Is It Better to Pay Off Your Mortgage or Invest?

Sponsored Content from Ameriprise Financial, Inc.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Deciding where to put your hard-earned money is often a complicated decision. That’s especially true if you’re considering paying off your mortgage early. While owning a home outright is a common aspiration, it may be more beneficial to invest extra cash in the markets instead.

There are several factors to consider when deciding whether to pay off your mortgage or invest the difference, including your personal financial values, time horizon, taxes, risk tolerance and the potential impact on savings.

An Ameriprise financial advisor can help you determine if paying off your mortgage is a smart move considering your overall financial goals.

When Is It Better to Pay Off Your Mortgage Early?

- If you want to save on interest: By paying off your mortgage in advance, you can save thousands of dollars in interest. This can be especially impactful if you are in the early years of your loan, when most of your monthly payment goes towards interest rather than principal.

- If you don’t mind losing the tax benefit: Paying off your mortgage means you can no longer take a tax deduction on your mortgage interest, which can help reduce your taxable income.

- If you want to free up cash — or reduce essential expenses: For most, a mortgage payment is among their most significant monthly bills. And eliminating this payment makes it possible to live on substantially less income or save more toward other priorities. That can be particularly helpful if you are close to retirement or are exploring ways to reduce living expenses.

- If the interest rate on your mortgage is high: If your mortgage rate is significantly higher than the interest you could receive on a low-risk investment, it may be worth paying off your mortgage, or consider refinancing.

- If you put a premium on peace of mind: Owning your own home outright can be liberating, and it’s hard to put a price on the security you may feel as a result. For some, that sense of freedom is worth far more than any potential returns they could earn if they had invested it instead.

- If you are debt-adverse: Even though debt — when used smartly — can be a wealth-building tool, some individuals just don’t like the risk and liability that comes with it. If being debt-free is among your financial goals, then paying off your mortgage is a logical step to achieve that.

Advice Spotlight

If you’re near retirement, consider the pros and cons of paying off your mortgage. Having a paid-for home in retirement is a priority for many retirees because it allows them to reduce their overall monthly living expenses.

Learn more: Effective debt management: Tips and strategies

When Is It Better to Invest Instead?

- If you haven’t saved enough for retirement or put a premium on investing: If you’re not maxing out contributions to your 401(k), IRA or other retirement accounts (or making larger catch-up contributions if you’re eligible), it’s generally advisable to do so before considering paying off your mortgage. After all, while you can take a loan for a mortgage, you cannot take a loan out to fund your retirement.

- If you have a low-cost mortgage: Did you refinance or secure a mortgage when interest rates were historically low? If so, any money you put into investments is likely to outpace whatever you might save in interest by paying off your mortgage.

- If you only plan to own your home for the short term: If you don’t see yourself living in your home for years to come, it may make sense to only make the minimal mortgage payments to insulate yourself from the possibility of a housing market downturn. Home values don’t always go up.

- If you have a higher tolerance for risk: While history is on the side of long-term investors, it’s important to remember that investing returns, of course, are not guaranteed. Markets are cyclical and periods of drawdowns are inevitable, when investing over a long time horizon.

- If you want more liquidity: Assets like stocks and bonds are far more liquid than home equity. If access to cash is a priority for you, then it may be better to invest rather than pay off your mortgage. In general, it’s much more challenging to tap into the equity in your home, compared to investments in a portfolio.

Advice Spotlight

Before you consider paying down your mortgage, address other high-interest debt and build an adequate cash reserve. That way, in the event of an unexpected expense or financial hardship, you won’t be forced to borrow money at high-interest rates or liquidate investments at a loss.

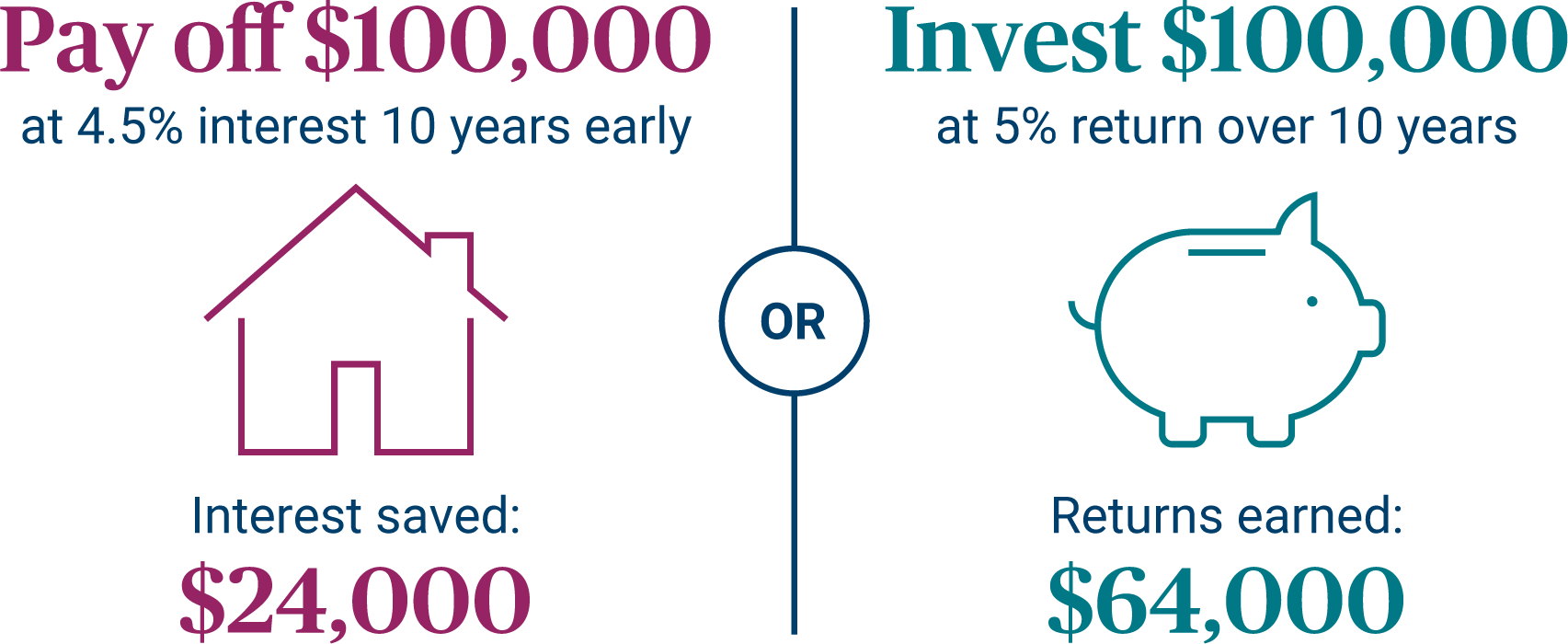

Crunching the Numbers: Pay Off Mortgage or Invest?

The return on paying off your mortgage early is the amount of money that would have been paid in interest. What you don’t know is the return you would have gotten on the money if you invested it instead.

Here’s one scenario:

This example is shown for illustrative purposes only and is not guaranteed.

Learn more: Strategies to help pay off debt faster

How You Can Pay Off Your Mortgage Faster While Still Investing

If you don’t have the funds or the desire to pay off your mortgage entirely but want to pay it down faster, there are several options to consider:

- Pay biweekly instead of monthly: This involves making half your monthly mortgage payment every two weeks instead of paying it in full once a month. By doing so, you’ll reduce the principal on your mortgage by the equivalent of an extra monthly payment every year. Over time, you may save tens of thousands of dollars in interest payments and reduce the time to pay off your mortgage by years. Not all mortgage companies allow biweekly payments, while others sometimes charge fees to do so, so talk to your lender if you’re considering this option.

- Make a regular “overpayment” to your mortgage: Tacking on an additional payment — such as $100 or $200, for example — to your monthly mortgage payment can be a manageable and routine way to pay down your loan faster. This strategy can be advantageous if you can make the additional payments at the very beginning of your loan because your savings on interest will be compounded over time.

- Make occasional lump-sum payments, when you can: Similar to the strategy above, this approach can save a significant amount of interest and shorten the life of the loan — without sacrificing your other savings or investment goals. As you have cash available — whether that be from a bonus or tax refund — you can funnel that money toward the principal balance on your mortgage.

- Refinance your loan: Refinancing a mortgage is a popular option when interest rates are low since it can reduce monthly payments and the interest paid over the life of the loan. But even when interest rates are higher, you can use refinancing to shorten the term of your loan and pay off your home quicker. Doing so, however will increase your monthly payments, and your new loan could also have a higher interest rate than your previous one. Either way, ensure a higher mortgage payment fits your monthly budget before deciding.

Use the Ameriprise Financial, Inc. mortgage refinance calculator to see how refinancing your mortgage could affect your monthly payments.

We Can Help You Evaluate Your Options

Talk to an Ameriprise financial advisor for help weighing the pros and cons of paying off your mortgage early based on your priorities and financial goals.

Questions to Ask an Ameriprise Financial Advisor During Your Initial Complimentary Consultation

- If I’m planning to retire soon, how can I balance my investing goals with paying down my mortgage faster?

- What factors should I consider to pay off my mortgage on an accelerated timeline?

- Should I prioritize investing overpaying off my mortgage, given my financial goals and time horizon?

When you’re ready to reach out to an Ameriprise financial advisor for a complimentary initial consultation, consider bringing these questions to your meeting.

This information is being provided only as a general source of information and is not a solicitation to buy or sell any securities, accounts or strategies mentioned. The information is not intended to be used as the primary basis for investment decisions, nor should it be construed as a recommendation or advice designed to meet the particular needs of an individual investor. Please consult with your financial advisor regarding your specific financial situation. Ameriprise Financial, Inc. and its affiliates do not offer tax or legal advice. Consumers should consult with their tax advisor or attorney regarding their specific situation. The initial consultation provides an overview of financial planning concepts. You will not receive written analysis and/or recommendations. Investment products are not insured by the FDIC, NCUA or any federal agency, are not deposits or obligations of, or guaranteed by any financial institution, and involve investment risks including possible loss of principal and fluctuation in value. Securities offered by Ameriprise Financial Services, LLC. Member FINRA and SIPC. Third party companies mentioned are not affiliated with Ameriprise Financial, Inc. This content was provided by Ameriprise Financial, Inc. Kiplinger is not affiliated with and does not endorse the company or products mentioned above. © 2024 Ameriprise Financial, Inc. All rights reserved.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.