Know What You Can Control as an Investor

Understanding the economy is important, but smart investing focuses on costs, tax effectiveness and other factors.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

So far in 2016, many of the comments we've received from clients, friends and acquaintances express frustration with the current economic and political environment for investors. The resurgence of volatility in the post-quantitative-easing world and uncertainty in many parts of the globe, politically and economically, exacerbated by the impact of plunging prices of oil and other commodities seem at odds with the healthy and growing global economy.

One of the quotes frequently attributed to Warren Buffett says, "Investing is simple but not easy." My interpretation of his comment is that many things get in the way of investing: investor psychology, fuzzy data, costs and sometimes just silly thinking.

Successful investing requires understanding what matters and, at the same time, recognizing what you can control. The intersection of and distinctions between these two concepts are important to identify when making portfolio decisions. For example, the ability to control what the economy does or doesn't do, whether the various marketplaces for investments will be favorable or unfavorable, what inflation will be and what new geopolitical events may pop into our world are impossible to know with any degree of precision. Yet we can't get enough of those opining their view of these topics. If they knew for sure what was coming, they would most likely keep their knowledge private in order to capitalize on the secret sauce.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

While the previous paragraph might lead you to conclude that this information is useless, it is not. It is helpful in framing the construction of a portfolio based on things that we can, in fact, control. Keeping the macroeconomic context in mind, focusing on four controllable factors can increase the effectiveness of a portfolio and its overall probability of success. These controllable factors are:

1. Valuations

Whether we are buying a private residence, business or other type of investment, common sense tells us that paying an expensive price will likely lead to a less than favorable outcome. At the same time, buying assets at a reasonable or possibly undervalued price will most likely lead to a favorable outcome.

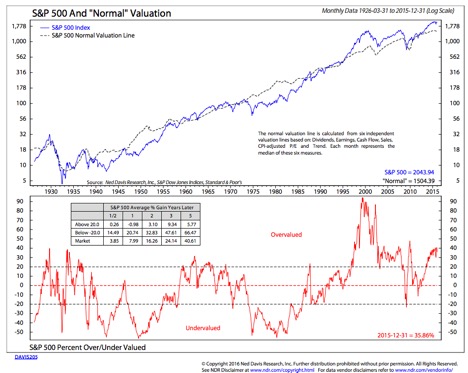

The chart below by Ned Davis Research shows the impact that valuation has on returns using a mix of five valuation metrics. Note the lower clip of the chart and the red line as it fluctuates between undervalued, fair value (between the upper and lower dashed lines) and overvalued. The box in the lower clip indicates how Standard & Poor's 500-stock index has delivered returns in the past, on average, when valuation metrics are at certain levels. The returns are cumulative not annualized.

Valuations matter and have a large impact on what reasonable returns can be expected. Of course, this does not guarantee those results, but it does provide some important clues. Does this mean that the S&P 500 should be totally avoided? No, but it does suggest that overweighting this singular asset type may not be helpful in constructing a high-probability portfolio. Other asset classes may provide better risk-return characteristics and would likely deserve a higher relative weighting from your base allocation model.

2. Costs

Of course, costs are a drag on portfolio performance, and you should try to make sure the costs incurred are not only reasonable but also deliver value. That can be harder to find if traditional core equities are only delivering mid-single-digit returns. In that scenario, active managers must deliver a significant excess return to offer value over a passive index fund or exchange-traded fund to compensate for their higher fees. For example, when a fund charges an expense ratio of 1%, if its gross return is 10%, the fee equals 10% of the return, but if its gross return is just 5%, the cost eats up 20% of the return. The burden of proof is on active managers, and their hill to climb has become much steeper in the likely low-return environment for long-only equity strategies.

3. Volatility

You may be under the impression that you have no control over volatility—and when it comes to the stock market, you are correct. Long-only equity strategies are volatile, there is never a good time for down drafts in the market and drawdowns come usually at the worst time. As if there were ever a good time!

Fortunately, investing is not necessarily restricted to long-only stocks, bonds and cash. Well-selected non-traditional strategies can reduce fluctuation in the portfolio dramatically and preserve capital during stressful times. Strategies such as market-neutral, long-short and managed futures add value by muting the impact of portfolio volatility. Absolute-return strategies, including private lending, real estate and private equity, provide additional characteristics and engines of return that add to the effectiveness of your portfolio.

4. Tax Effectiveness

No one likes to pay taxes, but doing it effectively can make it an easier pill to swallow. I prefer to use the term tax effectiveness over tax efficiency. Tax efficiency implies you should reduce taxes to the absolute lowest level they can be. Unfortunately, this too often leads to good short-term but lousy long-term decisions when it comes to taxes.

For example, tax loss harvesting each year can lead to lowering the overall cost basis of the portfolio. While deferral can be good, one of the items we likely will not have control over is the level of taxation in the future. The lowered tax basis in the portfolio also reduces investment flexibility in the future by having less taxed capital available to meet current needs or to reallocate portfolio positions. Tax effectiveness focuses instead on realizing an attractive after-tax return on capital while preserving maximum flexibility for the long term.

Investors who focus on the things that matter and the factors they have control over can then filter out the increasing level of noise that exists in the investing universe. Increasing your focus on the four factors within your control will lead to a portfolio with increased impact, satisfaction and results.

Bob Klosterman, CFP, is the Chief Executive Officer and Chief Investment Officer of White Oaks Investment Management, Inc., and author of the book, The Four Horsemen of the Investor’s Apocalypse.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Robert Klosterman, CFP® is the CEO and Chief Investment Officer of White Oaks Investment Management, Inc., a fee-only investment management and wealth advisory firm. Bob is the author of the book, "The Four Horsemen of the Investor's Apocalypse. White Oaks has been recognized by CNBC.com as one of the "Top 100 Fee-Only Wealth Management firms in the country.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.

-

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure Them

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure ThemHow can advisers reassure clients nervous about their plans in an increasingly complex and rapidly changing world? This conversational framework provides the key.

-

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate Empire

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate EmpireSmall rental properties can be excellent investments, but you can use 1031 exchanges to transition to commercial real estate for bigger wealth-building.

-

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs In

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs InRoth conversions are all the rage, but what works well for one household can cause financial strain for another. This is what you should consider before moving ahead.