Vanguard High-Yield Tax-Exempt: Don’t Call It Junk

Despite its name, this muni bond fund is keeping an eye on risk.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

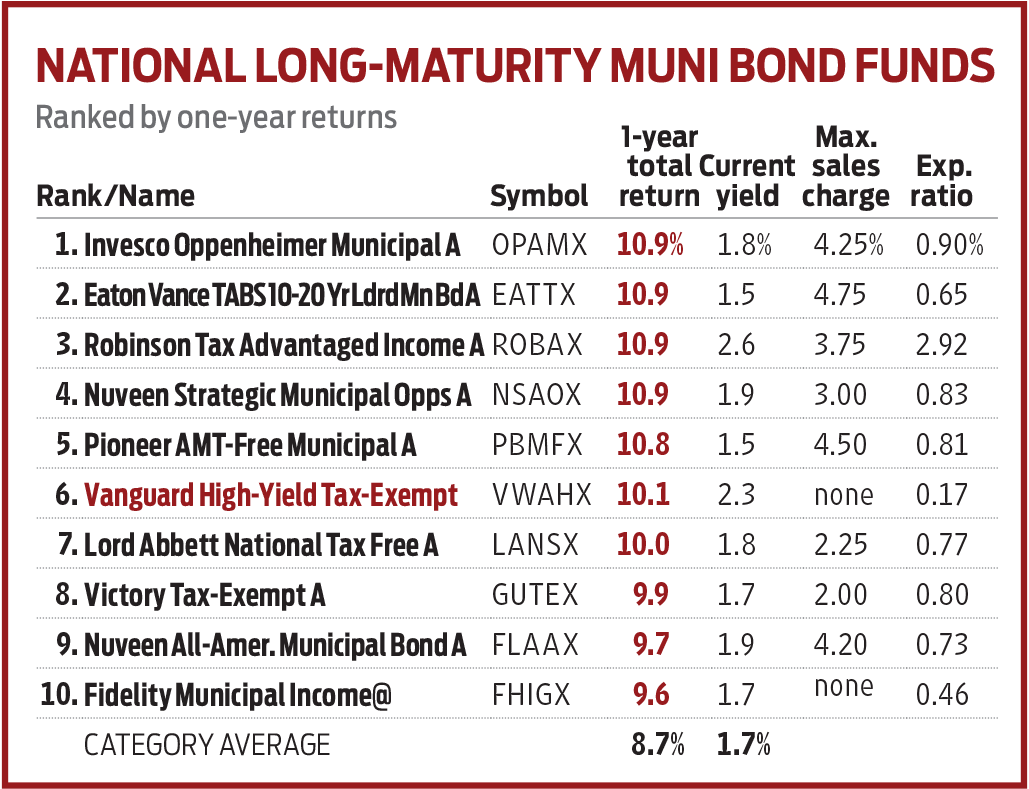

Names can be deceiving. French fries aren’t really French, and Vanguard High-Yield Tax-Exempt fund (symbol VWAHX) isn’t a high-yield bond mutual fund. In the bond investing world, the words high yield are interchangeable with junk—meaning bond issues rated below investment grade that pay high yields and come with an elevated risk of default. Vanguard High-Yield’s peer group, however, is muni bond funds with long maturities. Though the fund’s 15% stake in junk-rated or unrated muni debt is higher than the category average of roughly 4.5%, the typical fund in the actual high-yield muni category has 10 times that much—45%—in junk and unrated bonds.

The remainder of the fund’s assets are in investment-grade issues. Its yield is a generous 2.3%, which, because income from municipal bonds is exempt from federal taxes, is the equivalent of a 3.9% yield for investors in the highest federal tax bracket.

Should interest rates remain low, the muni market is a relatively safe place to hunt for yield, says Mathew Kiselak, who’s helmed the fund since 2010. In the 10 years through 2016, muni bonds defaulted only 0.18% of the time, compared with a 1.74% default rate for corporate bonds. Even so, the fund’s portfolio is built with a watchful eye toward risk.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Portfolio construction starts with a custom benchmark modeled on the Bloomberg Barclays Municipal index, with a tilt toward lower-quality, higher-yielding names. From there, Kiselak relies on input from Vanguard’s extensive muni bond team. In 2019, the fund began shifting assets from single-A-rated bonds to higher-quality, double-A-rated debt. Within the fund’s slug of triple-B-rated debt (one step above junk and 22% of assets), the team favors bonds backed by revenues from essential services, such as airports, hospitals and toll roads, all of which are unlikely to fare poorly even in a recession.

Low costs allow the fund to deliver nice returns without wading deep into junky waters. The 0.17% expense ratio is less than a third of the average for similar funds. Over the past decade, the fund’s 5.3% annualized return bested 91% of peer funds. The fund has beaten the Bloomberg Barclays muni index in nine of the past 10 calendar years.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Ryan joined Kiplinger in the fall of 2013. He wrote and fact-checked stories that appeared in Kiplinger's Personal Finance magazine and on Kiplinger.com. He previously interned for the CBS Evening News investigative team and worked as a copy editor and features columnist at the GW Hatchet. He holds a BA in English and creative writing from George Washington University.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Best Mutual Funds to Invest In for 2026

Best Mutual Funds to Invest In for 2026The best mutual funds will capitalize on new trends expected to emerge in the new year, all while offering low costs and solid management.

-

Smart Ways to Invest Your Money This Year

Smart Ways to Invest Your Money This YearFollowing a red-hot run for the equities market, folks are looking for smart ways to invest this year. Stocks, bonds and CDs all have something to offer in 2024.

-

Vanguard's New International Fund Targets Dividend Growth

Vanguard's New International Fund Targets Dividend GrowthInvestors may be skittish about buying international stocks, but this new Vanguard fund that targets stable dividend growers could ease their minds.

-

Best 401(k) Investments: Where to Invest

Best 401(k) Investments: Where to InvestKnowing where to find the best 401(k) investments to put your money can be difficult. Here, we rank 10 of the largest retirement funds.

-

7 Best Stocks to Gift Your Grandchildren

7 Best Stocks to Gift Your GrandchildrenThe best stocks to give your grandchildren have certain qualities in common. Here, we let you know what those are.

-

How to Find the Best 401(k) Investments

How to Find the Best 401(k) InvestmentsMany folks are likely wondering how to find the best 401(k) investments after signing up for their company's retirement plan. Here's where to get started.

-

How to Master Index Investing

How to Master Index InvestingIndex investing allows market participants the ability to build their ideal portfolios using baskets of stocks and bonds. Here's how it works.

-

The Best Vanguard ETFs to Buy

The Best Vanguard ETFs to BuyThe best Vanguard ETFs all feature rock-bottom fees, large asset bases and long trading histories. Here are a few of our favorites.