Tax Planning

News, insights and expert analysis on tax planning from the team at Kiplinger.

Latest

-

Five Big Beautiful Bill Changes and How Wealthy Retirees Can Benefit

Here's how wealthy retirees can plan for the changes in the new tax legislation, including what it means for tax rates, the SALT cap, charitable giving, estate taxes and other deductions and credits.

By Evan T. Beach, CFP®, AWMA® Published

-

Parents Prepare: Trump's Megabill Brings Three Crucial Tax Changes

Tax Changes Are you a parent? The so-called ‘One Big Beautiful Bill’ (OBBB) impacts several key tax incentives that can affect your family this year and beyond.

By Kate Schubel Published

Tax Changes -

'Drivers License': A Wealth Strategist Helps Gen Z Hit the Road

From student loan debt to a changing job market, this generation has some potholes to navigate. But with those challenges come opportunities.

By Alvina Lo Published

-

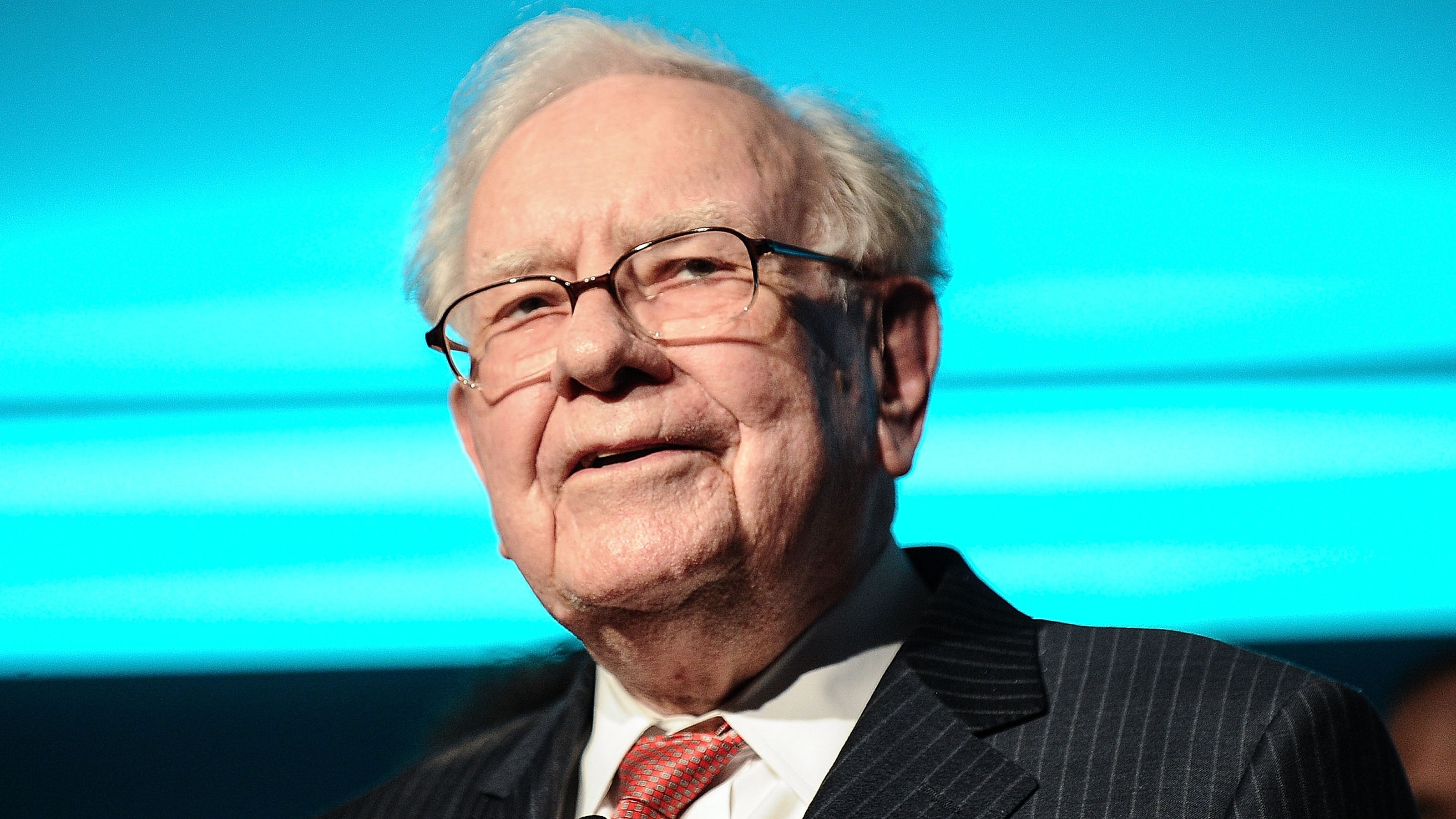

I'm an Investing Expert: This Is How You Can Invest Like Warren Buffett

Buffett just invested $15 billion in oil and gas, and you can leverage the same strategy in your IRA to potentially generate 8% to 12% quarterly cash flow while taking advantage of tax benefits that are unavailable in any other investment class.

By Daniel Goodwin Published

-

Five Summer Activities That Can Change Your Taxes for 2025

Tax Planning Certain summertime activities might help lower your taxable income.

By Kelley R. Taylor Last updated

Tax Planning -

Eight Things No One Tells You About Retirement

Making Your Money Last As you advance toward retirement, it's a good idea to start sharpening the focus of your retirement vision.

By Rachel L. Sheedy Last updated

Making Your Money Last -

The TCJA: Key Facts on the 2017 'Trump Tax Cuts' and What's Extended for 2025

Tax Law How many of the extended TCJA provisions in the so-called 'One Big Beautiful Bill' (OBBB) will impact your wallet?

By Kate Schubel Last updated

Tax Law -

Opportunity Zones: An Expert Guide to the Changes in the One Big Beautiful Bill

The law makes opportunity zones permanent, creates enhanced tax benefits for rural investments and opens up new strategies for investors to combine community development with significant tax advantages.

By Daniel Goodwin Published

-

10 Reasons You Don't Want to Retire in Florida

retirement An overabundance of boomers, critters, sweat and weirdness. Welcome to the dark side of the Sunshine State.

By Bob Niedt Last updated

retirement