Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

By Ian Formigle

We all want to protect our investments against the day the market crashes.

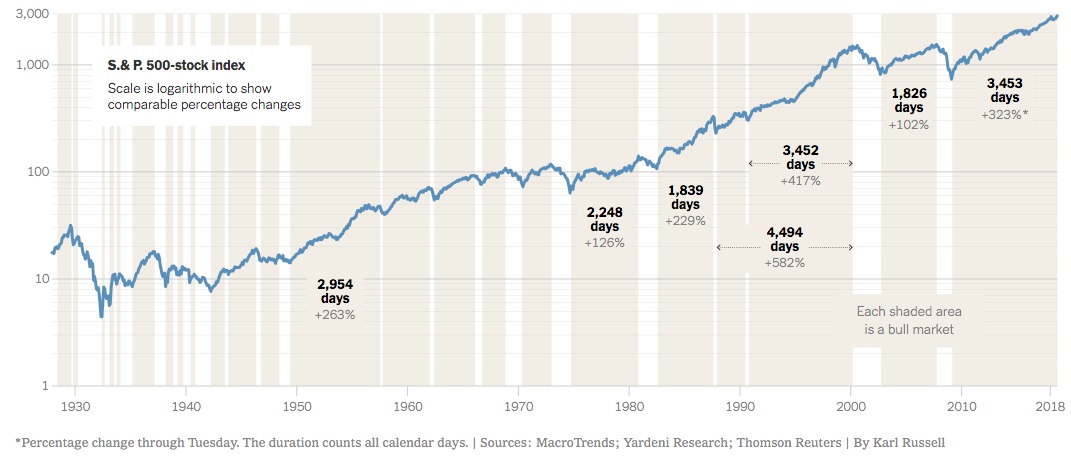

We may still be benefitting from one of the longest surges in stock market history–on March 9th, 2019, we celebrated the 10-year anniversary of the bull market. And for investors who risked the chaos of the 2008 financial crisis, the next few years turned out to be an amazing time to buy into the stock market. But now the logical question becomes, “What next? Stay invested or exit the market?”

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

[Accredited investors are finding alternatives to stocks in this online marketplace.]

Will the Bull Run End?

The short answer is yes. Every market run comes to an end at some point and the forces1 that pushed the S&P 500 down 6.2% in 2018 are still at play. The run may not end in 2019, but there are multiple reasons2 why this historic run could end sooner rather than later.

What's difficult to predict is when the end will happen. Public equities (i.e. stock markets) are volatile. Valuations go up and down depending on the news of the day, what analysts are saying, and what other investors are doing. It can be difficult, even for savvy investors, to discern the true market signals from the noise. So how can investors best protect their portfolios?

Alternatives to Stocks and Bonds

The key to protecting your portfolio from an unknowable future is to diversify your investments.

Alternative investments are assets that don’t fall into the typical stocks, bonds, and cash. It includes everything from venture capital to bitcoin to real estate. For many investors, real estate is an especially attractive alternative investment. Unlike the stock market, real estate’s value is driven by tangible factors, like physical improvements and/or market appreciation. And the asset’s value/performance generally doesn’t correlate to the stock market. According to “The Rate of Return of Everything,” a massive 2017 study by the National Bureau of Economic Research (NBER), over the past 145 years, real estate has exceeded stocks in terms of returns, but has done so with volatility (risk) more in line with bonds.3

But investing in a single real estate asset, like a rental property in San Francisco, comes with its own challenges. There are headaches associated with managing a property and its tenant. Rental income is binary—either you have a tenant, or you don’t. If anything goes wrong with the property, you’re 100% on the hook for resolving it. There’s also a risk in concentrating all your investment in a single asset–if anything happens to it (think a major flood or fire), there goes all your equity.

Commercial real estate minimizes those headaches. Commercial real estate investors are typically passive owners, meaning you aren’t responsible for the day-to-day management of the property. These investments can still provide a dependable cash flow thanks to multiple tenants, so even as you’re waiting for the sale or another liquidity event like refinancing (where the majority of your money is likely to be made), you can get your share of the property’s income.

Until the JOBS Act passed in 2014, access to commercial real estate investing was gated. Real estate developers and sponsors couldn’t market properties online, so individual investors traditionally needed real-world connections in order to learn about investment opportunities. Today, accredited investors can access direct commercial real estate investing opportunities via online marketplaces.

Returns in Commercial Real Estate

While there are no guarantees, commercial real estate investments can produce the same, if not better, results than the stock market. Average 20-year returns4 in commercial real estate have outperformed the S&P 500 Index, running at around 9.5%, compared to 8.6%.

Hindsight is always 20-20, and the bullish S&P 500 has seen an impressive annualized return of 15% since 2009, but great reward often comes with greater risk moving forward. Given that commercial real estate returns have a lower correlation to stocks, it provides an excellent means to diversify portfolios and hedge against an inevitable stock market correction.

How to Invest

Thanks to the 2014 JOBS Act, direct online investment in commercial real estate is now possible. Crowdfunding companies like CrowdStreet enable access between real estate developers and accredited investors. On the CrowdStreet Marketplace, investors can review properties, dig into the details and make offers directly to a real estate sponsor. Founded five years ago, CrowdStreet’s realized returns to date have an average annual rate of return (XIRR) of 31.7%.

For investors who may not be ready to invest directly in a specific offering, CrowdStreet offers a fund that algorithmically invests in 30-50 properties. The CrowdStreet Blended Portfolio, selects a wide range of asset types across U.S. markets, all pre-screened by CrowdStreet’s in-house investment experts.

To get started, create a free account to see the full details of every offering on the CrowdStreet Marketplace.

[Accredited investors are finding alternatives to stocks in this online marketplace.]

CrowdStreet operates an award-winning online commercial real estate investment Marketplace that gives accredited investors access to institutional-quality offerings. CrowdStreet is helping to create a community where individual accredited investors and sponsors can work together to build wealth through commercial real estate. Founded in 2014, the company has enabled over $500 million capital invested on CrowdStreet Marketplace through over 300 commercial real estate offering. To get started, create a free account in order to see the full details of every offering on the CrowdStreet Marketplace.

1https://www.nytimes.com/interactive/2019/01/01/business/dealbook/stock-markets-2019.html

2https://www.entrepreneur.com/article/321832

3https://www.biggerpockets.com/blog/real-estate-vs-stocks-performance

4https://www.investopedia.com/ask/answers/060415/what-average-annual-return-typical-long-term-investment-real-estate-sector.asp

This content was provided by CrowdStreet. Kiplinger is not affiliated with and does not endorse the company or products mentioned above.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Timeless Trips for Solo Travelers

Timeless Trips for Solo TravelersHow to find a getaway that suits your style.

-

A Top Vanguard ETF Pick Outperforms on International Strength

A Top Vanguard ETF Pick Outperforms on International StrengthA weakening dollar and lower interest rates lifted international stocks, which was good news for one of our favorite exchange-traded funds.

-

Is There Such a Thing As a Safe Stock? 17 Safe-Enough Ideas

Is There Such a Thing As a Safe Stock? 17 Safe-Enough IdeasNo stock is completely safe, but we can make educated guesses about which ones are likely to provide smooth sailing.

-

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid Investment

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid InvestmentAmerican Express stock is still a solid investment because management understands the value of its brand and is building a wide moat around it.

-

How the Stock Market Performed in the First Year of Trump's Second Term

How the Stock Market Performed in the First Year of Trump's Second TermSix months after President Donald Trump's inauguration, take a look at how the stock market has performed.

-

What the Rich Know About Investing That You Don't

What the Rich Know About Investing That You Don'tPeople like Warren Buffett become people like Warren Buffett by following basic rules and being disciplined. Here's how to accumulate real wealth.

-

How to Invest for Rising Data Integrity Risk

How to Invest for Rising Data Integrity RiskAmid a broad assault on venerable institutions, President Trump has targeted agencies responsible for data critical to markets. How should investors respond?

-

What Tariffs Mean for Your Sector Exposure

What Tariffs Mean for Your Sector ExposureNew, higher and changing tariffs will ripple through the economy and into share prices for many quarters to come.

-

How to Invest for Fall Rate Cuts by the Fed

How to Invest for Fall Rate Cuts by the FedThe probability the Fed cuts interest rates by 25 basis points in October is now greater than 90%.

-

Are Buffett and Berkshire About to Bail on Kraft Heinz Stock?

Are Buffett and Berkshire About to Bail on Kraft Heinz Stock?Warren Buffett and Berkshire Hathaway own a lot of Kraft Heinz stock, so what happens when they decide to sell KHC?

-

How the Stock Market Performed in the First 6 Months of Trump's Second Term

How the Stock Market Performed in the First 6 Months of Trump's Second TermSix months after President Donald Trump's inauguration, take a look at how the stock market has performed.