auto sales indicating that Japan’s economy and supply lines are coming back.

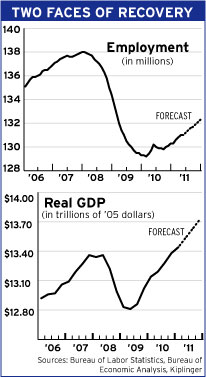

The best to expect is probably continued wobbly, weak GDP gains, with three or four more years to go before the economy begins to feel a great deal better. It’ll take that long for employment to again reach the prerecession high-water mark of 138 million and for unemployment to fall below 6% or so.

The fact is, this last recession was different from most. It was born in a housing bubble and sparked by financial crisis. It typically takes longer to recover from downturns arising from financial crises. And housing is usually one of the chief engines of growth following recessions; the Federal Reserve lowers interest rates, encouraging demand for mortgages and housing and spurring growth. That can’t happen this time.

Recovery will be slower, as the economy shifts to rely less on consumer spending and more on exports and business investment. It’s a worthy destination, but the trip won’t be a pleasant or smooth one.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Americans, Even With Higher Incomes, Are Feeling the Squeeze

Americans, Even With Higher Incomes, Are Feeling the SqueezeA 50-year mortgage probably isn’t the answer, but there are other ways to alleviate the continuing sting of high prices

-

Hiding the Truth From Your Financial Adviser Can Cost You

Hiding the Truth From Your Financial Adviser Can Cost YouHiding assets or debt from a financial adviser damages the relationship as well as your finances. If you're not being fully transparent, it's time to ask why.

-

How to Manage a Disagreement With Your Financial Adviser

How to Manage a Disagreement With Your Financial AdviserKnowing how to deal with a disagreement can improve both your finances and your relationship with your planner.

-

Farmers Brace for Another Rough Year

Farmers Brace for Another Rough YearThe Kiplinger Letter The agriculture sector has been plagued by low commodity prices and is facing an uncertain trade outlook.

-

Trump Reshapes Foreign Policy

Trump Reshapes Foreign PolicyThe Kiplinger Letter The President starts the new year by putting allies and adversaries on notice.

-

Congress Set for Busy Winter

Congress Set for Busy WinterThe Kiplinger Letter The Letter editors review the bills Congress will decide on this year. The government funding bill is paramount, but other issues vie for lawmakers’ attention.

-

The Kiplinger Letter's 10 Forecasts for 2026

The Kiplinger Letter's 10 Forecasts for 2026The Kiplinger Letter Here are some of the biggest events and trends in economics, politics and tech that will shape the new year.

-

What to Expect from the Global Economy in 2026

What to Expect from the Global Economy in 2026The Kiplinger Letter Economic growth across the globe will be highly uneven, with some major economies accelerating while others hit the brakes.

-

Amid Mounting Uncertainty: Five Forecasts About AI

Amid Mounting Uncertainty: Five Forecasts About AIThe Kiplinger Letter With the risk of overspending on AI data centers hotly debated, here are some forecasts about AI that we can make with some confidence.

-

Worried About an AI Bubble? Here’s What You Need to Know

Worried About an AI Bubble? Here’s What You Need to KnowThe Kiplinger Letter Though AI is a transformative technology, it’s worth paying attention to the rising economic and financial risks. Here’s some guidance to navigate AI’s future.

-

Will AI Videos Disrupt Social Media?

Will AI Videos Disrupt Social Media?The Kiplinger Letter With the introduction of OpenAI’s new AI social media app, Sora, the internet is about to be flooded with startling AI-generated videos.