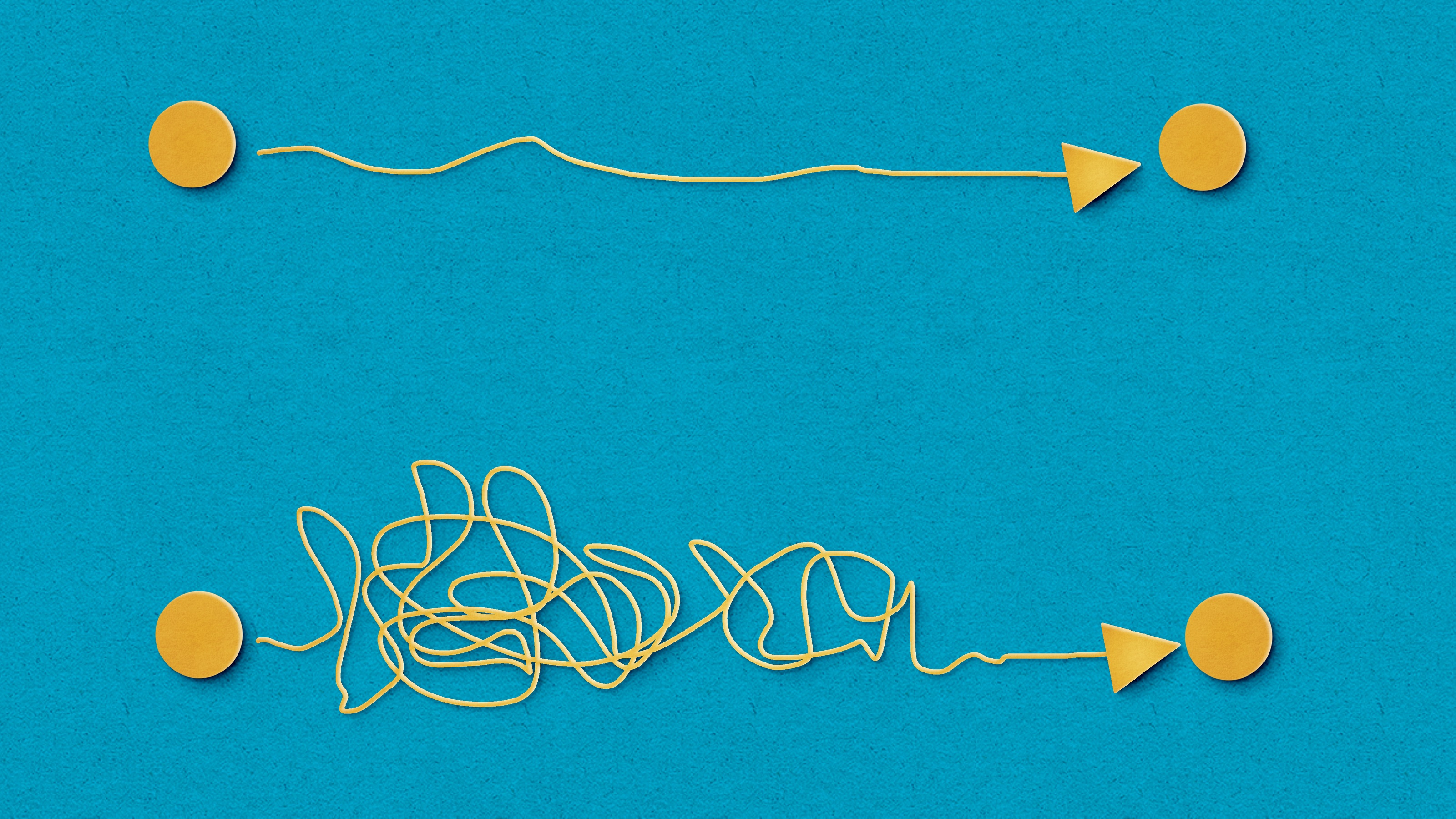

Donating Complex Assets Doesn't Have to Be Complicated

If you're looking to donate less-conventional assets but don't know where to start, this charity executive has answers, such as considering a donor-advised fund (DAF) for its tax benefits and ease of use.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

An insightful philanthropic plan and tax strategy takes into account the full breadth of a donor’s portfolio, including all non-cash and complex assets. With a thoughtful approach, these types of assets can be used to maximize charitable impact while minimizing tax liability.

Many portfolios contain less conventional forms of non-cash assets beyond marketable securities such as stocks, bonds and mutual funds. These are known as complex or illiquid assets and can include investments such as a partnership stake in a private company, a hedge fund interest or a real estate holding.

There are even less conventional sources, such as intellectual property or a painting by a famous artist.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Unfortunately, most charities cannot directly accept illiquid assets (such as private company shares) and require a conversion of the asset into cash. However, liquidating an asset before donation negates a portion of the potential tax benefit to the donor.

The Kiplinger Building Wealth program handpicks financial advisers and business owners from around the world to share retirement, estate planning and tax strategies to preserve and grow your wealth. These experts, who never pay for inclusion on the site, include professional wealth managers, fiduciary financial planners, CPAs and lawyers. Most of them have certifications including CFP®, ChFC®, IAR, AIF®, CDFA® and more, and their stellar records can be checked through the SEC or FINRA.

When a donor contributes an asset directly to a 501(c)(3) public charity, in addition to qualifying for a charitable tax deduction, they also avoid capital gains tax on the sale of the asset.

Fortunately, a donor-advised fund (DAF) with the expertise and scale to support complex liquidation can receive the asset, substantiate it and then liquidate it for granting to another charity.

There are several benefits to contributing complex assets into a DAF:

- Lessen capital gains on highly appreciated assets

- Rebalance your portfolio in a tax-efficient way

- Receive a tax deduction based on the asset's appraised valuation

- Simplify the paperwork and administrative tasks that go along with complex asset donations

An example of what a DAF can do

Here’s a hypothetical example comparing liquidating assets and donating the proceeds to charity vs contributing the assets directly to a DAF for charitable giving.

Let’s say an individual owns shares of a private company worth $10 million with a cost basis of $1.5 million. In this scenario, if the individual liquidated the assets, they would likely owe more than $2 million in capital gains taxes. (This scenario was calculated by multiplying the capital gains of $8.5 million by the long-term capital gains tax rate of 23.8%.)

Alternatively, by contributing directly to a DAF, the donor would pay nothing in capital gains, in most cases.

Considering the financial impact, independently liquidating the assets and paying capital gains would reduce the charitable deduction to about $8 million, whereas using a DAF would allow for the full $10 million charitable deduction.

How to donate complex assets with a DAF

Contributing marketable securities and other traditional non-cash assets into a DAF is a relatively straightforward process. Stocks or bonds, for example, are valued at the average of the high and low selling prices on the date of contribution multiplied by the number of units donated.

Contributing complex assets is a bit more individualized depending on the asset. In most instances, the DAF sponsor —such as Vanguard Charitable, where I am the chief financial officer — plays an active role, ensuring dollars are quickly and appropriately liquidated and available for grantmaking.

Looking for expert tips to grow and preserve your wealth? Sign up for Building Wealth, our free, twice-weekly newsletter.

Once contributed and liquidated by the DAF sponsor, donors can then recommend grants to public charities they wish to support.

Funds in the DAF are fully committed and available for grantmaking and, since they are invested in the market, will continue to grow over time, further extending philanthropic impact.

How it would work

For example, take an individual with a limited partnership in a private company interested in liquidating this asset for charitable giving. Vanguard Charitable would work with the donor to begin the process and conduct due diligence before transferring ownership to the DAF sponsor, allowing the donor to receive a tax deduction.

As part of its process, Vanguard Charitable would develop a timeline to liquidate the asset at the earliest opportunity. The donor could then recommend grants to qualified charities that align with their philanthropic goals.

In any scenario, donors should consult with their tax adviser to ensure the right strategy is in place.

Find the right partner to navigate complex assets and charitable giving

Different complex asset types may have different contribution requirements and terms, due to market size, timeframes for liquidation and costs incurred by the recipient organization.

The right DAF partner can help navigate the nuances of contributing illiquid assets and incorporate all considerations into an effective giving strategy.

Complex assets are already a part of many financial portfolios, making them the perfect addition to an investor’s philanthropic plan.

A DAF allows donors to assess their entire portfolio for charitable giving opportunities and minimize the tax impact of giving, ensuring more of their money goes toward charitable giving.

Related Content

- What Can a Donor-Advised Fund Do for You? (A Lot)

- How High Interest Rates Enhance a Type of Charitable Trust

- Kids Not Ready for Their Inheritance? Consider a Private Foundation

- Developing a Charitable Giving Strategy: Where to Begin

- How to Give an Inheritance While You're Alive

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Mark Froehlich joined Vanguard Charitable, a 501(c)(3) public charity sponsoring donor-advised funds, as chief financial officer in 2019. As a certified public accountant, he works to oversee the nonprofit’s finance and operations functions. An experienced financial leader, Mark has always maintained a strong connection to the nonprofit sphere. Most recently, he was the chief financial officer at the Philadelphia Foundation.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the 'Medigap Trap?'

Quiz: Do You Know How to Avoid the 'Medigap Trap?'Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Why Invest In Mutual Funds When ETFs Exist?

Why Invest In Mutual Funds When ETFs Exist?Exchange-traded funds are cheaper, more tax-efficient and more flexible. But don't put mutual funds out to pasture quite yet.

-

We Retired at 62 With $6.1 Million. My Wife Wants to Make Large Donations, but I Want to Travel and Buy a Lake House.

We Retired at 62 With $6.1 Million. My Wife Wants to Make Large Donations, but I Want to Travel and Buy a Lake House.We are 62 and finally retired after decades of hard work. I see the lakehouse as an investment in our happiness.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.