Understanding Capital Gains and Losses

What's a capital asset, and how much tax do I have to pay when I sell?

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

What's a Capital Gain?

A capital gain is what the tax law calls the profit when you sell a capital asset, which is property such as stocks, bonds, mutual fund shares or property. The profit is your gain over the basis paid. The basis is typically defined as the original price plus any related transaction costs.

What's the Difference Between a Short-Term Gain and a Long-Term Gain?

A very big difference. The law divides investment profits into different classes determined by the calendar. Short-term gains come from the sale of property owned one year or less; long-term gains come from the sale of property held more than one year.

What Is the Holding Period?

That's the period you hold the property before you sell it. When figuring the holding period, the day you buy property does not count, but the day you sell it does. So, if you bought a stock on April 16, 2013 your holding period began on April 17. Thus, April 16, 2014, would mark the end of the first year. If you sold on that day, you would have a short-term gain or loss. A sale on April 17 would produce long-term results, though, since you would have held the asset for more than one year.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

How Much Do I Have to Pay?

The tax rate you pay depends on whether your gain is short-term or long-term.

Short-term profits are taxed at your maximum tax rate, just like your salary, up to 39.6%.

Long-term gains are treated much better. Long-term gains are taxed at 15% for taxpayers in four tax brackets (25%, 28%, 33%, 35%). If you're in the highest bracket bracket (39.6%), then your long-term gains are taxed at 20%. Low-bracket taxpayers (10% and 15%) pay no capital gains tax at all.

There are exceptions, of course. Long-term gains on collectibles such as stamps, antiques and coins are taxed at 28% for the five upper tax brackets; tax payers in the lower brackets are taxed at their normal rates.

Gains on real estate attributable to depreciation are taxed at 25%, unless you're in the 10% or 15% bracket. (This is Uncle Sam's way of taking back tax deductions from depreciating a property is actually sold at a profit.)

Capital gains may also be subject to the Net Investment Income Tax, set up to fund the Affordable Care Act. If your income is above $200,000 ($250,000 if filing jointly), there’s an additional 3.8% levy.

What is a Capital Loss?

A capital loss is a loss on the sale of a capital asset such as a stock, bond, mutual fund or real estate. As with capital gains, capital losses are divided by the calendar into short- and long-term losses.

Can I Deduct my Capital Losses?

Losses on your investments are first used to offset capital gains of the same type. So, short-term losses are first deducted against short-term gains and long-term losses are deducted against long-term gains.

QUIZ: Test Your Investing IQ

Net losses of either type can then be deducted against the other kind of gain. So, for example, if you have $2,000 of short-term loss and only $1,000 of short-term gain, the extra $1,000 of loss can be deducted against long-term gain. If short- and long-term losses exceed all of your capital gains for the year, up to $3,000 of the excess loss can be deducted against other kinds of income, including your salary, for example, and interest income.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

A Retiree’s Guide to Key Dates in 2021

A Retiree’s Guide to Key Dates in 2021Basics It's critical -- and financially sound -- to hit these important financial deadlines spaced throughout the year.

-

The 5 Best Investments You Can Make in 2019

The 5 Best Investments You Can Make in 2019Markets Everyone is looking forward to 2019 if only because 2018 has been so ugly.

-

10 Things Boomers Must Know About RMDs From IRAs

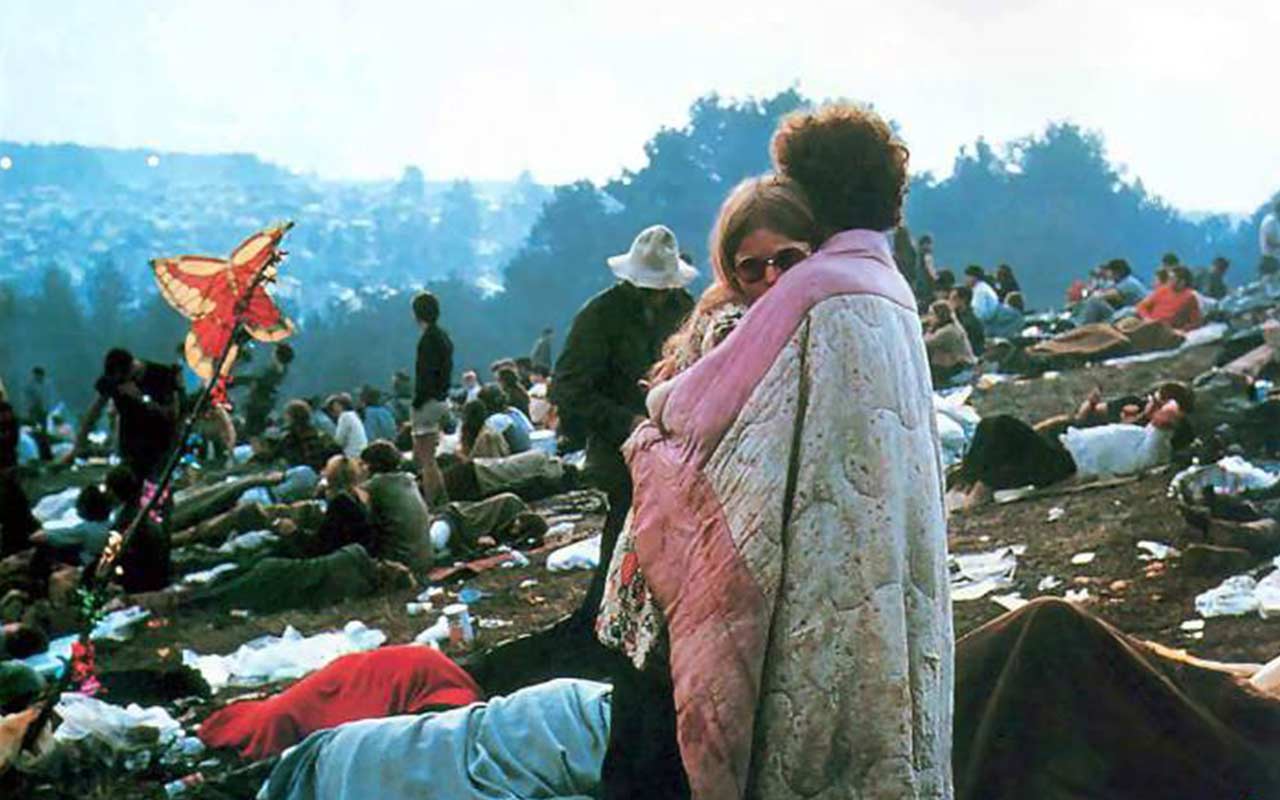

10 Things Boomers Must Know About RMDs From IRAsretirement Members of the Woodstock Generation are increasingly reaching the age at which “the establishment” demands they start unwinding their traditional IRAs and employer-sponsored retirement plans such as 401(k)s.

-

FAQs About Health Savings Accounts

FAQs About Health Savings Accountssavings A health savings account can be a powerful financial tool to cover medical expenses and save for the future.

-

Why You Need a Roth IRA

Why You Need a Roth IRARoth IRAs With this indispensable savings tool, your money grows tax-free, you can invest in almost anything and you get several cool perks.

-

Tax Planning for Retirement

Tax Planning for Retirementtax planning Taxes don’t stop when your paycheck does. In fact, tapping your retirement nest egg comes with all sorts of new rules and opportunities.

-

Midyear Strategies to Cut Your 2016 Tax Bill

Midyear Strategies to Cut Your 2016 Tax Billtaxes If you're looking for something to do this summer, focus on reaping financial rewards in 2016 with these tax planning strategies.

-

6 Tax Factors to Consider When Picking a Retirement Destination

6 Tax Factors to Consider When Picking a Retirement Destinationretirement It pays to know how much you might pay in state and local taxes before you move.