Bear Market? I See a Bull Market for the Next 15-20 Years

Here’s what a long view of the direction of markets shows us.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The first week of 2016 started with a big move down in equity prices as a result of geopolitical events in emerging markets and fears of slowing economies worldwide. However, there are larger trends influencing markets today.

Understanding today’s market moves requires the study of market history and secular trends that dominate market direction. Most investors are unaware of secular bull and bear markets that control long-term direction of markets for significant periods of time.

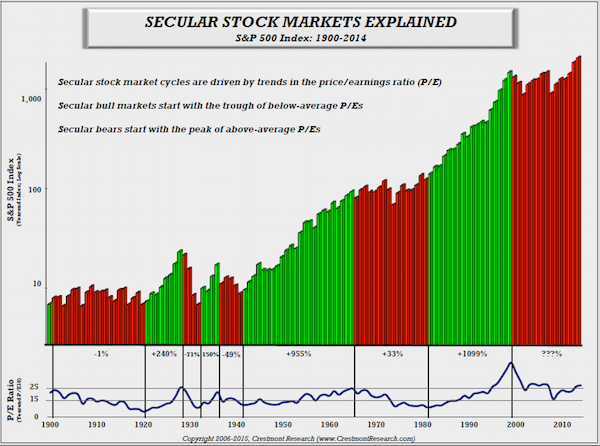

Let’s review the last century of stock market cycles. Classifying bull markets and bear markets is necessary to understand their impact on short-term trends. I define secular bull markets as extended periods or years when the stock market achieves higher highs and higher lows, and bear markets retreat to lower highs and even lower lows. These extended bear and bull markets can last for eight to 20 years for either market. Take a look at this illustration of the S&P 500 for 114 years, with bull markets in green and bear markets in red:

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

It is important to remember that the stock market is an auction system made up of millions of investors interacting electronically to achieve the best results for their efforts. People are emotional by nature, often influenced by both the fear of losing wealth and the greed of not attaining enough wealth; as a result, overbidding for desired stocks will push markets to much higher highs years before ending bull markets and beginning the bear markets that follow. There are, of course, other contributing factors, but most secular market trends are driven by the basic human emotions of fear and greed.

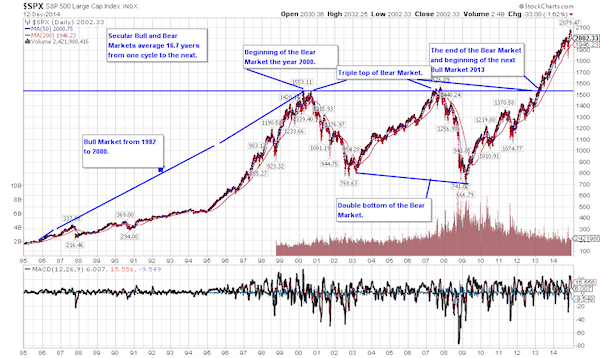

If you accept the existence of secular market trends, then the question is: where are we in 2016? To understand the answer to this question, let’s review the bear market that began in the year 2000. The bear market began in March 2000 after one of the greatest bull markets in history (1982-2000), giving investors a 1099% return if they invested in the S&P 500 for that period of time.

The bear market of 2000 began with the busting of the dot-com bubble and the S&P 500 falling in value until October 2002, with the final low reached in March 2003 before rising in value for the next four-and-a-half years until October 2007. The market fell again until March 2009 before starting its rise to current levels with the market highs reached in May 2015.

The S&P 500 did one extraordinary thing that did not happen during the prior 14 years of the secular bear market. In May 2013, it reached the highs achieved in the years 2000 and 2007, but, this time, it broke through the ceiling and has continued to rise to current (2016) levels. We at Geasphere believe that the breakout in 2013 was the end of the 14-year secular bear market and the beginning of the next secular bull market. (See illustration and explanation below of the 2000 secular bear market.)

The chart shows the beginning and the end of the secular bear market by illustrating the price action of the S&P 500 over the 14-year period. More importantly, it demonstrates the basic principal of economics: if you have more sellers than buyers in the market, markets will go down; the reverse is true that if you have more buyers than sellers in the market, it will go up. We believe the market has begun the next secular bull market that will last another 15 to 20 years.

We live in a time of the 24-hour news cycle, in which information that used to be interesting only to professionals is now packaged and highlighted with great graphics and music to investors with sensational entertainment values-- and yes, this might make good television, but it does not make good investors.

Enjoy the ride, because it’s going to be a long one.

Eduard Hamamjian, an accredited Asset Management Specialist, has been in the industry since 1992. With years of experience in investment research, portfolio construction and even business ownership, he has developed a suite of services specific to business owners.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

As an Accredited Asset Management Specialist, Eduard has developed his investment approach through a unique diversification method, and proprietary stock valuation and various other strategies for research, construction and management of portfolios. Eduard's innovative strategies allow him to provide distinct value for GeaSphere clients looking for growth without excessive risk. He oversees the construction, research and management of client portfolios. In recent years, he has combined his investment approach with practical planning tools and cash flow solutions, so that he can deliver comprehensive services for business owners. He also partners with accounting firms for a simpler, more tax-efficient process for each client.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.

-

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure Them

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure ThemHow can advisers reassure clients nervous about their plans in an increasingly complex and rapidly changing world? This conversational framework provides the key.

-

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate Empire

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate EmpireSmall rental properties can be excellent investments, but you can use 1031 exchanges to transition to commercial real estate for bigger wealth-building.