How to Give on Thanksgiving ... Without Giving Up Your Deductions

As the year winds down, it's time to think of others. You've probably heard that the new tax law has changed how people are giving to charity, but now's when you can put one of two tax-saving plans into action.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

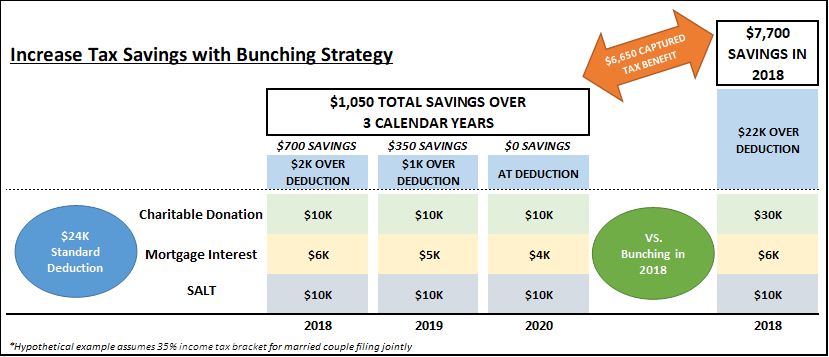

While the Tax Cuts and Jobs Act of 2017 simplifies tax filing for millions of Americans by eliminating several deductions in favor of a higher standard deduction, the higher deductions mean that many charitable contributions will no longer have a positive impact an individual’s tax return.

Note that the IRS has a limit on how much individuals can deduct for charitable gifts in a given year. Appreciated stock gifts to a DAF are capped at 30% of AGI. While there are some rules that allow excessive gift amounts to be carried forward on an individual’s return – it applies only to those who continue to itemize deductions each year. Careful planning is required for individuals making charitable gifts larger than 30% of expected AGI.

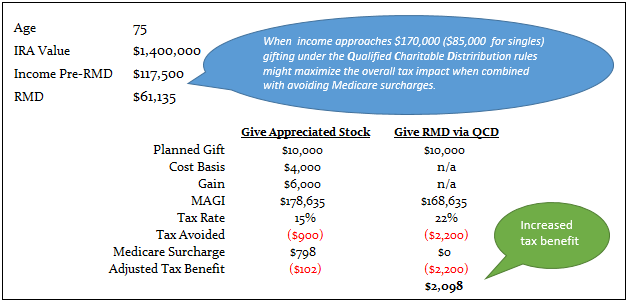

Giving for Retirees

For individuals over age 70½, consider donating your required minimum distribution from an IRA to charity. Individuals 70½ or older can gift up to $100,000 to charity tax-free each year using the qualified charitable distribution (QCD). The gift satisfies the IRS distribution requirement and means that the distribution is not taxable income for the individual. Note that the money must move directly from the IRA to the charity for it to count as a tax-free transfer. All donations must be made to a public charity.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Importantly, there is no need to itemize deductions to receive a tax benefit from the IRA gift. The tax-free transfer also lowers AGI, which may help to avoid the Medicare high-income surcharge and may also lower taxes paid on Social Security.

SEE ALSO: What Type of Giver Are You? To Do the Most Good, Find Your Giving Personality

What to Give

Maximizing Your Giving

Giving is an important part of the holiday season, especially for those with the means to help others, but the new tax laws might influence the ways you choose to give. While the new deduction structure may offset the personal tax impact of your charitable donations, with the right strategies you can make sure you are rewarded for those donations within the tax code. Some of these strategies include the use of “gift bunching” and/or gifting directly from IRAs. However you decide to give, you should always consult your adviser to ensure you utilize the tax code and your investments to your advantage.

Who should be mindful of these strategies?

- Charitably inclined individuals who have a small or no mortgage.

- Medicare participants who have modified adjusted gross incomes (MAGI) close to any of the Medicare premium surcharge thresholds.

- Anyone whose itemized deductions typically hover around $24,000.

See Also: 5 Ways to Maximize Your Charitable Giving

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

John Bratschi is CEO of Prio Wealth, a $2.7 billion registered investment advisory firm in Boston that helps clients prioritize their financial and life goals. With over 33 years' experience in the financial services industry, John works to integrate each client's individual priorities with their plans and portfolios and gives them a framework to make better choices every day.