Saving for Retirement: How to React to Market Volatility

A new poll conducted by Kiplinger and Barclay's reveals concerns about market swings and potential downturns. See how your savings—and confidence level—measure up

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Many Americans saving for retirement are wary of stocks and have moved a significant portion of their money into cash. In the wake of future volatility for the stock market, they say they are willing to make more changes to their investments, make lifestyle compromises or delay retirement. Nearly half say the economy is slowing, nearly one-third believe the U.S. will be in a recession by the end of 2020, and more than one-third expect the market to decline during 2020. Plus, some four out of 10 respondents are checking their portfolio either daily or weekly.

This survey was conducted by Brown Oak Audience Insights between October 17 and October 21, 2019 and has a 3% margin of error. We surveyed a national sampling of 850 preretirees age 40 and above who have at least $100,000 in household net worth (excluding a primary residence). Respondents were equally divided between men and women.

The median amount saved for retirement among all respondents is $513,100, but among respondents 60 or older, that figure jumps to $707,760. Those figures are still well short of the median amount they expect to need in retirement: about $1.23 million. Even so, more than two-thirds are very confident or somewhat confident that they have saved (or will save) enough for a comfortable retirement.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

We’ve included highlights from the poll here. Figures are medians unless otherwise indicated.

What is your asset valuation?

Respondents have a relatively low stock allocation and high levels of cash. In fact, they are holding more cash than bonds.

Stocks: 44%

Cash: 18%

Bonds: 16%

Real estate: 10%

Other: 13%

How worried are you about stock market declines currently?

Very worried: 11%

Somewhat worried: 52%

Not worried: 37%

What are you doing now to deal with stock market volatility?

Staying diversified and waiting it out: 63%

Seeking professional advice: 19%

Shifting to bonds and cash: 14%

Investing in more defensive stock sectors: 9%

Purchasing an annuity: 8%

Investing in target-date funds: 8%

Nothing: 17%

What are you doing now to deal with stock market volatility?

Nearly half of respondents would consider reducing investments in stocks to deal with market volatility. Here’s how much they’d trim their holdings

No stocks: 6%

10% or less: 20%

25% or less: 40%

50% or less: 28%

Which of the following investments have you increased (or would you increase) in a volatile market?

Savings accounts: 53%

Money market accounts: 39%

Certificates of deposit: 34%

Annuities: 19%

U.S. Treasuries: 15%

Gold: 10%

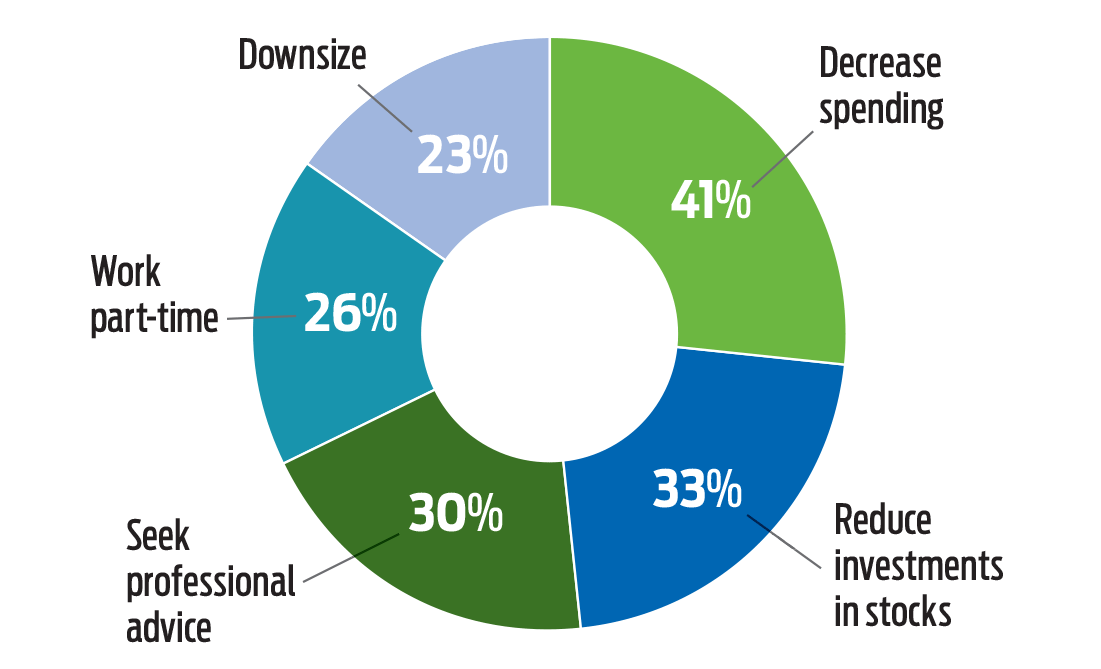

What would you do to deal with market volatility during retirement (top five)

How much would your investments need to decline for you to consider delaying retirement?

Less than 25%: 36%

25% to 49%: 54%

How long would you be willing to delay retirement to give your investments time to recover?

1 to 4 years: 69%

5 to 9 years: 21%

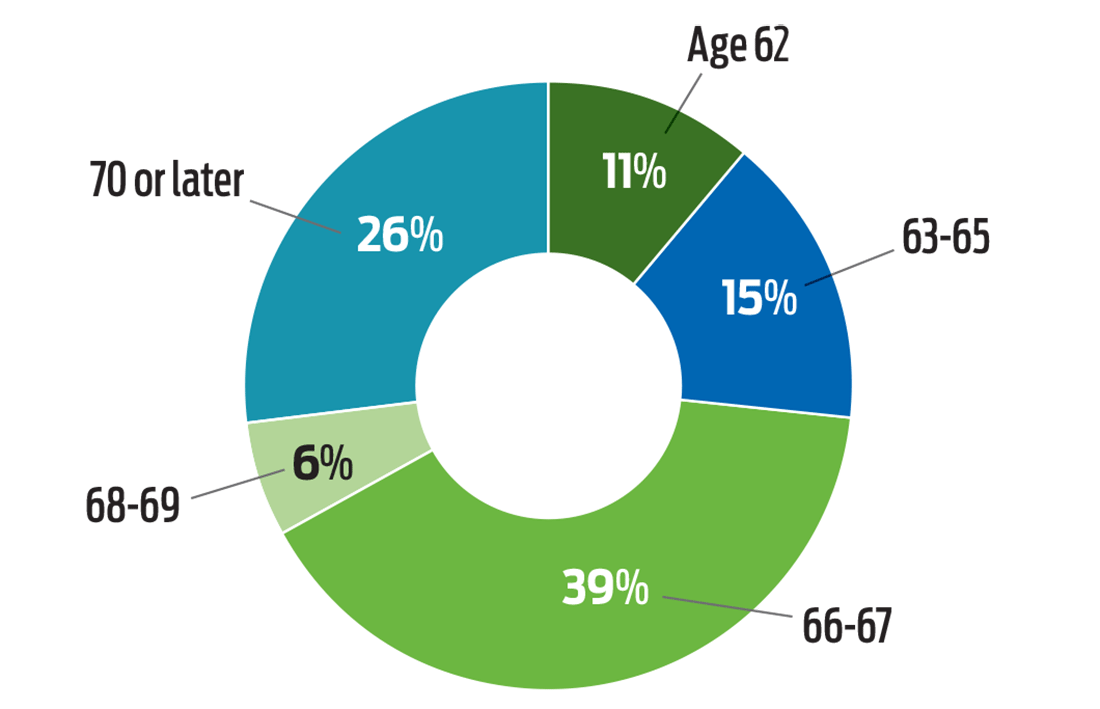

At what age do you plan to claim Social Security?

Would you consider taking Social Security earlier than planned to give your portfolio time to recover from a downturn?

Yes: 24%

No: 51%

Not sure: 26%

Some percentages don’t add up to 100% because of rounding or because respondents chose all answers that were applicable.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.