Jim Cramer's Stock Picks Stink

The host of CNBC’s "Mad Money" has lagged the market dramatically over the past 15 years.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

CNBC’s “Mad Money” features flashing lights, beeping horns and Jim Cramer, the screaming, fast-talking, always-in-motion host, who always has a strong opinion on which stocks you should buy and which you should sell. Right now!

It’s hard to look away from Cramer; he is terrific fun to watch. No wonder “Money Monster,” a movie that was released in mid May, centers on a thinly disguised Cramer, played by George Clooney. In the movie, an enraged viewer who was wiped out because he invested all of his money on what turned out to be a disastrous stock recommendation takes Clooney hostage.

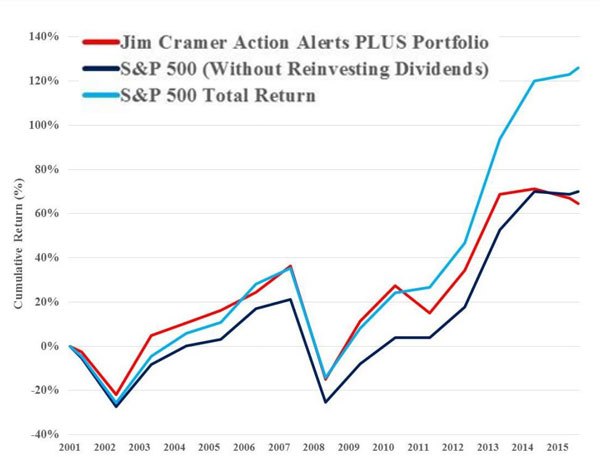

Does life imitate art? Well, maybe not hostage-taking, but a new paper from two researchers at the University of Pennsylvania’s Wharton School finds that Cramer’s picks have been less than scintillating. To be more specific, from August 1, 2001, through March 31, 2016, Cramer’s Action Alerts PLUS Portfolio returned a cumulative 64.5%, compared with 126.1% for Standard & Poor’s 500-stock index, including dividends. On an annualized basis, Cramer, a former hedge fund manager, trailed the S&P 500 by an average of 2.2 percentage points per year over that nearly 15-year-long period.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

What’s more, the Cramer portfolio has been about 5% more volatile than the S&P over that period, the Wharton paper, authored by Jon Hartley and Matthew Olson, finds.

Cramer doesn’t dispute the paper’s findings. “We have never promised outperformance,” he said in a statement. “We have promised transparency, teaching and a way to understand how the money-management process works.” He called the subscription service “largely an educational product.”

Cramer’s picks essentially matched the S&P through 2010. But since then, they have badly lagged the benchmark. From January 1, 2011, through March 31 of this year, Cramer’s picks returned an annualized 5.0%, compared with 12.2% annualized for the S&P 500.

Launched in August 2001, Action Alerts PLUS Portfolio has been a centerpiece of the financial advice offered by TheStreet.com. The website belongs to TheStreet, Inc. (symbol TST), a publicly traded company that Cramer co-founded in 1996. PLUS Portfolio subscribers, who pay $15 a month, always get the recommendations before Cramer buys them for the portfolio, the Wharton paper reports. Likewise, subscribers get Cramer’s picks before he airs them on “Mad Money.”

In March 2005, when CNBC launched “Mad Money,” Cramer converted the portfolio into a charitable trust. All dividends and other cash distributions received by the trust are donated to charity. Cramer and Stephanie Link were co-portfolio managers until last year when Link went to TIAA-CREF. Cramer is now the sole portfolio manager, but he works closely with Jack Mohr, the portfolio’s research director.

On its website, TheStreet compares the return of the Action Alerts PLUS Portfolio to the S&P 500 plus dividends received but not reinvested. That’s because the portfolio donates the dividends to charity rather than reinvesting them. The unusual alternative calculation doesn’t help the portfolio’s relative performance much. From August 2001 through June 30, 2015, according to TheStreet, the S&P 500 with dividends received but not reinvested returned a smidgen less than the traditional calculation of the S&P’s total return (with dividends reinvested)—a cumulative 122.8% compared with 124.8%. June 30, 2015, is the last date for which TheStreet reported returns.

The Action Alerts PLUS Portfolio has lagged the benchmark woefully, no matter how you compute the numbers. The lesson for investors is, perhaps, too obvious: When someone is screaming at you to buy anything, hold tight to your wallet. Good investing, alas, is usually pretty boring.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Are You 'Too Old' to Benefit From an Annuity?

Are You 'Too Old' to Benefit From an Annuity?Probably not, even if you're in your 70s or 80s, but it depends on your circumstances and the kind of annuity you're considering.

-

Seeing Retirement Ahead? Why Your 50s Will Be So Significant

Seeing Retirement Ahead? Why Your 50s Will Be So SignificantThis is the perfect time to assess whether your retirement planning is on track and determine what steps you need to take if it's not.

-

Your Retirement Isn't Set in Stone, But It Can Be a Work of Art

Your Retirement Isn't Set in Stone, But It Can Be a Work of ArtSetting and forgetting your retirement plan will make it hard to cope with life's challenges. Instead, consider redrawing and refining your plan as you go.

-

ESG Gives Russia the Cold Shoulder, Too

ESG Gives Russia the Cold Shoulder, TooESG MSCI jumped on the Russia dogpile this week, reducing the country's ESG government rating to the lowest possible level.

-

Morningstar Fund Ratings Adopt a Stricter Curve

Morningstar Fund Ratings Adopt a Stricter Curveinvesting Morningstar is in the middle of revamping its fund analysts' methodology. Can they beat the indices?

-

Market Timing: The Importance of Doing Nothing

Market Timing: The Importance of Doing NothingInvestor Psychology Investors, as a whole, actually earn less than the funds that they invest in. Here’s how to avoid that fate.

-

Commission-Free Trades: A Bad Deal for Investors

Commission-Free Trades: A Bad Deal for Investorsinvesting Four of the biggest online brokers just cut their commissions to $0 per transaction. Be careful, or you could be a big loser.

-

Vanguard Dividend Growth Reopens. Enter at Will.

Vanguard Dividend Growth Reopens. Enter at Will.investing Why you should consider investing in this terrific fund now.

-

Health Care Stocks: Buy Them While They're Down

Health Care Stocks: Buy Them While They're Downinvesting Why this sector should outperform for years to come

-

Buy Marijuana Stocks Now? You'd Have to Be Stoned.

Buy Marijuana Stocks Now? You'd Have to Be Stoned.stocks Don't let your investment dollars go to pot

-

4 Valuable Lessons From the 10-Year Bull Market

4 Valuable Lessons From the 10-Year Bull MarketInvestor Psychology Anything can happen next, so you must be mentally prepared.