Sponsored by Stone Ridge Asset Management

3 Retirement Income Mistakes—And How Bond Ladders Can Help You Avoid Them

Many retirees unknowingly jeopardize their financial security by making three common income-investing mistakes. Learn how bond ladders—made easier with LifeX ETFs—can help lock in predictable retirement income.

Retirement marks a major shift in the purpose of your investment portfolio—your paycheck stops, but your bills don’t. Now, the purpose of your portfolio is not only to grow but also to generate monthly income to support your lifestyle.

What sort of income-producing investment strategies should you pick? Far too often, investors fall into traps that can undermine their financial security just when they need it.

If you’re relying on your investments to fund retirement, watch out for these three common mistakes—and learn how a simple, time-tested strategy called bond laddering can help you avoid them. And better yet, learn about ETFs like LDDR that make investing in a bond ladder easier than ever.

Mistake #1: Relying Too Heavily on Dividend Stocks or Bond Funds

Generating income with dividend-paying stocks or high-grade bond funds can sound like a solid plan—until you need to sell shares.

The problem? While the income from these investments may be stable, the value of your investment may not be. And the only way to get your money back is by selling your shares at the market price.

Said differently, these investments are subject to price volatility. If the market drops and you need to tap your portfolio for unexpected expenses—like a new roof or a family vacation—you may have to sell at a loss.

Let’s look at two hypothetical scenarios:

1. At the beginning of 2022, Howard puts $10,000 into a bond index fund tracking the Bloomberg U.S. Corporate Bond Index (1). At the end of the year, he goes to sell his shares to help fund a new car purchase only to find they’re now valued at ~$8,450—a loss of 13% in one bad year (2).

2. At the beginning of 2023, Suzanne puts $10,000 into the same fund. At the end of the year, she sells her shares which have increased in value to ~$10,850, a return of ~8.5% (2). Depending on her income that year, she might pay up to 20% capital gains tax + 3.8% net investment income tax + state and local taxes, which can be as high as 14.8% for a New York City resident. Net of those taxes, she might keep a gain of only ~5.2% (3).

🛠️ The Fix: Bond laddering can help shield you from this kind of price risk. By structuring a ladder of individual bonds that mature at regular intervals—say, every year—you know exactly how much money you’ll have available—and when (4). By accessing your money through bond maturities instead of having to sell, you can help insulate yourself from price risk.

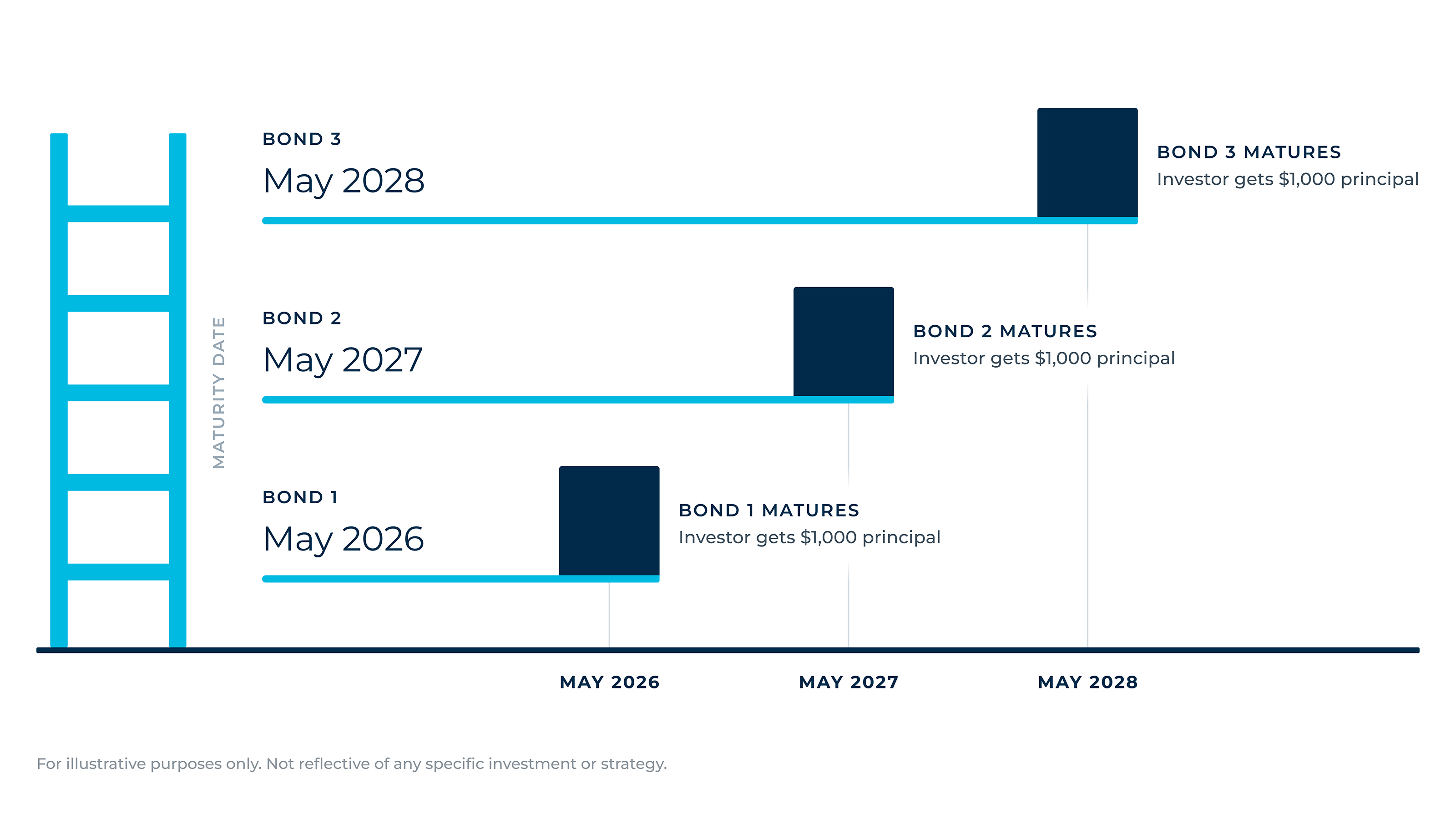

How Bond Ladders Work

Holding bonds with staggered maturities means you know how much you’ll get back and when.

Example: 3 bonds with maturities 1 year apart, each with $1,000 face value

Mistake #2: Hiding Out in Cash, Money Market Funds, or Short-Term Bonds

In an effort to sidestep volatility, many investors go to the other extreme—parking too much in bank accounts, money market funds, or short-term bonds. While this does reduce price risk, it creates another problem: reinvestment risk.

In an economic or geopolitical crisis, yields can collapse quickly. While you might like current interest rates, think about what would happen if interest rates fall from 4% to 2%. The amount of income you earn from these investments could quickly get cut in half! In retirement, that kind of sudden shock to your income can be especially stressful.

🛠️ The Fix: A bond ladder allows you to lock in today’s interest rates for multiple years, reducing your exposure to reinvestment risk. The longer the ladder, the lower the reinvestment risk. You might even consider a ladder that lasts to or through your life expectancy. For example, if you’re 65 years old, a 30-year bond ladder may last for the rest of your lifetime.

Risk Tradeoff: Traditional Retirement Income Solutions

Mistake #3: Avoiding Principal Spending at All Costs

Many retirees are reluctant to spend down principal, believing it’s safer to live off interest and dividends alone. But this approach is a bit like making sure your car never runs out of gas by simply never driving it. You worked hard to earn it. Better to use it wisely than not to use it at all.

Refusing to touch principal can lead to:

- Overexposure to risky assets in search of yield

- Higher tax bills from tax-inefficient “high yield” assets

- Underspending and living below your means

🛠️ The Fix: A bond ladder provides a reliable framework for spending principal while making your money last. Each rung of the ladder represents not just interest income but also a scheduled return of principal (tax-free!), designed to support your lifestyle. You know how long your money should last—as long as the longest maturity bond in the ladder. It’s a disciplined, sustainable way to maximize spending power and minimize your tax bill.

Why Bond Laddering Works—And Why It’s Easier Than Ever

Bond laddering isn’t new. Investors and professional money managers have been using them for decades to create predictable, tax-efficient income. But historically, building a bond ladder required purchasing individual bonds—often with high minimums, trading costs, and many tedious steps.

That’s where LifeX bond ladder ETFs come in.

LifeX takes the complexity out of laddering by offering cost-effective bond ladder ETFs designed to deliver the benefits of a traditional bond ladder without the manual labor.

- Convenience of an ETF

- Stable monthly cash flow

- Built with U.S. government bonds

You could invest in the S&P 500 by buying each individual stock yourself, but you probably use an index fund for efficiency and professional management (5). Similarly, instead of spending hours building and maintaining a bond ladder, investors and advisors can now instantly access a professionally constructed ladder—no guesswork, no selling into a volatile market, and no stress.

Final Thoughts: Predictability is Power

In retirement, uncertainty is the enemy. And while no strategy is perfect, bond laddering offers one of the most reliable ways to turn your nest egg assets into predictable, tax-efficient income—without the price and reinvestment risk of traditional income solutions.

If you’re looking for a retirement income plan that's boring and predictable so you can get excitement from the rest of your life, LifeX bond ladder ETFs are designed to give you a professional-grade bond ladder in a single trade—streamlined, cost-effective, and built for predictable income.

Want to learn more about how bond ladders can work in your retirement income plan? Visit LifeXFunds.com to explore tools, insights, and bond ladder ETFs built for today's retirees.

(1) The Bloomberg U.S. Corporate Bond Index measures the investment grade, fixed-rate, taxable corporate bond market. Investors cannot invest directly in an index.

(2) Returns represent total return of the Bloomberg U.S. Corporate Bond Index in 2022. Does not include any fees or expenses that would be incurred by investing in a fund that tracks the index.

(3) The tax discussion herein is general in nature. Actual tax rates will depend on an investor’s specific situation, including state of residence, income level, and other factors. Investors should consult their tax advisers about their specific situation. Purchases of the LifeX Income ETFs in a qualified retirement account may not benefit from a tax-advantaged distribution structure.

(4) Bond investments are subject to default risk, or the risk that an issuer will fail to make some or all of their principal and/or interest payments.

(5) The S&P 500 is an index including 500 large U.S. companies and is widely regarded as the best single gauge of large-cap U.S. equities.

Index Performance (as of 3/31/2025)

Bloomberg U.S. Corporate Bond Index

1-year: 4.87%; 5-year: 1.51%; 10-year: 2.43%

Performance data quoted represents past performance and does not guarantee future results. The index shown is unmanaged and not available for direct investment. Index performance does not reflect expenses, fees, or taxes. Returns over 1 year are annualized.

Risk Disclosures

Investing involves risks, including possible loss of principal. Past performance is no guarantee of future results.

Carefully consider the risks and investment objective of any ETF prior to investing. There can be no assurance that an ETF will achieve its investment objectives. This and other information can be found in the Funds' prospectuses, which may be obtained by visiting www.lifexfunds.com. Read the prospectus carefully before investing.

The purpose of each LifeX Term Income ETF is to provide reliable monthly distributions consisting of income and principal through the end of a calendar year specified in the ETF’s prospectus.

Each Term Income ETF intends to make distributions for which a portion of each distribution is expected and intended to constitute a return of capital, which will reduce the amount of capital available for investment and may reduce a shareholder’s tax basis in his or her shares.

Fixed income risks include credit risk, which refers to the possibility that the bond issuer will not be able to make principal and interest payments.

The LifeX Income ETFs invest in debt securities issued by the U.S. Treasury (“U.S. Government Bonds”) as well as money market funds that invest exclusively in U.S. Government Bonds or repurchase agreements collateralized by such securities. U.S. Government Bonds have not historically had credit-related defaults, but there can be no assurance that they will avoid default in the future.

This material is not intended to be relied upon as a forecast, research, or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date indicated herein and may change as subsequent conditions vary.

This commentary may contain “forward-looking” information that is not purely historical in nature. There is no guarantee that any forward-looking statements made will come to pass. Reliance upon information in this post is at the sole discretion of the reader.

ETFs may trade at a premium or discount to NAV. Shares of any ETF are bought and sold at market prices (not NAV) and are not individually redeemed from the Fund. Brokerage commissions will reduce returns. The Fund is an actively managed ETF, which is a fund that trades like other publicly-traded securities.

Nothing contained herein constitutes investment, legal, tax or other advice nor is it to be relied on in making an investment or other decision. Legal advice can only be provided by legal counsel. Before deciding to proceed with any investment, investors should review all relevant investment considerations and consult with their own advisors.

The LifeX Income ETFs are distributed by Foreside Financial Services, LLC.

This content was provided by Stone Ridge Asset Management. Kiplinger is not affiliated with and does not endorse the company or products mentioned above.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.