This Market Indicator Suggests a Continued Bull Market

There’s not a lot of enthusiasm for trading with borrowed money, despite low interest rates. That’s a contrarian bullish sign.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

The current bull market, which started in early 2009, has been called “the most hated bull market in history.” It seems investors have been waiting in vain for that other shoe to drop only to see the market march higher with nary a correction.

Stocks climb a proverbial wall of worry, and negative sentiment among rank-and-file investors is actually a contrarian bullish sign. It is when sentiment gets one-sidedly bullish and investors throw caution to the wind that you know a major top is near.

But with the S&P 500 now sitting near all-time highs… and tripling in value from its 2009 crisis lows… is it really fair to call this rally “hated”?

Article continues belowFrom just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Let’s take a look at investor trading on margin. When investors are feeling bullish, they are a lot more likely to trade aggressively… and to borrow money to do it.

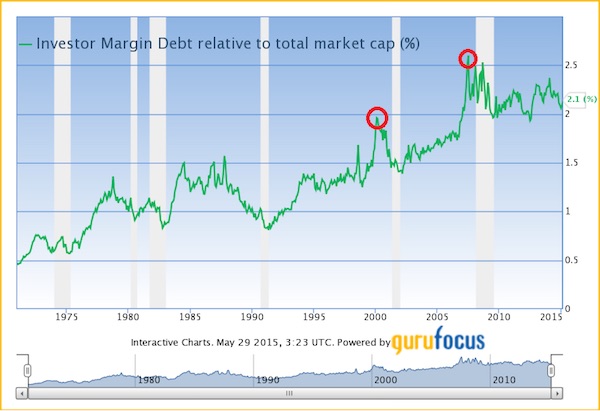

As you can see in the chart, investor margin debt as a percentage of market cap does indeed tend to surge leading into a major market top and tends to fall dramatically during a market decline. We saw investor margin debt jump from less than 1% of market cap to nearly 2% during the great 1990s tech bubble. And it had another major spike during the bull market of the mid 2000s.

Today, we certainly don’t see a lot of investor enthusiasm for margin trading, and margin debt is actually trending lower. We’re still at levels that are high by historical standards, but much of this can be explained by two factors:

- Ease of margin trading with discount online brokers

- Falling interest rates over the past 30 years…and particularly over the past 6 years.

Remember, the Fed has kept short-term lending rates at close to zero for six years now, so it’s natural that investors will borrow more aggressively on margin. “Free money” makes carry trades that wouldn’t be profitable under “normal” conditions worth doing. Seen in this context, today’s margin debt levels are far less impressive and certainly far less indicative of investor enthusiasm.

So, at least by this metric, our bull market today really is more unloved than hated, at least by the standards of recent major tops.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Charles Lewis Sizemore, CFA is the Chief Investment Officer of Sizemore Capital Management LLC, a registered investment advisor based in Dallas, Texas. Charles is a frequent guest on CNBC, Bloomberg TV and Fox Business News, has been quoted in Barron's Magazine, The Wall Street Journal, and The Washington Post and is a frequent contributor to Yahoo Finance, Forbes Moneybuilder, GuruFocus, MarketWatch and InvestorPlace.com.