Resolve to Let the Force Be With You

Can you answer these core questions about your investing philosophy and strategy? 2016 would be a good time to start.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

If you are like many investors, you find yourself dazzled by the sound and fury of the stock market. Months (if not years) of speculation about rising interest rates, the carnage in the oil sector, and continuing incidents of terrorism can certainly leave anyone confused, fearful, and uncertain. These are the times an investor needs to be levelheaded and take a step back to focus on what they know to be most important.

Like the heroes in the “Star Wars” movie anthology, we must find the answer within. Most of us intuitively know that steady, reliable, proven, and recognizable investments should make up the core of our portfolios. These are the type of investments that we should focus on during turbulent times. We know that there will always be the need for food, medicine, electricity, fuel, and other basic necessities. Companies serving these needs have shown their worth over decades and are not subject to fads or fashion. The names are familiar because they have been burned into our memories over time, largely because of the needs they fill.

We also know the value of diversification in spreading our investment risk, along with the value of investing over time, so as not to buy (or sell) at the most inopportune times. So the knowledge of these principles should serve as our guide during times of uncertainty.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

While others may be hard-pressed to find answers, we already know them if only we tap into our accumulated learning. Are we adequately diversified? If not, what sectors should we fill? And while we understand the need to invest for our futures, can we simply show the discipline to do it gradually, rather than gambling on large, one-time purchases?

If we are tempted to sell, can we take time to evaluate whether the reasons are sound and that we will accomplish something by doing so? These are the types of questions that we need to answer to our own satisfaction, rather than simply following the latest guru or talking head. We all should resolve to find a way to become more capable of answering these questions.

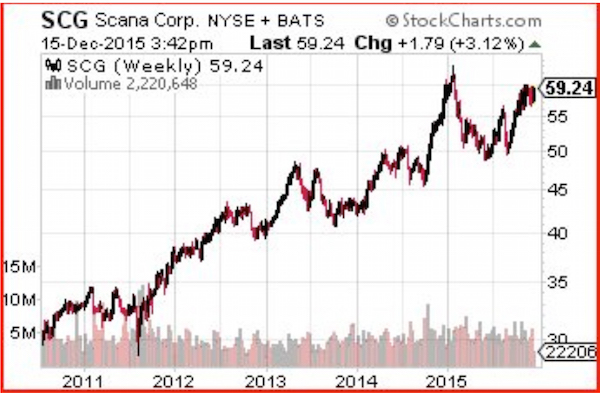

For all the above reasons, we at Moneypaper Publications LLC like SCANA Corp (SCG). Founded in 1924, SCANA engages in the generation, transmission, distribution, and sale of electricity to retail and wholesale customers in South Carolina. It also provides natural gas, offers energy-related risk management services, owns two liquefied natural gas plants, and provides tower site construction, management, and rental services in South and North Carolina. SCANA supplies electricity to 688,000 customers and provides natural gas to 859,000 residential, commercial, and industrial customers in North Carolina and South Carolina, as well as 450,000 customers in Georgia. According to Yahoo! Finance, consensus estimates call for the company to have earned about $3.82 per share in 2015 and $3.94 in 2016, compared with $3.79 in 2014. SCANA has increased its dividend for 15 consecutive years and its $2.18-per-share annual payout provides a yield of 3.8%.

What makes SCANA attractive is its position as a solid, reliable utility serving the growing populace of the Southeastern United States. The stock’s growing dividend is well covered by earnings. The payout ratio is just 57% of 2015 earnings and continuing dividend increases mean that the current yield likely will keep growing over time, compared with the current price.

And a strategy of dollar-cost averaging should be handsomely rewarded by the above-average yield compounding over time, driven by reinvestment and continued growth in the customer and earnings base. SCANA has all the hallmarks of a relatively safe, reliable holding that can be built from a single share to a large, solid holding for retirement.

Ms. Vita Nelson is one of the earliest proponents of dividend reinvestment plans (DRIPs) and a knowledgeable authority on the operations of these plans. She provides financial information centered around DRIP investing at www.drp.com and www.directinvesting.com. She is the Editor and Publisher of Moneypaper's Guide to Direct Investment Plans, Chairman of the Board of Temper of the Times Investor Service, Inc. (a DRIP enrollment service), and co-manager of the MP 63 Fund (DRIPX).

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Timeless Trips for Solo Travelers

Timeless Trips for Solo TravelersHow to find a getaway that suits your style.

-

A Top Vanguard ETF Pick Outperforms on International Strength

A Top Vanguard ETF Pick Outperforms on International StrengthA weakening dollar and lower interest rates lifted international stocks, which was good news for one of our favorite exchange-traded funds.

-

Is There Such a Thing As a Safe Stock? 17 Safe-Enough Ideas

Is There Such a Thing As a Safe Stock? 17 Safe-Enough IdeasNo stock is completely safe, but we can make educated guesses about which ones are likely to provide smooth sailing.

-

Missed Your RMD? 4 Ways to Avoid Doing That Again (and Skip the IRS Penalties), From a Financial Planner

Missed Your RMD? 4 Ways to Avoid Doing That Again (and Skip the IRS Penalties), From a Financial PlannerIf you miss your RMDs, you could face a hefty fine. Here are four ways to stay on top of your payments — and on the right side of the IRS.

-

What Really Happens in the First 30 Days After Someone Dies (and Where Families Get Stuck)

What Really Happens in the First 30 Days After Someone Dies (and Where Families Get Stuck)The administrative requirements following a death move quickly. This is how to ensure your loved ones won't be plunged into chaos during a time of distress.

-

AI-Powered Investing in 2026: How Algorithms Will Shape Your Portfolio

AI-Powered Investing in 2026: How Algorithms Will Shape Your PortfolioAI is becoming a standard investing tool, as it helps cut through the noise, personalize portfolios and manage risk. That said, human oversight remains essential. Here's how it all works.

-

A Newly Retired Couple With a Portfolio Full of Winners Faced a $50,000 Tax Bill: This Is the Strategy That Helped Save Them

A Newly Retired Couple With a Portfolio Full of Winners Faced a $50,000 Tax Bill: This Is the Strategy That Helped Save ThemLarge unrealized capital gains can create a serious tax headache for retirees with a successful portfolio. A tax-aware long-short strategy can help.

-

5 Retirement Myths to Leave Behind (and How to Start Planning for the Reality)

5 Retirement Myths to Leave Behind (and How to Start Planning for the Reality)Separating facts from fiction is an important first step toward building a retirement plan that's grounded in reality and not based on incorrect assumptions.

-

I'm a Financial Adviser: Silence Is Golden, But It Hurts Your Heirs More Than You Think

I'm a Financial Adviser: Silence Is Golden, But It Hurts Your Heirs More Than You ThinkTalking to heirs about transferring wealth can be overwhelming, but avoiding it now can lead to conflict later. Here's how to start sharing your plans.

-

Will Your Children's Inheritance Set Them Free or Tie Them Up?

Will Your Children's Inheritance Set Them Free or Tie Them Up?An inheritance can mean extraordinary freedom for your loved ones, but could also cause more harm than good. How can you ensure your family gets it right?

-

I'm a Financial Adviser: This Is the Real Key to Enjoying Retirement With Confidence

I'm a Financial Adviser: This Is the Real Key to Enjoying Retirement With ConfidenceA resilient retirement plan is a flexible framework that addresses income, health care, taxes and investments. And that means you should review it regularly.