How to Keep Tabs on Your Credit Reports

Free weekly access is ending, but several services let you view your credit files more than once a year.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Update: The deadline to check your credit reports with the three major bureaus has been extended to April 2022. You can access them weekly for free.

Last spring, in response to the coronavirus crisis, the three major credit bureaus—Equifax, Experian and TransUnion—began offering consumers a free credit report every week at AnnualCreditReport, the federally authorized source of free credit reports. But unless the bureaus provide a last-minute extension, the free weekly reports will last only through April.

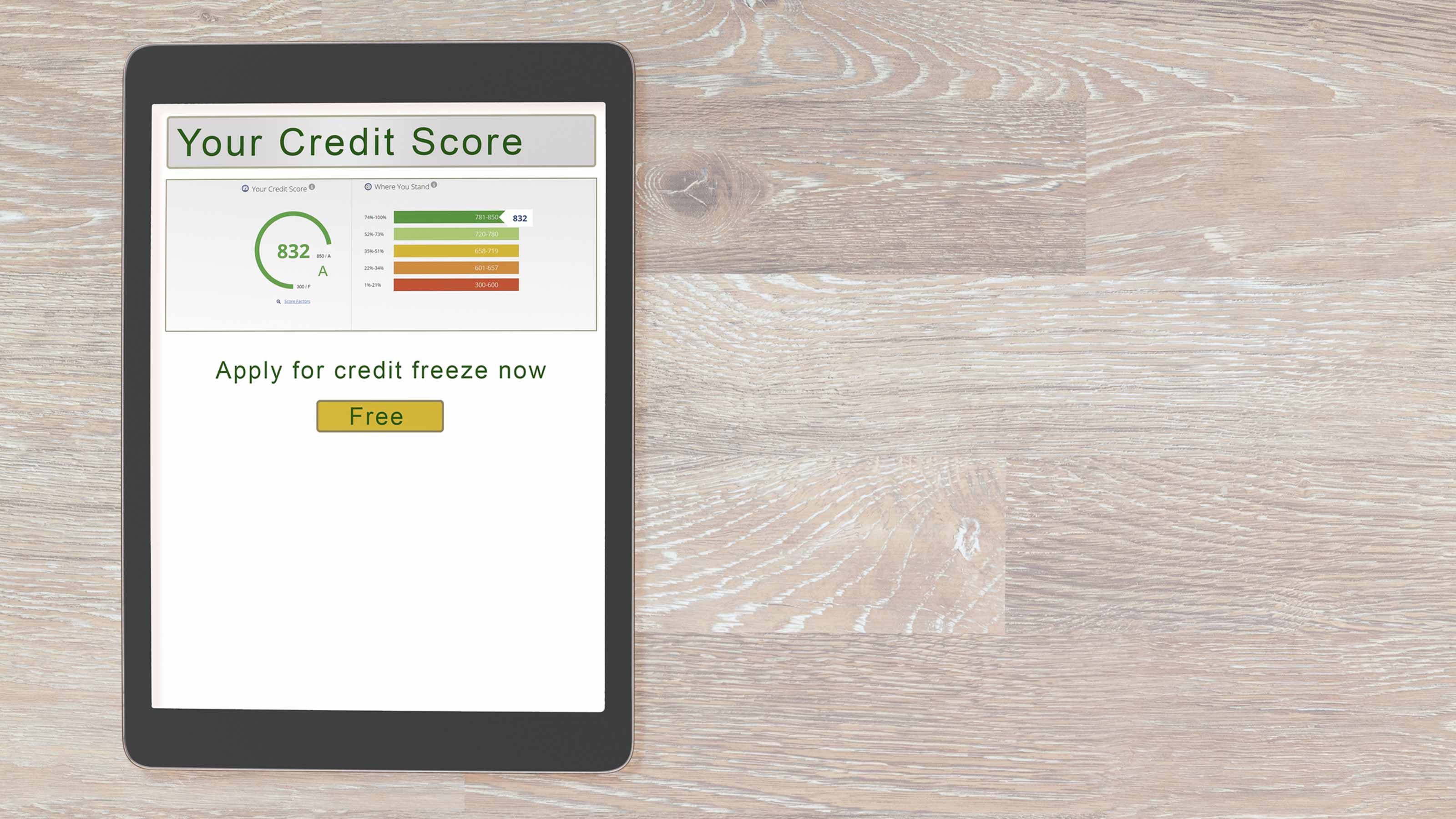

You’ll still be able to get a free report from each bureau through AnnualCreditReport once every 12 months, but you can see your reports for free more frequently through other websites that pull report data with your permission. If you create an account at CreditKarma.com, for example, you can see updated information from your Equifax and TransUnion reports once a week. You can also have the site monitor your reports for significant changes, such as the presence of a new loan or credit card, and send you alerts through e-mail or the site’s mobile app. And Credit Karma offers free updates of your VantageScore credit scores based on data from each of the two bureaus.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

If you would rather get free Equifax and TransUnion reports directly from those bureaus, each offers services through its website. At Equifax, you can register for free monthly updates of your Equifax credit report and VantageScore credit score. And by signing up for TransUnion’s TrueIdentity at Transunion.com, you get unlimited access to your TransUnion report and credit monitoring alerts.

To check your report from the third major bureau, Experian, you can enroll at FreeCreditScore.com, which Experian sponsors. The site provides a new free credit report and FICO credit score based on Experian data every 30 days, as well as credit-monitoring alerts.

To ensure that your reports remain free at any of these sites, skip pitches to upgrade to three-bureau report access or other services, and don’t enter your credit card number or other payment information.

In addition to the yearly credit reports at AnnualCreditReport.com, you’re entitled to a free report from the bureaus in certain other situations, including if you place a fraud alert on your report (a move you may make if you suspect identity theft); your report contains inaccurate information because of fraud; an adverse action has been taken against you (such as your application for credit being denied) because of information in the report; you’re unemployed and expect to apply for employment in the next 60 days; or you receive public assistance.

Reviewing Your Reports

Regularly checking your credit reports is important in case a lender or other provider furnishes erroneous information to the bureaus, the bureaus mix up your file with that of someone else, or an identity thief opens fraudulent accounts in your name.

On your reports, make sure that all the accounts listed are yours and that the details on each —such as history of on-time payments, balances, credit limits and dates the accounts were opened — are accurate. Check that your address is listed correctly, too.

If you find a problem, contact the lender or company that provided the faulty data and file a dispute with each credit bureau that is reporting it. (You can get more information at Equifax.com, at Experian. and at Transunion.com.) Include an explanation of your dispute, the resolution you expect, details such as the account number and name of the lender or other furnisher, and any supporting documents, such as a bank statement showing that you paid a bill on time despite a lender reporting that you didn’t.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Lisa has been the editor of Kiplinger Personal Finance since June 2023. Previously, she spent more than a decade reporting and writing for the magazine on a variety of topics, including credit, banking and retirement. She has shared her expertise as a guest on the Today Show, CNN, Fox, NPR, Cheddar and many other media outlets around the nation. Lisa graduated from Ball State University and received the school’s “Graduate of the Last Decade” award in 2014. A military spouse, she has moved around the U.S. and currently lives in the Philadelphia area with her husband and two sons.