How to Stay the Course in Rocky Markets

The best returns come from time in the market, not timing the market.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

When the market gets jumpy, so do investors. In periods of volatility, anxious stock market investors can be tempted to take money off the table, fearing a potentially major slide in their portfolio. Take this past May, for example. Stocks began to waver early in the month, when a presidential tweet regarding tariffs re-inflamed investor concerns over a possible trade war between the U.S. and China. Investors responded by taking their proverbial ball and going home. May marked the largest monthly exit from exchange-traded stock funds ever recorded, with investors walking out the door with $19.9 billion.

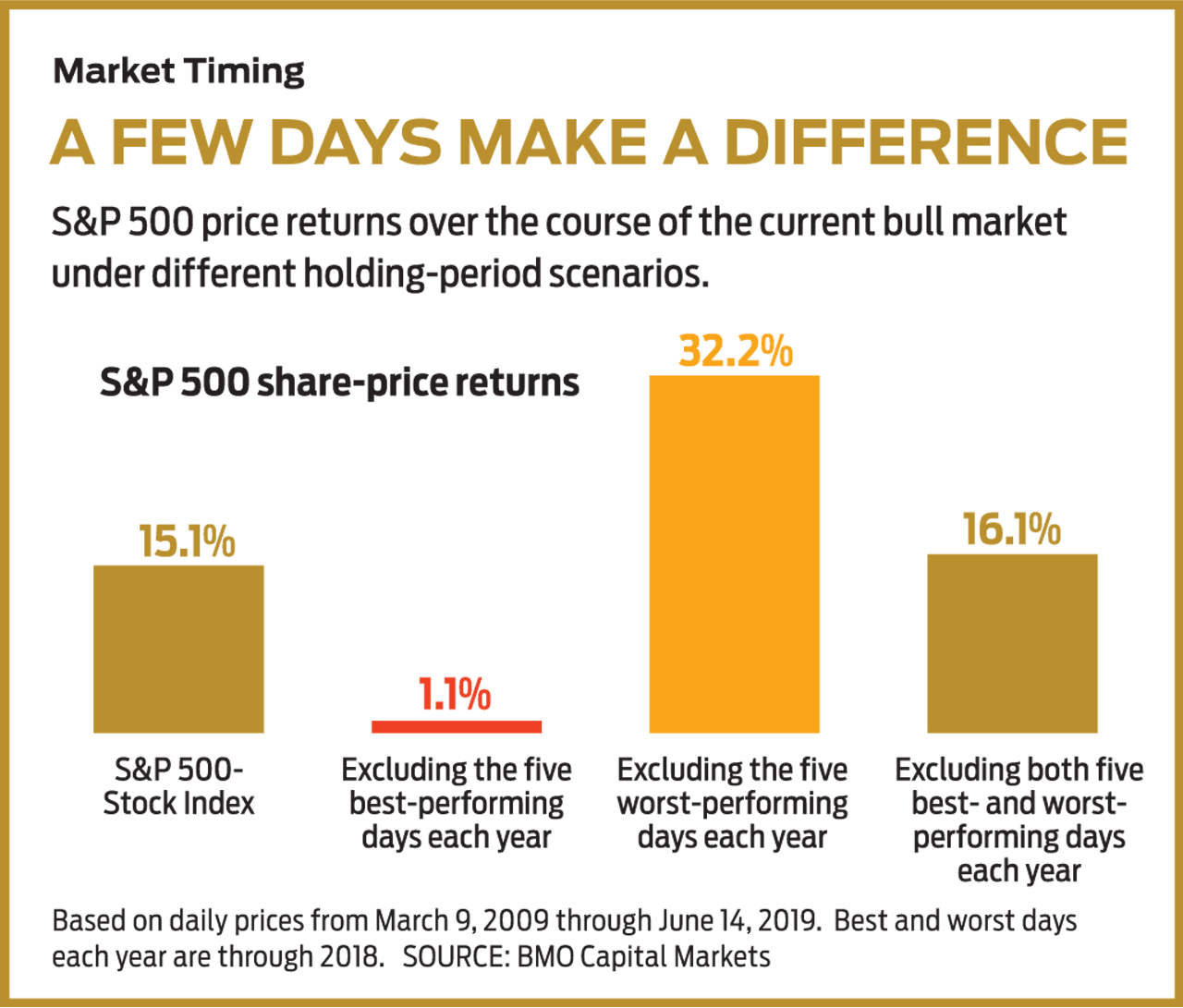

You can hardly blame them for wanting to avoid a bad day or two. Consider: From the beginning of the current bull market, stocks in Standard & Poor’s 500-stock index have returned an annualized 15.1% (not including dividends). Exclude the five days from each year through 2018 with the worst returns, however, and the annualized price gain jumps to an astonishing 32.2%, according to data from investment research firm BMO Capital Markets.

Investors who missed out on the May downdraft made out. Say you were able to exit stocks following the president’s May 5th tweet. You would have avoided a 6.6% slide in the S&P 500 from then through May 31. But before congratulating yourself on a savvy piece of market timing, ask yourself if, or when, you planned to buy back in. After all, from the end of May through June 14, the market had already bounced back by nearly 5%.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Stay invested. Exiting stocks amid a turbulent market may help assuage your anxiety, but you’re likely to miss out on substantial gains while you sit on the sidelines. That’s because much of the market’s long-term performance is driven by returns from a few outstanding days. Remember the S&P 500’s 15.1% annualized return over the course of the current bull run? If we leave out the five best days of each year for the market, the annualized return plummets to a measly 1.1%. On an initial $10,000 investment, that’s the difference between ending up with about $40,000 and about $11,000.

And if you think you’ll be able to pinpoint when to exit and then get back in the game, think again. Since the bull began in 2009, 40% of the market’s five best days of the year have occurred within a week of the five worst days, according to BMO. Investors who don’t have a crystal ball are better off staying fully invested than attempting to wring gains from short-term,

market-timing moves.

It helps to anticipate short-term bouts of volatility and to have a plan in place for when those stretches occur. If you’re determined to add to positions when stocks decline, make a shopping list of potential targets. Make sure your portfolio’s asset allocation aligns with your tolerance for risk. If a major decline in the stock market would keep you up at night or cause you to panic and liquidate your nest egg, consider pruning back your stock allocation or adding an investment intended to mitigate volatility.

The iShares Edge MSCI Minimum Volatility USA ETF (symbol USMV, $62) tracks an index of large and midsize stocks with an emphasis on firms with stable cash flows and steady returns. Since its October 2011 inception, the fund has been 21.2% less volatile than the S&P 500 while outstripping the index by an average of 0.4 percentage point per year. Smoothing out the market’s occasionally steep ups and downs might keep you in the market longer, says Sam Stovall, chief investment strategist at research firm CFRA. “If you go to the amusement park but don’t like the roller coaster, then spend some time on the merry-go-round,” he says.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Ryan joined Kiplinger in the fall of 2013. He wrote and fact-checked stories that appeared in Kiplinger's Personal Finance magazine and on Kiplinger.com. He previously interned for the CBS Evening News investigative team and worked as a copy editor and features columnist at the GW Hatchet. He holds a BA in English and creative writing from George Washington University.