VWOB: How to Find Yield With Emerging Market ETFs

Yield-hungry investors who are willing to take on extra risk should consider emerging-markets debt.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

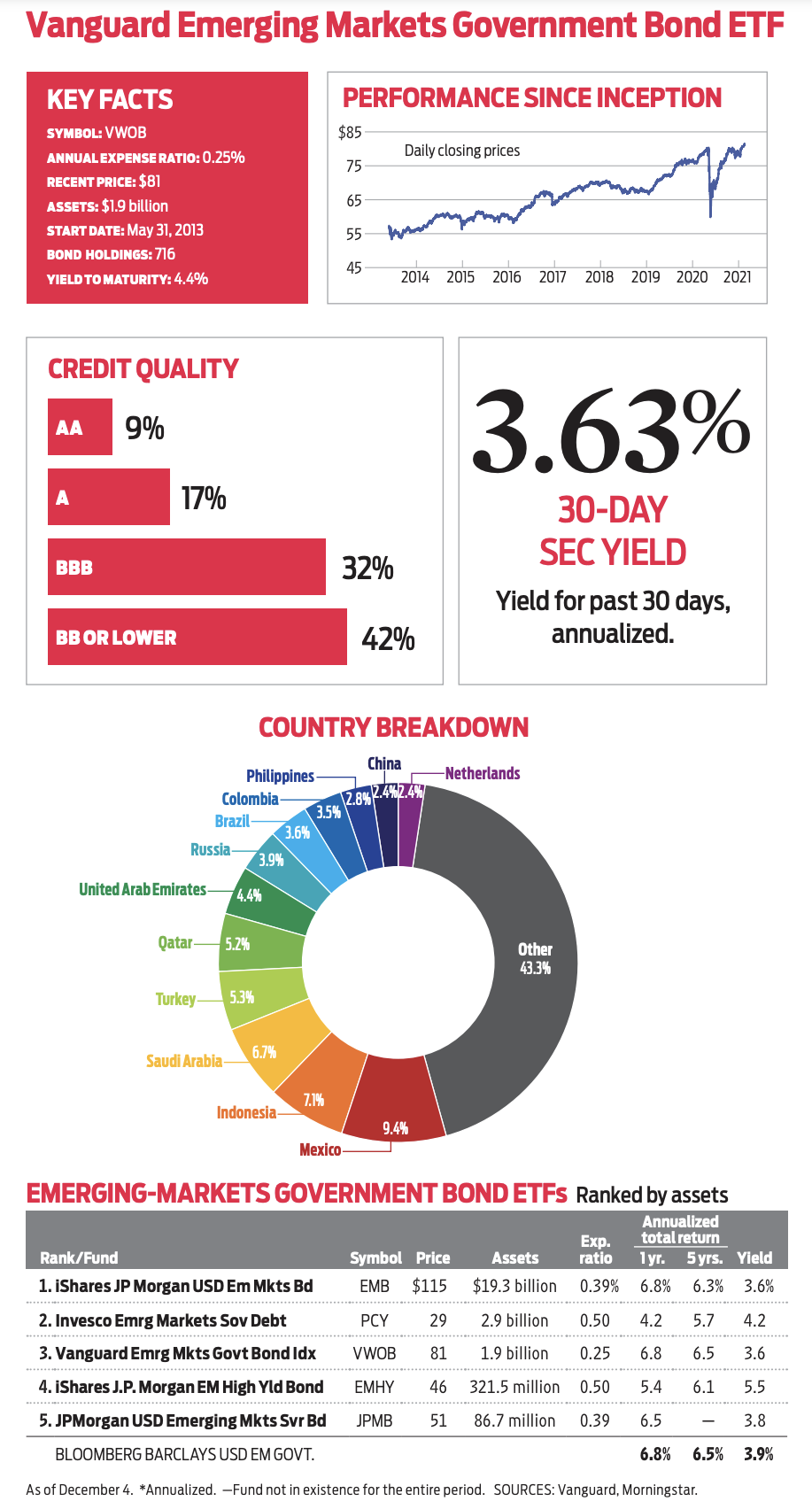

In a low interest-rate world, traditional approaches to building portfolios need tweaking. Yield hungry investors who are willing to take on extra risk should consider emerging-markets debt, particularly dollar-denominated government bonds. Vanguard Emerging Markets Government Bond Index ETF (VWOB, $82.07) is a good choice.

Many emerging economies are beginning to recover post-COVID. That’s reflected in the recent rally in the MSCI EM Index, which tracks stocks in emerging countries. Some countries in particular boast high-quality credit ratings and have been “more disciplined with monetary and fiscal policy,” adds Josh Barrickman, co-head of the U.S. bond index team at Vanguard.

A weaker dollar tends to boost these bonds, too, because it lowers the cost (in local currencies) to service debt denominated in U.S. greenbacks.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

All of that bodes well for this sector. But investors should expect more risk and volatility with emerging-markets debt than with, say, U.S. corporate bonds. “You’re dealing with local economies, politics and things that are often hard to predict,” says Barrickman.

The ETF is an index fund. But a team of credit analysts at Vanguard work to “avoid riskier situations,” says Barrickman, while still tracking the benchmark. In recent years, that has meant sidestepping big stakes in troubled countries such as Venezuela and Ecuador.

Over the past five years, VWOB has returned 6.5% – better than 61% of its peer group.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Nellie joined Kiplinger in August 2011 after a seven-year stint in Hong Kong. There, she worked for the Wall Street Journal Asia, where as lifestyle editor, she launched and edited Scene Asia, an online guide to food, wine, entertainment and the arts in Asia. Prior to that, she was an editor at Weekend Journal, the Friday lifestyle section of the Wall Street Journal Asia. Kiplinger isn't Nellie's first foray into personal finance: She has also worked at SmartMoney (rising from fact-checker to senior writer), and she was a senior editor at Money.