Bear Market? I See a Bull Market for the Next 15-20 Years

Here’s what a long view of the direction of markets shows us.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

The first week of 2016 started with a big move down in equity prices as a result of geopolitical events in emerging markets and fears of slowing economies worldwide. However, there are larger trends influencing markets today.

Understanding today’s market moves requires the study of market history and secular trends that dominate market direction. Most investors are unaware of secular bull and bear markets that control long-term direction of markets for significant periods of time.

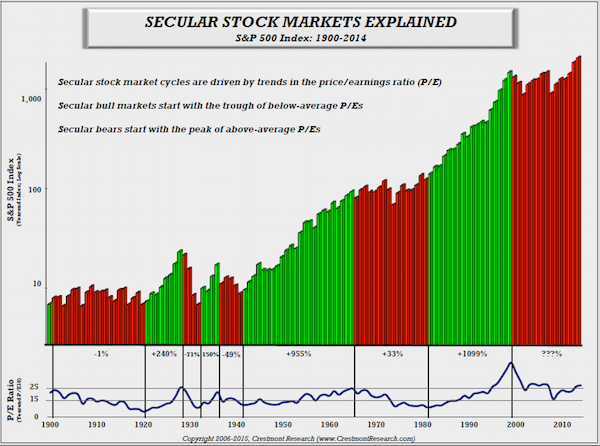

Let’s review the last century of stock market cycles. Classifying bull markets and bear markets is necessary to understand their impact on short-term trends. I define secular bull markets as extended periods or years when the stock market achieves higher highs and higher lows, and bear markets retreat to lower highs and even lower lows. These extended bear and bull markets can last for eight to 20 years for either market. Take a look at this illustration of the S&P 500 for 114 years, with bull markets in green and bear markets in red:

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

It is important to remember that the stock market is an auction system made up of millions of investors interacting electronically to achieve the best results for their efforts. People are emotional by nature, often influenced by both the fear of losing wealth and the greed of not attaining enough wealth; as a result, overbidding for desired stocks will push markets to much higher highs years before ending bull markets and beginning the bear markets that follow. There are, of course, other contributing factors, but most secular market trends are driven by the basic human emotions of fear and greed.

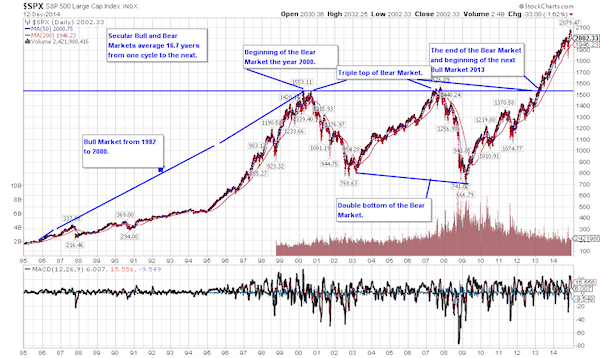

If you accept the existence of secular market trends, then the question is: where are we in 2016? To understand the answer to this question, let’s review the bear market that began in the year 2000. The bear market began in March 2000 after one of the greatest bull markets in history (1982-2000), giving investors a 1099% return if they invested in the S&P 500 for that period of time.

The bear market of 2000 began with the busting of the dot-com bubble and the S&P 500 falling in value until October 2002, with the final low reached in March 2003 before rising in value for the next four-and-a-half years until October 2007. The market fell again until March 2009 before starting its rise to current levels with the market highs reached in May 2015.

The S&P 500 did one extraordinary thing that did not happen during the prior 14 years of the secular bear market. In May 2013, it reached the highs achieved in the years 2000 and 2007, but, this time, it broke through the ceiling and has continued to rise to current (2016) levels. We at Geasphere believe that the breakout in 2013 was the end of the 14-year secular bear market and the beginning of the next secular bull market. (See illustration and explanation below of the 2000 secular bear market.)

The chart shows the beginning and the end of the secular bear market by illustrating the price action of the S&P 500 over the 14-year period. More importantly, it demonstrates the basic principal of economics: if you have more sellers than buyers in the market, markets will go down; the reverse is true that if you have more buyers than sellers in the market, it will go up. We believe the market has begun the next secular bull market that will last another 15 to 20 years.

We live in a time of the 24-hour news cycle, in which information that used to be interesting only to professionals is now packaged and highlighted with great graphics and music to investors with sensational entertainment values-- and yes, this might make good television, but it does not make good investors.

Enjoy the ride, because it’s going to be a long one.

Eduard Hamamjian, an accredited Asset Management Specialist, has been in the industry since 1992. With years of experience in investment research, portfolio construction and even business ownership, he has developed a suite of services specific to business owners.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

As an Accredited Asset Management Specialist, Eduard has developed his investment approach through a unique diversification method, and proprietary stock valuation and various other strategies for research, construction and management of portfolios. Eduard's innovative strategies allow him to provide distinct value for GeaSphere clients looking for growth without excessive risk. He oversees the construction, research and management of client portfolios. In recent years, he has combined his investment approach with practical planning tools and cash flow solutions, so that he can deliver comprehensive services for business owners. He also partners with accounting firms for a simpler, more tax-efficient process for each client.

-

Why Some Michigan Tax Refunds Are Taking Longer Than Usual This Year

Why Some Michigan Tax Refunds Are Taking Longer Than Usual This YearState Taxes If your Michigan tax refund hasn’t arrived, you’re not alone. Here’s what "pending manual review" means and how to verify your identity if needed.

-

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have TodayCaterpillar stock has been a remarkably resilient market beater for a very long time.

-

Good Stock Picking Gives This Primecap Odyssey Fund a Lift

Good Stock Picking Gives This Primecap Odyssey Fund a LiftOutsize exposure to an outperforming tech stock and a pair of drugmakers have boosted recent returns for the Primecap Odyssey Growth Fund.

-

A Newly Retired Couple With a Portfolio Full of Winners Faced a $50,000 Tax Bill: This Is the Strategy That Helped Save Them

A Newly Retired Couple With a Portfolio Full of Winners Faced a $50,000 Tax Bill: This Is the Strategy That Helped Save ThemLarge unrealized capital gains can create a serious tax headache for retirees with a successful portfolio. A tax-aware long-short strategy can help.

-

5 Retirement Myths to Leave Behind (and How to Start Planning for the Reality)

5 Retirement Myths to Leave Behind (and How to Start Planning for the Reality)Separating facts from fiction is an important first step toward building a retirement plan that's grounded in reality and not based on incorrect assumptions.

-

I'm a Financial Adviser: Silence Is Golden, But It Hurts Your Heirs More Than You Think

I'm a Financial Adviser: Silence Is Golden, But It Hurts Your Heirs More Than You ThinkTalking to heirs about transferring wealth can be overwhelming, but avoiding it now can lead to conflict later. Here's how to start sharing your plans.

-

Dow Dives 521 Points as Goldman, AmEx Slide: Stock Market Today

Dow Dives 521 Points as Goldman, AmEx Slide: Stock Market TodayNews of Block's massive layoffs exacerbated AI worries across the financial sector.

-

Will Your Children's Inheritance Set Them Free or Tie Them Up?

Will Your Children's Inheritance Set Them Free or Tie Them Up?An inheritance can mean extraordinary freedom for your loved ones, but could also cause more harm than good. How can you ensure your family gets it right?

-

I'm a Financial Adviser: This Is the Real Key to Enjoying Retirement With Confidence

I'm a Financial Adviser: This Is the Real Key to Enjoying Retirement With ConfidenceA resilient retirement plan is a flexible framework that addresses income, health care, taxes and investments. And that means you should review it regularly.

-

Life Loves to Throw Curveballs, So Ditch the Rigid Money Rules and Do This Instead

Life Loves to Throw Curveballs, So Ditch the Rigid Money Rules and Do This InsteadSome rules are too rigid for real life. A values-based philosophy is a more flexible approach that helps you retain confidence — whatever life throws at you.

-

Big Nvidia Numbers Take Down the Nasdaq: Stock Market Today

Big Nvidia Numbers Take Down the Nasdaq: Stock Market TodayMarkets are struggling to make sense of what the AI revolution means across sectors and industries, and up and down the market-cap scale.