I See a Major Stock Market Decline Ahead

Do not buy the hype that the market is fairly valued or undervalued. You can see for yourself in the charts below.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

"Price is what you pay: value is what you get." – Warren Buffett

Investors seem to have a good handle on stock prices. This stock is $100/sh, that stock is $45/sh and so on. But do they know the value of those stocks?

Just because a stock trades for $50/sh doesn't mean its value is $50/share. The same goes for the market. Just because the S&P 500 trades at 1950, doesn't mean it is worth 1950.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

There are a number of ways to value a stock or a market. Price/Earnings Ratio (PE) is most often used. It tells an investor how many dollars the company earns for each share of stock they own. Suppose a company has Earnings Per Share (EPS) of $2.00 and a stock that trades at $30. Its' PE would be 15. By itself, this tells you nothing, but comparing it to the earnings growth rate may reveal if the stock price is over or under valued.

So, for example, a stock trading at $100/sh with a PE of 10 may be a better value than a stock trading at $15 with a PE of 25. Why? The $100 stock has a lower PE. Generally, lower PE's mean better value. So even though the $15 stock had a lower price, since its price to earnings ratio was so much higher, it was not as good a value.

Each stock has its own PE and EPS growth rate. They all move in cycles that may appear to be random to some. That is where markets come in. Studying the market's earnings and cycles can give an investor insights into whether the whole market is over or under valued.

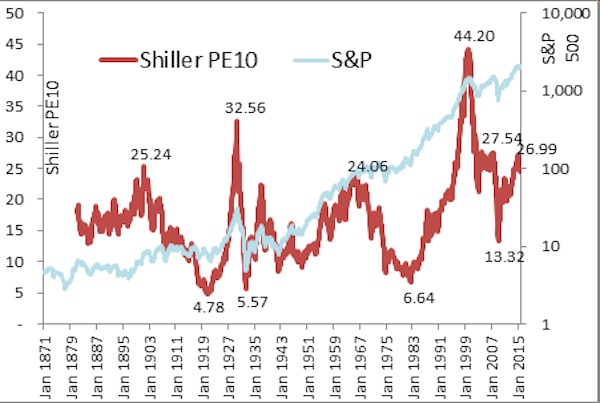

The chart below shows the Shiller PE10 compared to the S&P 500. (The PE10 is a PE measurement developed by Robert Shiller. It measures the moving average of 10 years of S&P 500 earnings and applies inflation to help smooth out volatility.) While the market appears to continually go up, (it doesn't, as we all have been painfully aware since 2016 began, but more on that at another time) the PE10 has a very clear cycle. The peak PE10 in 1929 was 32.56. The peak during the Dot-com bubble was 44.20. The peak before the 2008 crash was 27.54. And what was the most recent peak (in 2015)? – 26.99. PE10s above 24 tend to be very overvalued.

Because value is cyclical, the PE10 goes up and then down. The PE10 has hit 4.78; 5.57 and 6.64 at previous value lows. PE10s under 10 would be considered very undervalued. What was the low in 2009, when the market hit a price low? 13.32 - Far from previous value lows. This is one of the main reasons we have felt that the ensuing market rally from 2009 through 2014 was artificial, based on outside influences and not based on market fundamentals or value.

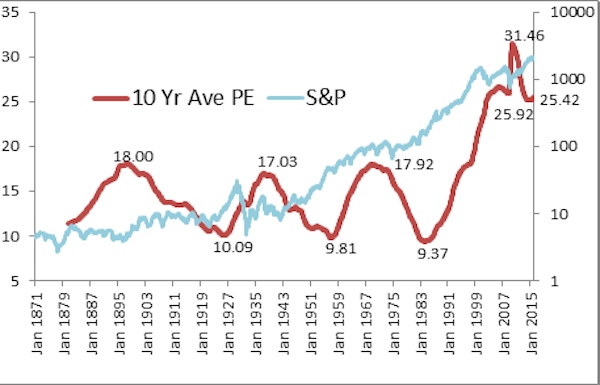

Below is a simpler chart showing the rolling ten year average PE of the S&P 500. Here the cycle is much clearer, peaking in the high teens and bottoming around 9 or 10 times earnings. Until 1997.

In 1997, at about 18 PE, the chart appears to want to top out. But instead, it skyrockets higher. This is part of the so-called “Greenspan Miracle,” where former Fed Chairman Alan Greenspan discovered that pumping money into the system would pump up the market. As you can see, the red line (10 yr average PE) continued up to an all-time high of 31.46, almost double previous highs. Since then, the PE has come down, but is still well above previous highs.

So what does all of this mean to investors? In order for the composite "value" of the market to come down to its historical cyclical lows, either earnings are going to have to skyrocket or stock prices have a long way to fall. To bring stock prices down to previous historically high values, the market would have to drop another 20% or so. To come down to average valuation, the market would have to drop around 50% and to get to historically low values…. you don't want to know.

So here are the five numbers you should understand before you invest another dollar:

1) The Current PE10 is about 24 to 26.

2) Historical lows for the PE10 averaged about 5.50 (not including 2009.)

3)The 2009 low only hit 13.32, more than double the average low.

4) Peaks above 24 have always led to long term market declines.

5) The Trailing 10 year average PE at the end of 2015 was 25.42, more than 2.5 times the historical lows.

How do you use this information?

- Expect a major league market decline. It may be fast, it may be slow. It may last months, it may last years.

- Review your holdings to see if they are overvalued or not.

- Do not panic, rationally decide what to keep and what to sell.

- Do not buy the hype that the market is fairly valued or undervalued. You can see for yourself by the charts above, the market is very overvalued based on PE10 and trailing 10 year average PE.

- Sell into rallies. There will very likely be some spectacular rallies.

- Whatever you decide to keep, be prepared to see it at much lower prices.

- Prepare a shopping list of companies you would like to own at lower prices.

- Rely on your strategy. If it is tactical, let it do its work, moving you in and out of the market. If it is contrarian, stick with it, if it is Dollar Cost Averaging, the volatility may work in your favor, (if it is indexing or buy n' hold – good luck! You might want to change strategies.)

Lastly, when I first started in the business, more than 30 years ago, an old-timer told me a hard truth about the markets - that bear markets hurt as many people as much as possible. That is why they have such big rallies, to sucker people back in, and then slam them.

John Riley, registered Research Analyst and the Chief Investment Strategist at CIS, has been defending his clients from the surprises Wall Street misses since 1999.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

In 1999, John Riley established Cornerstone Investment Services to offer investors an alternative to Wall Street. He is unique among financial advisers for having passed the Series 86 and 87 exams to become a registered Research Analyst. Since breaking free of the crowd, John has been able to manage clients' money in a way that prepares them for the trends he sees in the markets and the surprises Wall Street misses.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

How to Watch the 2026 Winter Olympics Without Overpaying

How to Watch the 2026 Winter Olympics Without OverpayingHere’s how to stream the 2026 Winter Olympics live, including low-cost viewing options, Peacock access and ways to catch your favorite athletes and events from anywhere.

-

Here’s How to Stream the Super Bowl for Less

Here’s How to Stream the Super Bowl for LessWe'll show you the least expensive ways to stream football's biggest event.

-

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to Chance

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to ChanceAdding a pet trust to your estate plan can ensure your pets are properly looked after when you're no longer able to care for them. This is how to go about it.

-

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate Plan

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate PlanAn outdated or incomplete estate plan could cause confusion for those handling your affairs at a difficult time. This guide highlights what to update and when.

-

I'm a Financial Adviser: This Is Why I Became an Advocate for Fee-Only Financial Advice

I'm a Financial Adviser: This Is Why I Became an Advocate for Fee-Only Financial AdviceCan financial advisers who earn commissions on product sales give clients the best advice? For one professional, changing track was the clear choice.

-

I Met With 100-Plus Advisers to Develop This Road Map for Adopting AI

I Met With 100-Plus Advisers to Develop This Road Map for Adopting AIFor financial advisers eager to embrace AI but unsure where to start, this road map will help you integrate the right tools and safeguards into your work.

-

The Referral Revolution: How to Grow Your Business With Trust

The Referral Revolution: How to Grow Your Business With TrustYou can attract ideal clients by focusing on value and leveraging your current relationships to create a referral-based practice.

-

This Is How You Can Land a Job You'll Love

This Is How You Can Land a Job You'll Love"Work How You Are Wired" leads job seekers on a journey of self-discovery that could help them snag the job of their dreams.

-

65 or Older? Cut Your Tax Bill Before the Clock Runs Out

65 or Older? Cut Your Tax Bill Before the Clock Runs OutThanks to the OBBBA, you may be able to trim your tax bill by as much as $14,000. But you'll need to act soon, as not all of the provisions are permanent.

-

The Key to a Successful Transition When Selling Your Business: Start the Process Sooner Than You Think You Need To

The Key to a Successful Transition When Selling Your Business: Start the Process Sooner Than You Think You Need ToWay before selling your business, you can align tax strategy, estate planning, family priorities and investment decisions to create flexibility.