Should You Buy an Annuity?

When breaking down the decision, it's important to understand what you're getting, and what you’re giving up, with this retirement product.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Annuities are a popular retirement planning device. Sales broke a record in 2018, according to data from LIMRA. Yet, they continue to be misunderstood.

There are several types of annuities, with fixed, fixed indexed and variable being some of the most common. Unfortunately, annuities are so complex, that salespeople often have difficulty communicating their values and shortcomings to clients. It is sometimes said, humorously, that the greatest value of an annuity is the steak dinner that it comes with.

Joking aside, the point is that annuities are complex and most of their benefits are intangible, except for the steak. As a client, you will eventually have to decide to become an expert with annuities or to make a leap of faith.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Annuities have value. However, their value must be balanced against the costs and lost opportunity that come with them. In addition to the direct costs of the annuity, like “mortality and expense,” the expense ratio of the investments or the costs of the “riders” and indirect opportunity costs, what is the value of the benefits you might be giving up to get an annuity? Answering that question will help you clarify whether the annuity is the right investment for you.

First, what does an annuity get you?

The most commonly advertised benefit of an annuity is fixed income. The insurance company that sells and manages the annuity will be paying you periodically, usually monthly, for the rest of your life (usually). That payment is presented as fixed: It will never decrease. That is appealing to a lot of people. Finally, a financial instrument with some safety built in.

Rarely does the salesperson point out the obvious: The periodic payment amount will never increase either.

Why is that significant? In an age where people ought to be planning for retirement for 20 or 30 years or more, a periodic payment that does not increase is basically a payment that continuously loses value to inflation. While you may not notice it from one year to the next, inflation is pernicious. It will slowly eat away your purchasing power.

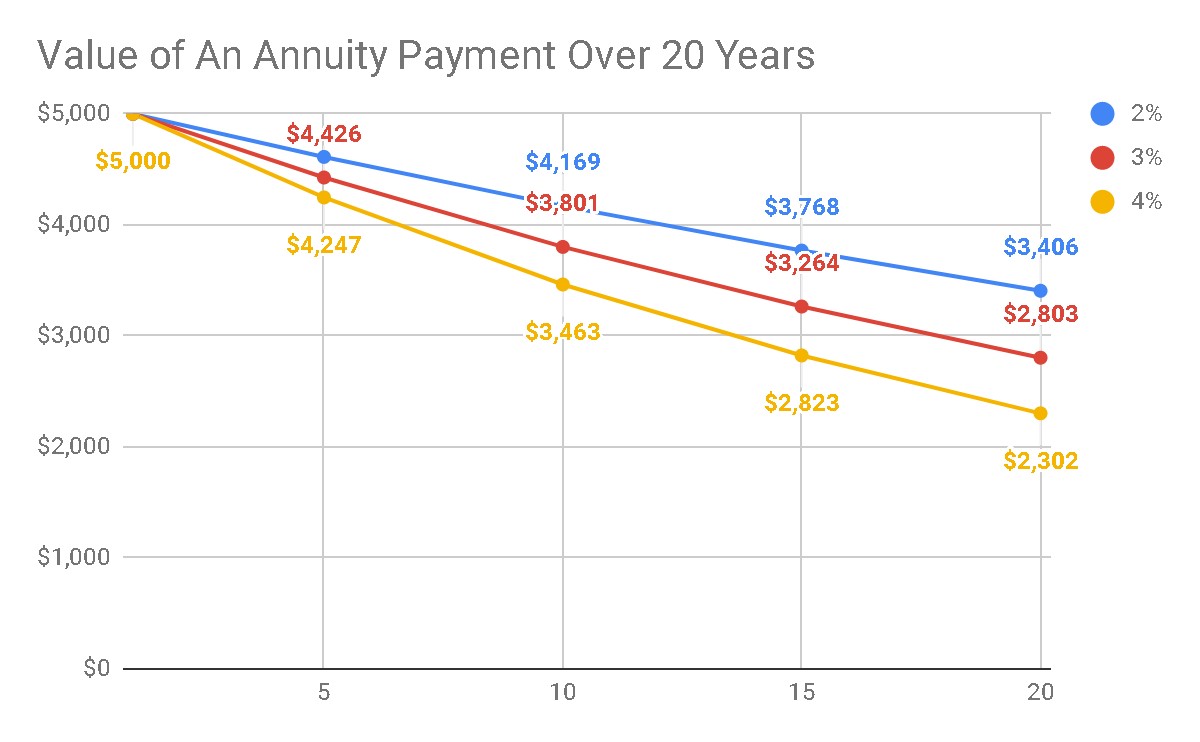

For instance, the table below shows that with inflation of 3%, the value in today’s dollars of a $5,000 annuity payment that you might receive today goes down to $2,803 in 20 years. In other words, you would be losing almost $2,200 of purchasing power automatically. Needless to say, this is something that you would want to know before buying the annuity.

Source: Insight Financial Strategists LLC

Also, gains on annuities are tax-deferred. Americans love tax-deferred investments, almost as much as they like tax-free investments. That is a key point to note: The money that you contribute to an annuity is not taxable when it distributes in retirement because, presumably, you have already paid taxes on it. Therefore, when the annuities distribute in retirement, part of the distribution is your own money, and it comes back to you tax-free. The gains, however, come back to you taxable as ordinary income.

Now, how does the tax treatment of annuities compare to other methods of investing, like for example investing in equities and fixed income outside of an annuity? As with annuities, contributions to those investments are not taxed again when they are distributed. However, your gains on these types of investments will usually be taxable as capital gains. This is important because for many people capital gains tax rates are lower than ordinary income tax rates.

In other words, you may very well be paying more taxes by putting your money in an annuity than if you had invested outside of it, if the right circumstances are met.

What are you missing out on when you buy an annuity?

An attractive benefit of annuities is that the payment amounts are guaranteed. Financial planners are not usually able to say that anything is guaranteed, because we do not know the future. However, financial salespeople can say that about annuities, because the benefits are guaranteed by the insurance company. Obviously, that is a very powerful statement, especially in the absence of comparable guarantees for traditional investment products.

The bottom line is that traditional investments are not guaranteed. We know from watching the market that anything can happen. In particular, the stock market can, and does, drop from time to time. Hence, if we could protect ourselves from the risk of stocks going down, it would be a good thing. However, this sense of security comes with its own cost, because even though stocks can fall, over the long term, they tend to rise more than they fall. According to Logan Kane of Seeking Alpha, on any random day we have a 47% chance of stocks falling and a 53% chance of stocks rising. In any given year, we have a 75% chance of stocks rising.

Therefore, when we protect ourselves against the downsides of the stock market with annuities we give up upside opportunity cost in return.

Lastly, what about the costs?

Insurance companies tend to be less than forthcoming about the costs of their annuities, except when regulations force them to disclose them. For instance, variable annuities typically disclose a lot of information. When you read the prospectus you will find that it discloses various kinds of fees: administration, mortality and expense, mutual fund subaccount, turnover ratio, and death benefit being some of the most common. According to the Motley Fool, you might find that the total ongoing cost of your variable annuity can be anywhere from 2.46% to 5.94% a year.

Disclosure requirements for fixed and fixed index annuities are much less vigorous, which may be why insurance companies don’t typically disclose them. However, disclosure notwithstanding, there is definitely a cost that goes to paying your salesperson’s commission or the complicated options and futures strategies on your fixed index.

The primary value of annuity products is not in the income or guarantee or tax benefit that they provide. The primary value of annuities is that they absorb some of the risks that you as an investor are not willing to take in the market. Annuities give you a guaranteed fixed income. In exchange, they limit the possibility of growth in your capital or your income.

They do that by balancing your risks with those of other people like you. Most of us will not have an average life expectancy. We will see one that is either above average or below average. As Bill Sharpe, a Nobel prize winner in economics, reminds us, buying an annuity allows us to share those risks, and for those of us who are above average, an annuity may well be a great bargain.

As the organizer of the annuity party, the insurance company absorbs some of the risks as well. When we buy an annuity, we are transferring the risk of investing on our own to the insurance company. If the insurance fails in its investments, it usually commits to paying us anyway.

That is valuable, but does the benefit need to cost that much? Could it be overpriced?

The bottom line for consumers

Annuities can provide incredible value. However, the simplicity of providing guaranteed monthly income is well overtaken by the complexity, direct costs and the opportunity cost.

It is important to understand what you are getting — and what you are giving up — with an annuity. You can make sure that it meets your needs first by getting advice that is in your best interest by a fee-only financial planner. You can find one at NAPFA or XYPN. Both are organizations of Certified Financial Planners who are committed to giving you advice that is in your best interest.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Chris Chen CFP® CDFA is the founder of Insight Financial Strategists LLC, a fee-only investment advisory firm in Newton, Mass. He specializes in retirement planning and divorce financial planning for professionals and business owners. Chris is a member of the National Association of Personal Financial Advisors (NAPFA). He is on the Board of Directors of the Massachusetts Council on Family Mediation.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.

-

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure Them

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure ThemHow can advisers reassure clients nervous about their plans in an increasingly complex and rapidly changing world? This conversational framework provides the key.

-

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate Empire

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate EmpireSmall rental properties can be excellent investments, but you can use 1031 exchanges to transition to commercial real estate for bigger wealth-building.

-

The 8 Stages of Retirement: An Expert Guide to Confidence, Flexibility and Fulfillment, From a Financial Planner

The 8 Stages of Retirement: An Expert Guide to Confidence, Flexibility and Fulfillment, From a Financial PlannerRetirement planning is less about hitting a "magic number" and more about an intentional journey — from understanding your relationship with money to preparing for your final legacy.