How to Survive a 10% Correction

Stocks are overdue for a pullback. Here’s how to get ready.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

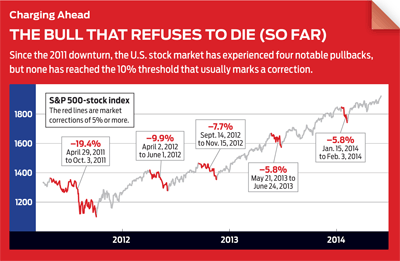

Stock market corrections are an inevitable part of investing. Since 1932, declines of 10% to 20% (the traditional definition of a correction) have occurred an average of every two years, according to InvesTech Research. The last one was in 2011 (though we came close in 2012). The physics of the stock market haven’t changed: What goes up can’t go up forever. Are we due for a big drop?

Sources: InvesTech Research, Yahoo

Beef up your buying power. While stocks continue to hit record highs, take some profits from your winners and build a cash reserve. You may also want to unload some clunkers. When the market finally sinks, scoop up bargains. “We’re prepared for the emergence of more-meaningful discounts,” says David Perkins, co-manager of Weitz Value fund, which at last report had nearly 30% of its assets in cash.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Prepare a shopping list. Jot down a list of stocks you’d like to acquire at lower prices. “There are many stocks on my buy-at-the-right-price list,” says Wasatch Funds chairman Sam Stewart. He likes health care and would start to nibble at Walgreens (symbol WBA, $72) if it fell to the high $50s. Scott Klimo, director of research at Saturna Capital, which manages the Amana funds, would use a 10% correction to add to a stake in search engine giant Google (GOOG, $560) and Borg Warner (BWA, $63), a leading maker of turbochargers. (All prices are as of May 30.)

Don’t miss a stealth correction. Broad measures such as Standard & Poor’s 500-stock index have been marching to new highs, but a closer look at the market shows that some sectors have already taken big hits and are starting to recover. Two examples: Internet services and biotech stocks. “Now is not a bad time to buy the stocks that got beaten up,” says Ed Yardeni, an economist and market strategist.

Turn off the TV. If a decline starts to snowball, you’ll hear about it—over and over. “Don’t become your portfolio’s worst enemy by allowing yourself to get caught up in the negative hysteria,” says Sam Stovall, chief stock strategist at S&P Capital IQ. Instead, remind yourself that the market has experienced 20 drops of 10% to 20% since World War II (plus 13 bear-market tumbles of at least 20%). Even so, large-company stocks have returned 11.1% annualized since the war’s end.

Have a strategy. You’ve probably heard of dollar-cost averaging, a strategy of investing a set amount in the market at periodic intervals. Consider a correction-market twist: Invest periodically, but use decline thresholds instead of time intervals to determine when. For example, you might put a set amount into stock funds in your 401(k) after every 5% dip.

Anticipate better days. The effects of corrections don’t last long. After a drop of 10% to 20%, it typically takes just four months to break even, says Stovall.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Anne Kates Smith brings Wall Street to Main Street, with decades of experience covering investments and personal finance for real people trying to navigate fast-changing markets, preserve financial security or plan for the future. She oversees the magazine's investing coverage, authors Kiplinger’s biannual stock-market outlooks and writes the "Your Mind and Your Money" column, a take on behavioral finance and how investors can get out of their own way. Smith began her journalism career as a writer and columnist for USA Today. Prior to joining Kiplinger, she was a senior editor at U.S. News & World Report and a contributing columnist for TheStreet. Smith is a graduate of St. John's College in Annapolis, Md., the third-oldest college in America.