How to Play the High-Yield Rally

Junk bonds have been on a tear, so this fund has shifted to defense.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

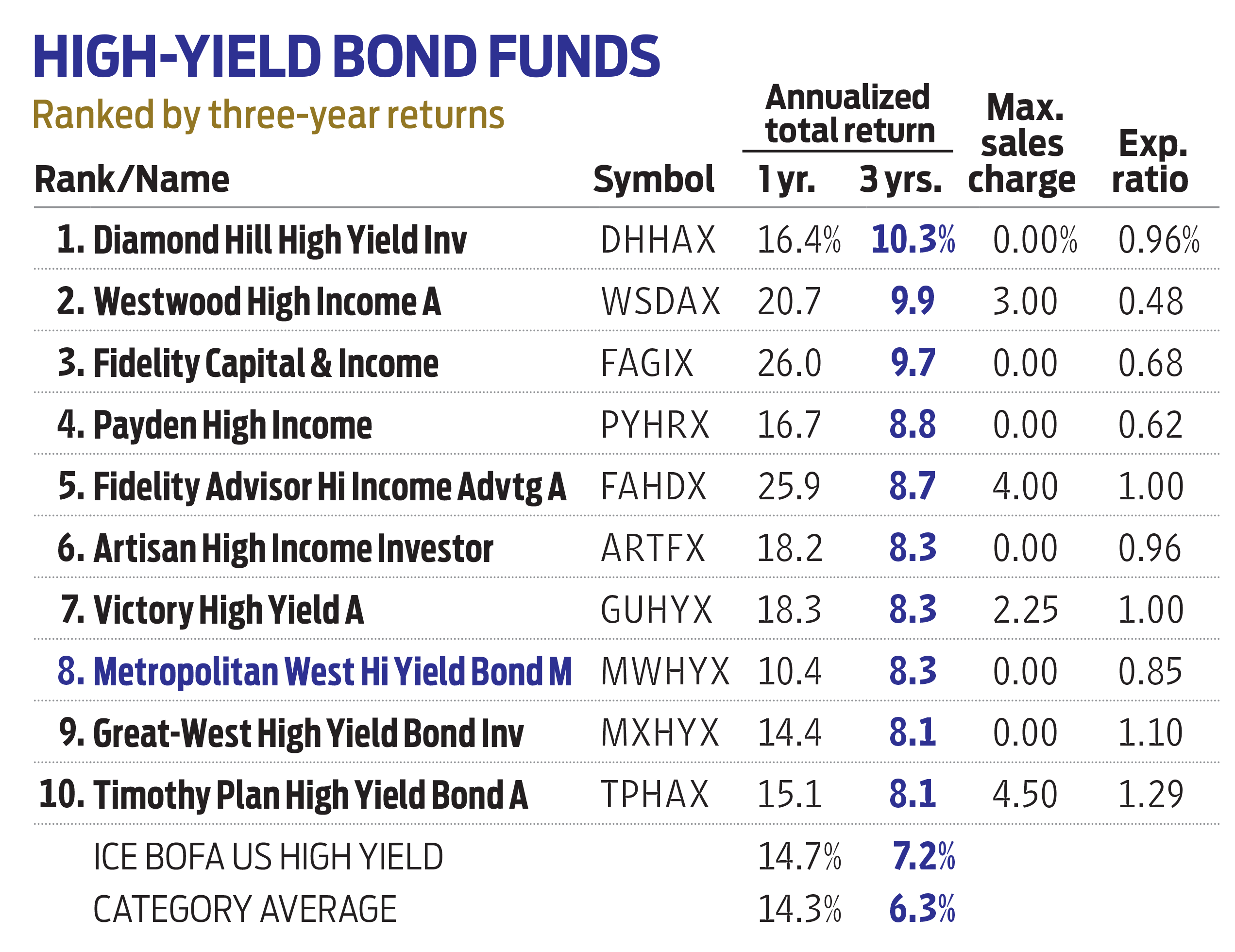

High-yield bonds have been on a roll. Over the past 12 months, funds that invest in junk-rated debt – credit rated double-B to triple-C – have gained 14%, on average, more than any other bond-fund category. As a result, investors have poured more money into high-yield bond funds in the first half of 2021 than in all of 2020.

That might make you wary. But investors with a long-term view should consider Metropolitan West High Yield Bond (MWHYX). The fund's managers run it with a full market cycle in mind. They're conservative, they like a bargain, and they let bond prices and the difference between yields in junk bonds and Treasuries – known as the spread – influence when to dial up or pull back on risk.

When prices are low and spreads are high, the managers take on more risk. When the opposite is true, they reduce risk.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"We try to insulate the fund from downdrafts by being more conservative" when prices are high, says co-manager Laird Landmann. Over the long haul, this approach has delivered above-average returns with below-average volatility.

These days the percentage of junk bonds that trade cheaply (below 90 cents on the dollar) is less than 1.5%, the lowest it has been over the past 20 years. Current spreads between junk bonds and Treasuries, about three percentage points, are near decade lows, too.

Time for Caution

That has the fund managers on the defensive. Bank loans now make up about 18% of the fund’s assets – a "max positioning" for the fund, says co-manager Jerry Cudzil. These securities have seniority in the capital structure – they get paid first – and interest rates that adjust in line with a short-term benchmark.

The managers have also shifted into more defensive industries, such as cable, food and beverage, and managed health care. "Today, you're not being compensated to take on more risk," says Cudzil. "These sectors will experience less volatility from an earnings perspective."

The fund's 8.3% three-year annualized return ranks among the top 8% of all high-yield bond funds. It was one-third less volatile than its peers over that stretch, too.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Nellie joined Kiplinger in August 2011 after a seven-year stint in Hong Kong. There, she worked for the Wall Street Journal Asia, where as lifestyle editor, she launched and edited Scene Asia, an online guide to food, wine, entertainment and the arts in Asia. Prior to that, she was an editor at Weekend Journal, the Friday lifestyle section of the Wall Street Journal Asia. Kiplinger isn't Nellie's first foray into personal finance: She has also worked at SmartMoney (rising from fact-checker to senior writer), and she was a senior editor at Money.