How to Build a Retirement Income Plan

Sponsored Content from Sensible Money

Many people have a target number in mind when saving for retirement. Perhaps it’s $1 million by age 55, or maybe it’s $4 million by their mid-60s. Having a target number is a good start, but it does not tell the whole story.

As you prepare to exit the workforce, you’ll need a retirement income plan that shows where your cash flow will come from, when each income source will begin, and how long it will last. It's like the difference between a photo and a movie. A photo captures a moment in time; a movie tells a story, progressing through time.

Just like a movie, a comprehensive retirement income plan incorporates the ebb and flow of cash flows, ensuring your assets align with your living expenses throughout retirement. To build an effective plan, start with these five essential steps.

Watch this YouTube video on How to Make a Retirement Income Plan.

Build an Income Timeline

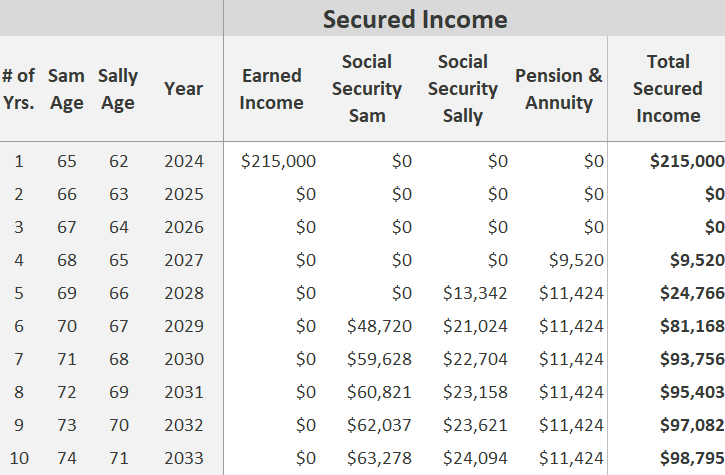

Most retirees will have one or two sources of steady income. The most common is Social Security, followed by pensions, annuity income, and deferred compensation payments. Cash flows may begin at different ages. A timeline illustrates these changes in a way that's easy to see.

Take the example of a hypothetical couple, Sam and Sally, who hope to jointly retire at year-end, with Sam at age 65 and Sally at 62. The couple determined that given their longer life expectancies, they would not claim Social Security retirement benefits early. Sam, the higher wage earner of the two, plans to claim Social Security at age 70 to maximize the survivor benefit payable to Sally. Sally intends to begin Social Security at age 66 based on her earnings record, then file for additional spousal benefits at age 67 after Sam files.

Sally will also receive a small pension from her years of administrative work at their local municipality. The pension will begin paying her a monthly check when she reaches 65.

When you add this together, the secured income they'll receive gradually builds up to over ninety thousand annually within seven years.

Build a retirement plan customized for your unique financial situation.

Identify Your Expenses Over Time

When you retire, your spending will vary yearly as your needs change. Here are a few examples:

- Payments on a fixed-rate mortgage won’t rise and will disappear once the loan is paid off. However, taxes and insurance don’t go away and will increase with inflation. And don’t forget you'll have home maintenance and repairs.

- If you retire before age 65, you'll need to budget more to cover health insurance premiums for the years before Medicare coverage begins.

- Most retirees spend more during early retirement, called the "go-go" years, with expenditures declining in mid-retirement.

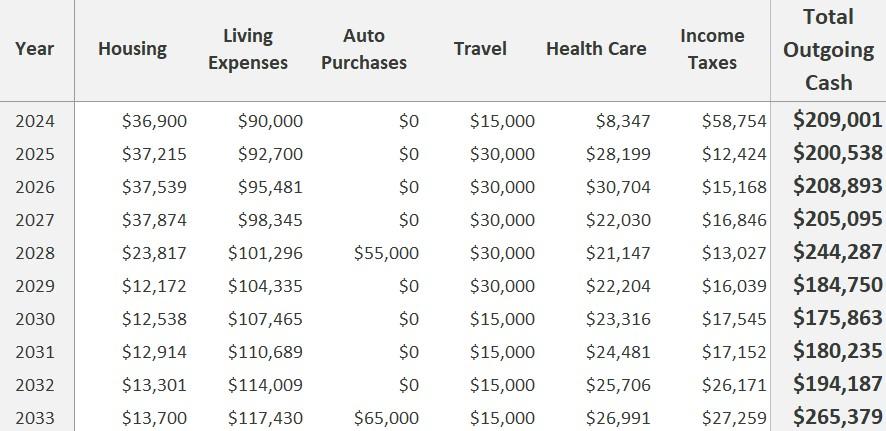

Sam and Sally group their expenses into six categories: housing, living expenses, auto purchases, travel, health care, and income taxes.

Their mortgage will be paid off about five years into retirement, but they expect property taxes and insurance to rise about 3% a year. Monthly health insurance premiums will take a significant chunk of their budget for the first few years, dropping once Sally reaches age 65 and transitions to Medicare. They also plan to front-load their travel, desiring to double their typical fifteen thousand annual budget for their first five years of retirement, but then cut back on travel beyond age 70. And they figure they will have three more car purchases during retirement.

Sam and Sally also estimate their taxes throughout retirement. They factor in their plan to begin withdrawals from tax-deferred retirement accounts right away rather than waiting until their respective required minimum distribution ages: 73 for Sam and 75 for Sally. This strategy will allow them to withdraw funds at the 12% and 15% marginal rates, whereas later in retirement a large portion of their withdrawals will land in the 25% marginal rate.

Sam and Sally realize they will need more cash flow early in retirement. However, as they shift to Medicare, pay off the mortgage, and reduce travel, spending will decline and reach its lowest level in about seven years.

Their expense timeline allows them to see this pattern of expected spending easily.

Stress-test your retirement income plan with these 3 steps.

Calculate Withdrawal Needs

To customize withdrawals, take your expense timeline, which shows total annual expenses, including taxes, and subtract the corresponding fixed income for each year. When laid out year-by-year, this gap illustrates how your needed withdrawals from savings and investments will change over time. You rarely see an orderly pattern, such as a withdrawal need that matches 4% of financial assets.

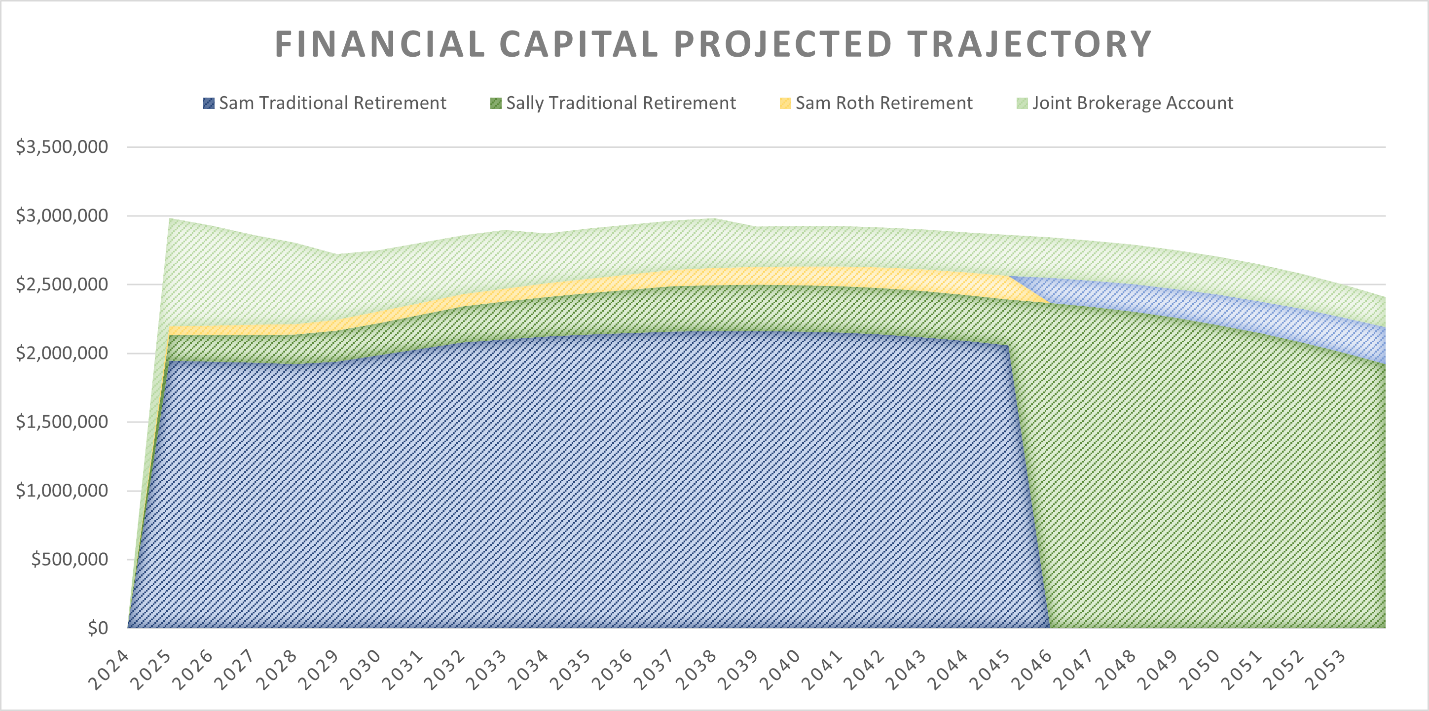

After comparing their timelines, Sam and Sally see they will need to withdraw about $200,000 from savings and investments in their first year of retirement but only about $82,000 in 2030. Do they have enough to support their desired withdrawals?

To find out, they take their starting nest egg of $2.8 million, subtract their withdrawals at the beginning of each year, and test it against annual investment returns of 4%, 5%, and 6%.

At 4%, Sam and Sally can cover their expenses but may gradually spend down principal if their inflation projections prove correct. At 5%, shown in the visual below, they have enough and retain most of their capital throughout retirement.

Get a free guide on 4 Things Near-Retirees Must Know About the 4% Rule.

Fine Tune Your Assumptions

To fine-tune your projections, you'll need realistic assumptions. Should you assume living expenses rise 3% yearly, as Sam and Sally did? Research shows that retirees spending $100,000 or more a year don't need their spending to go up at the same pace as inflation. If you are a higher-income household, consider modeling an annual increase of 3% in early retirement but lowering it to 2% during your mid to late retirement years. On the other hand, health care expenses may rise faster than general inflation, so you may want to plan for that.

Also, will you plan for an annual cost-of-living increase to your Social Security benefit? While recent cost-of-living adjustments to Social Security have been substantial, with a 5.9% increase in 2022, 8.7% in 2023, and 3.2% in 2024, to be more conservative, factor in a 2% annual increase.

When developing assumptions, be cautious of unrealistic scenarios. It can be tempting to assume a high inflation rate and a low return on savings; however, interest rates are also typically higher during times of high inflation, which we’ve seen in recent years, making such a scenario an outlier.

And what about investment returns? With money market yields currently north of 5%, shouldn’t you count on higher return expectations? Your retirement time horizon is thirty years, and rates are likely to bounce around as they have in the past. You can’t count on high yields throughout retirement. If you invest conservatively, an estimated rate of return of 3% to 4% a year may be realistic. If you keep at least 60% of your portfolio in equities, a 5% to 7% annual return may be reasonable.

And if you tend to react poorly when market volatility spooks you, you’re unlikely to see savings grow at 5% or more a year. A lack of following a disciplined strategy can erode investment returns. Your assumptions need to match your behavior.

Learn how to build a retirement portfolio that will stand up over time using one of these four methods.

Weigh Your Options

Once you've constructed your retirement income model, you're in a perfect position to evaluate your choices. Some people choose to work longer to build up their nest egg. Others downsize their lifestyle to be able to afford to retire earlier.

Many of the outcomes you desire during retirement are on opposing sides of a teeter-totter. For example, you can choose a withdrawal strategy that maximizes cash flow but not while increasing that income stream's reliability. If you aim to preserve wealth for the next generation, you may have to spend less in retirement. You can purchase income annuities if you’re concerned about outliving your money, but they might not keep up with inflation. And though a greater allocation to equities offers the potential for higher cash flows, that’s not guaranteed, especially if you abandon stocks in volatile markets.

When you have a timeline and realistic assumptions in place, and you're clear on the outcomes that matter, you'll be ready to make objective decisions about how to achieve your retirement lifestyle. That is the power of a well-designed retirement income plan.

Discover how to squeeze every penny out of your retirement savings. Download the Don’t Cheat Yourself guide today.

Dana Anspach is the founder and CEO of Sensible Money, LLC. Practicing as a financial planner since 1995, when Dana began working with people in their 50s and 60s, she realized that a different type of planning was needed to align one’s finances for a transition out of the workforce.

Dana says, “The retirement income planning process is alive with choices and variables. To make the best decisions, you need a way to understand the interactions between your choices and the corresponding impact on your future. You need an independent voice. You need information free of the influence of politics and sales incentives. Thus, the vision for Sensible Money was born.”

You can also read the first chapter of Dana Anspach’s book, Control Your Retirement Destiny. And listen to this podcast.

This content was provided by Sensible Money. Kiplinger is not affiliated with and does not endorse the company or products mentioned above.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

This content is part of a paid partnership

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.