Lower Your Expectations for Returns Over the Next Decade

The best you can hope for is modest gains. The solution? Save more.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

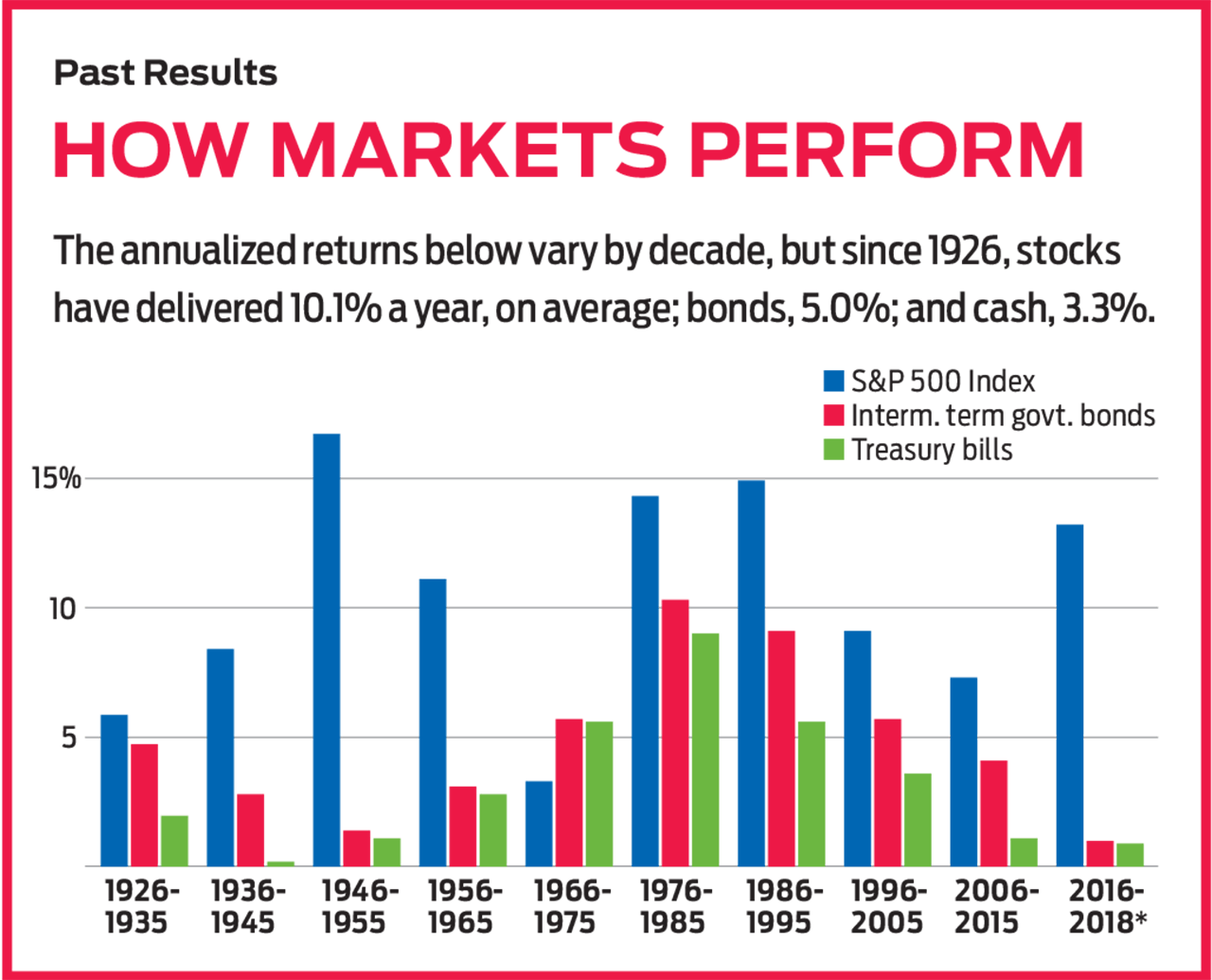

Most financial pundits will tell you that the average annual return from large-company stocks since 1926 is 10.1%. If your investment horizon is a very long way off, you may well get that much. Over any given decade, however, there is a huge variation from the long-term average.

No one has a crystal ball, but you can make assumptions based on current economic trends, corporate earnings projections and stock prices. And that can give you an idea of how much to invest in stocks, bonds and cash over the next decade.

A lot to live up to. Standard & Poor’s 500-stock index averaged a 14.0% annual gain, including dividends, over the past 10 years. Don’t expect that for the next 10 years. Brian Singer, head of the Dynamic Asset Allocation Strategies team at institutional investment house William Blair, thinks large-company stocks—such as those in the S&P 500—will gain a below-average 6% annually over the next decade.

Article continues belowFrom just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Blame the bull market. The run that began in 2009 is the longest bull market ever, and it has gained three times the amount an average bull market does. Typically, big bull markets are followed by big losses, says Sam Stovall, chief investment strategist of U.S. equity strategy at CFRA—say, 40% or more. A bear that big would tear a hunk out of the stock market’s projected 10-year return.

You might increase your stock returns by investing abroad—especially in emerging markets, if you can tolerate the risk. It’s a matter of playing catch-up. Foreign stocks have lagged their U.S. counterparts over the past decade, particularly lately. The MSCI Europe, Australasia and Far East index has fallen 9.0% over the past 12 months, and the MSCI Emerging Markets index has fallen 8.7%. The S&P 500 is up 1.8% over the same period.

Foreign currencies have fallen against the U.S. dollar as well, and if they rebound, they could put some extra octane into your portfolio as returns earned abroad translate into more dollars here. “The odds are 90 to 10 that emerging markets will beat U.S. stocks,” says Rob Arnott, founder of Research Affiliates. He’s forecasting a 9.7% annualized return for emerging markets over the next decade—about the same as their 30-year average. Foreign developed markets, where earnings growth is slower than in emerging markets, should return 7.5% annualized over the next decade, he says.

Bonds will disappoint. Government bonds have earned an annualized 5.0% since 1926. It’s unlikely that interest rates will return to the long-term average, which includes the towering yields of the 1970s and early 1980s. In today’s global and disinflationary economy, the 10-year yield is unlikely to rise above 4%, up from 2.9% recently. Mix in the likelihood of principal losses as yields drift higher (prices and yields move in opposite directions), and you get disappointing bond returns over the next 10 years. “We see a 2.5% to 4% annual return from bonds,” says Roger Aliaga-Díaz, senior economist at Vanguard’s Investment Strategy Group.

Cash is the third asset class in a balanced portfolio. Barring a surge in inflation, the Federal Reserve is unlikely to push up its benchmark short-term interest rate much past 3%, and savings rates follow that closely. A 3% return from cash over the next 10 years wouldn’t be unusual: Treasury bills have returned an average 3.3% a year since 1926. What’s unusual is how close cash returns could be to bond returns. Just don’t give up on bonds. You’ll want them in your portfolio if there’s a recession and a bear market in stocks.

If the next decade produces lower-than-average returns on stocks and bonds, your best bet is to save more. If you increase your saving rate, and your investments provide more than the middling returns expected, you won’t just reach your goals, you’ll roar past them.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.