Entrepreneurs: Avoid These Six Costly Blunders When Starting a Business

Don't be among the 20% that fail in their first year.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

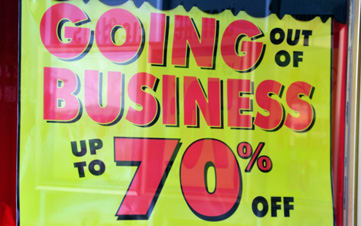

New business launches are soaring despite the tough economic backdrop, but how many will succeed? Around 20% of businesses fail during their first year – and 60% disappear within three years of launch. Those percentages may be even higher in future owing to high inflation and recessionary pressures.

Business advisers point to several common mistakes to avoid when starting a business. Avoid those errors from the start, you have a better chance of success.

Mistake number one is not to have a business plan. Failed businesses frequently haven’t spent time developing a clear roadmap for how they will achieve their objectives and what that might require in terms of resources.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Your business plan should be detailed, with clear targets for sales, costs, marketing campaigns and so on. And it should set out what you’ll aim to do over the next 12 months at least, even if the plan has to be updated as market circumstances change.

A second common error is not to understand cash flow. Your business must have sales that exceed its costs to make a profit. But you also need to think about when money is coming in and out of the business. Costs tend to fall due upfront, and may be particularly high in your firm’s early days. Sales revenues, by contrast, may not come in until weeks or months later. Managing your business’s finances to address this mismatch is vital.

Thirdly, don’t skimp on your market research. It’s tempting to launch a business on the basis of merely an instinct that there will be demand for your product or service, but doing so will increase your chances of disappointment. Spend some time identifying the size of the customer base you are targeting, as well as its willingness to spend money on what you’re offering. Look at whether competitors are already meeting that demand. If so, do you have a unique selling point?

Problem four is that running a business requires a broad range of skills entrepreneurs may not have. Business founders often have vision; they’re creative and innovative. But businesses also need sound management, which requires a more mundane skill set.

Are you financially literate enough to manage the accounts? Are you organized enough to keep operations flowing smoothly? Do you have the confidence to manage a team? All these skills can be acquired through hiring, but it is crucial to identify shortfalls up front.

A fifth hallmark of business failures is that they have tried to grow too fast. It is exciting to launch a business and see the orders come flooding in, but you need the right structures in place to manage growth.

The danger is that the business gets overstretched, fails to deliver to customers it has made promises to – or delivers shoddy work. That can ruin your reputation before the company has really got going. Turn down orders from customers you’re not confident you can service instead of simply trying to wing it.

The final problem is lacking a back-up plan. Even in benign economic times, businesses are buffeted by unexpected surprises – anything from the failure of a key supplier to a fire in the warehouse. Unless you have contingency plans for coping with a major problem, and a financial cushion to fall back on, such a setback could sink your business, even it is otherwise successful.

Subscribe to our A Step Ahead e-newsletter for more business and economic advice,

delivered to your inbox three times a week.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.